All References to Distributions Relate Only to Payments of Benefits during the Plan Year Form

Understanding the Purpose of the Form

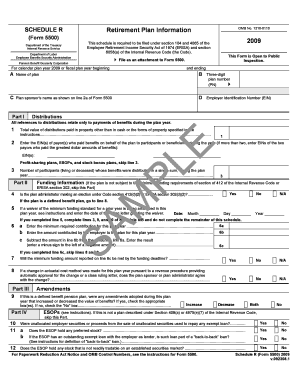

The form titled "All References To Distributions Relate Only To Payments Of Benefits During The Plan Year" serves as a crucial document for individuals and organizations managing benefit plans. It clarifies that all references to distributions pertain solely to the payments made during a specific plan year. This ensures that beneficiaries and plan administrators have a clear understanding of the timing and nature of benefit payments, which is essential for compliance and financial planning. By focusing on payments made within the plan year, the form helps streamline the reporting and distribution process, thereby reducing confusion and potential errors.

How to Complete the Form

Completing the form involves several key steps to ensure accuracy and compliance. First, gather all relevant information regarding the benefit payments made during the plan year. This includes details such as the amount distributed, the recipient's information, and any applicable tax implications. Next, fill out the form carefully, ensuring that each section is completed with precise data. It is important to double-check for any discrepancies before submission. If necessary, consult with a financial advisor or legal expert to clarify any complex issues related to the distributions.

Key Elements of the Form

The form contains several essential elements that must be understood for effective use. Key components include the identification of the plan year, the total amount of distributions, and the specific beneficiaries receiving payments. Additionally, the form may require information regarding the type of benefits being distributed, such as retirement funds or insurance payouts. Understanding these elements is vital for ensuring that all distributions are reported accurately and in compliance with applicable regulations.

Legal Considerations for the Form

Legal compliance is a critical aspect of using the form. It is important to understand the regulations governing benefit distributions, which may vary by state and type of benefit plan. The form must be filled out in accordance with IRS guidelines to avoid potential penalties. Organizations should also be aware of any disclosure requirements that may apply to their specific benefit plans. Consulting with legal professionals can help clarify these obligations and ensure that all necessary legal standards are met.

Examples of Form Usage

Practical examples of how the form is utilized can provide valuable insights. For instance, a company may use the form to report distributions made to employees as part of a retirement plan. In another scenario, a health insurance provider might use the form to document benefit payments made to policyholders during the plan year. These examples illustrate the form's versatility and importance in various contexts, highlighting its role in maintaining accurate financial records and ensuring compliance with regulatory requirements.

Filing Deadlines and Important Dates

Timely filing of the form is essential to avoid penalties. Organizations must be aware of specific deadlines associated with benefit distributions, which can vary based on the plan type and regulatory requirements. Typically, forms must be submitted by the end of the plan year or within a designated period following the distribution of benefits. Keeping track of these deadlines helps ensure that all reporting obligations are met and that beneficiaries receive their payments without unnecessary delays.

Quick guide on how to complete all references to distributions relate only to payments of benefits during the plan year

Easily Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The Easiest Way to Edit and eSign [SKS] Effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important parts of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to All References To Distributions Relate Only To Payments Of Benefits During The Plan Year

Create this form in 5 minutes!

How to create an eSignature for the all references to distributions relate only to payments of benefits during the plan year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What do you mean by distributions in the context of airSlate SignNow?

In airSlate SignNow, 'All References To Distributions Relate Only To Payments Of Benefits During The Plan Year' refers to how we handle financial transactions related to the services provided. Our platform ensures that all document transactions, including those that involve payments, are accurately tracked and managed.

-

How does airSlate SignNow improve document signing efficiency?

Our platform allows users to eSign documents seamlessly, signNowly streamlining the process. By ensuring 'All References To Distributions Relate Only To Payments Of Benefits During The Plan Year', we help users maintain clarity and efficiency in their financial and legal document workflows.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored for different business needs. Each plan is designed to provide maximum value while ensuring 'All References To Distributions Relate Only To Payments Of Benefits During The Plan Year' are clearly reflected, preventing any confusion in billing and document finalization.

-

What key features does airSlate SignNow provide?

Our key features include document templates, eSigning capabilities, and flexible integrations with various platforms. All these features support the principle that 'All References To Distributions Relate Only To Payments Of Benefits During The Plan Year', making our solution comprehensive for managing documents efficiently.

-

How can airSlate SignNow integrate with my existing tools?

airSlate SignNow offers robust integrations with popular business tools, enhancing your existing workflows. By aligning with our principle that 'All References To Distributions Relate Only To Payments Of Benefits During The Plan Year', we ensure that all integrated features function smoothly without disrupting your current processes.

-

Can airSlate SignNow support multiple users within an organization?

Yes, airSlate SignNow is designed to support team collaboration, enabling multiple users to work on documents simultaneously. This collaboration reinforces the clarity of 'All References To Distributions Relate Only To Payments Of Benefits During The Plan Year', ensuring all parties are on the same page concerning financial agreements.

-

What security measures does airSlate SignNow have in place?

We prioritize security with advanced encryption and compliance protocols. Our commitment to integrity ensures that 'All References To Distributions Relate Only To Payments Of Benefits During The Plan Year' are handled with the utmost confidentiality and protection of sensitive data.

Get more for All References To Distributions Relate Only To Payments Of Benefits During The Plan Year

Find out other All References To Distributions Relate Only To Payments Of Benefits During The Plan Year

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online