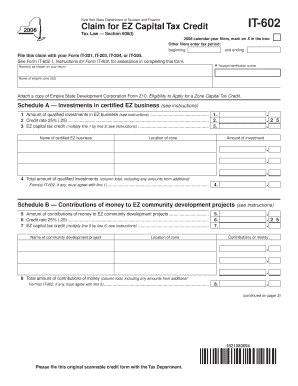

Form it 602 Tax Ny

What is the Form IT 602 Tax Ny

The Form IT 602 Tax Ny is a tax form used by New York State to report and calculate the amount of state income tax owed by individuals or entities. This form is primarily utilized by taxpayers who need to reconcile their tax liabilities with the state tax authority. It is essential for ensuring compliance with New York State tax regulations and for accurately reporting income earned within the state.

How to Obtain the Form IT 602 Tax Ny

The Form IT 602 Tax Ny can be obtained through the New York State Department of Taxation and Finance website. Taxpayers can download the form directly in PDF format for easy printing. Additionally, physical copies may be available at local tax offices or through various authorized agents. It is advisable to ensure you have the most current version of the form to avoid any issues during filing.

Steps to Complete the Form IT 602 Tax Ny

Completing the Form IT 602 Tax Ny involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income and any deductions or credits you are eligible for, following the instructions provided on the form.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Legal Use of the Form IT 602 Tax Ny

The Form IT 602 Tax Ny is legally required for individuals and entities that meet specific income thresholds as defined by New York State tax law. Failure to file this form can result in penalties, interest charges, and potential legal action by the state. It is crucial for taxpayers to understand their obligations and ensure that they are using the form correctly to avoid complications.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines for filing the Form IT 602 Tax Ny. Typically, the form is due on April fifteenth of each year, coinciding with the federal tax filing deadline. However, it is essential to check for any updates or changes to deadlines, especially in light of any state-specific extensions or changes due to extraordinary circumstances.

Required Documents

To successfully complete the Form IT 602 Tax Ny, taxpayers should prepare the following documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Proof of any deductions or credits, such as receipts for charitable donations or medical expenses

- Previous year's tax return for reference

Form Submission Methods

The Form IT 602 Tax Ny can be submitted through various methods to accommodate different preferences:

- Online submission through the New York State Department of Taxation and Finance e-filing system.

- Mailing a physical copy of the completed form to the appropriate state tax office.

- In-person submission at designated tax offices for those who prefer face-to-face assistance.

Quick guide on how to complete form it 602 tax ny

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage [SKS] across any platform using the airSlate SignNow Android or iOS applications and streamline any document-driven process today.

The Easiest Way to Modify and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize necessary sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign feature, which takes only seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Don't worry about lost or misplaced files, tedious document searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] to guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form IT 602 Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the form it 602 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 602 Tax Ny and why is it important?

Form IT 602 Tax Ny is a New York State tax form that allows businesses to claim a credit for taxes paid to other jurisdictions. It's essential for ensuring that you receive due credits and maintain compliance with state tax regulations, potentially lowering your overall tax liabilities.

-

How does airSlate SignNow simplify the process of completing Form IT 602 Tax Ny?

airSlate SignNow streamlines the completion of Form IT 602 Tax Ny by allowing users to fill out, sign, and send the form digitally. Our platform provides a user-friendly interface that minimizes errors and speeds up the submission process, making tax filing hassle-free.

-

What features does airSlate SignNow offer for managing Form IT 602 Tax Ny?

With airSlate SignNow, you can enjoy features like templates for Form IT 602 Tax Ny, alerts for signing deadlines, and the ability to track document status. These tools enhance efficiency and ensure that your tax forms are completed accurately and on time.

-

What is the pricing structure for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to fit various business needs, with options for individuals and teams. All plans provide access to features such as electronic signatures and customizable templates, including Form IT 602 Tax Ny, at a competitive rate.

-

Does airSlate SignNow integrate with any accounting software for Form IT 602 Tax Ny?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions. This integration allows users to easily import financial data, reducing the time spent filling out Form IT 602 Tax Ny and minimizing errors associated with manual entry.

-

Can I store and manage my completed Form IT 602 Tax Ny securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including completed Form IT 602 Tax Ny. Our platform ensures that your sensitive information is protected with robust encryption and compliance with data privacy regulations.

-

Is training or support available for using airSlate SignNow to fill out Form IT 602 Tax Ny?

Yes, airSlate SignNow offers comprehensive support and training resources to help users navigate the platform. This includes tutorials, FAQs, and customer service assistance to ensure that you can efficiently complete Form IT 602 Tax Ny and maximize the benefits of our service.

Get more for Form IT 602 Tax Ny

Find out other Form IT 602 Tax Ny

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now