Form N 848, Rev , Power of Attorney Intuit

What is the Form N-848, Rev, Power of Attorney Intuit

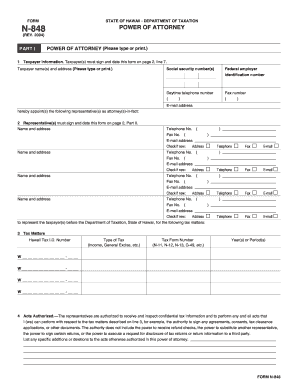

The Form N-848, Rev, Power of Attorney Intuit is a legal document that allows an individual to designate another person to act on their behalf in specific matters, particularly in tax-related issues. This form is typically used to grant authority to a tax professional or an attorney to handle tax matters with the Internal Revenue Service (IRS) or state tax authorities. By completing this form, the taxpayer can ensure that their representative has the necessary legal power to communicate and manage their tax responsibilities effectively.

How to Use the Form N-848, Rev, Power of Attorney Intuit

Using the Form N-848 involves several steps. First, the individual must clearly identify the representative they wish to appoint. This includes providing the representative's name, address, and contact information. Next, the form requires the taxpayer to specify the scope of authority granted to the representative, which may include filing tax returns, receiving tax information, and representing the taxpayer in audits or appeals. Once completed, the form should be signed and dated by the taxpayer to validate the appointment.

Steps to Complete the Form N-848, Rev, Power of Attorney Intuit

Completing the Form N-848 involves a systematic approach:

- Gather necessary personal information, including your Social Security number and contact details.

- Provide the representative's information, including their name, address, and phone number.

- Clearly outline the specific powers you wish to grant, ensuring they align with your needs.

- Review the form for accuracy and completeness before signing.

- Submit the completed form to the appropriate tax authority, either electronically or via mail.

Legal Use of the Form N-848, Rev, Power of Attorney Intuit

The Form N-848 is legally binding once signed by the taxpayer. It empowers the designated representative to act in the taxpayer's best interest regarding tax matters. This includes the ability to receive confidential tax information and make decisions regarding tax filings. It is crucial to understand that the authority granted is limited to the scope defined in the form, and the taxpayer retains the right to revoke this power at any time by submitting a written notice to the tax authority.

Key Elements of the Form N-848, Rev, Power of Attorney Intuit

Key elements of the Form N-848 include:

- Taxpayer Information: Full name, address, and Social Security number.

- Representative Information: Name, address, and contact details of the appointed representative.

- Scope of Authority: Specific powers granted to the representative, such as filing returns and representing the taxpayer.

- Signature: The taxpayer's signature and date, which validate the form.

Required Documents

When submitting the Form N-848, it is essential to include any required supporting documents. This may include proof of identity, such as a driver's license or Social Security card, depending on the tax authority's requirements. Additionally, if the representative is a tax professional, they may need to provide their professional credentials or identification number. Ensuring all necessary documents are included can help prevent delays in processing.

Quick guide on how to complete form n 848 rev power of attorney intuit

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without hold-ups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and Electronically Sign [SKS] Effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Mark important sections of the documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and electronically sign [SKS] while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form N 848, Rev , Power Of Attorney Intuit

Create this form in 5 minutes!

How to create an eSignature for the form n 848 rev power of attorney intuit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form N 848, Rev , Power Of Attorney Intuit?

Form N 848, Rev , Power Of Attorney Intuit is a document that grants someone else the authority to act on your behalf, specifically in relation to tax matters. It's essential for users who need to delegate responsibilities for handling tax-related issues with Intuit. Using airSlate SignNow makes it easy to complete and eSign this important form securely.

-

How can airSlate SignNow help with the Form N 848, Rev , Power Of Attorney Intuit?

airSlate SignNow streamlines the process of completing the Form N 848, Rev , Power Of Attorney Intuit by providing customizable templates and an intuitive interface. You can create the document quickly, fill in necessary details, and send it for eSignature in just a few clicks. This saves you time and ensures accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for Form N 848, Rev , Power Of Attorney Intuit?

Yes, there are different pricing plans available for airSlate SignNow that cater to various business needs. These plans allow you to choose the features that best suit your requirements, including handling Form N 848, Rev , Power Of Attorney Intuit. You’ll find that the pricing is cost-effective compared to traditional methods.

-

What features does airSlate SignNow offer for processing Form N 848, Rev , Power Of Attorney Intuit?

airSlate SignNow offers features like customizable templates, bulk sending, real-time tracking, and reminders to ensure timely completion of the Form N 848, Rev , Power Of Attorney Intuit. Additionally, it provides a secure encryption system to protect your sensitive information throughout the signing process.

-

Are there any integrations available with airSlate SignNow for Form N 848, Rev , Power Of Attorney Intuit?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including cloud storage services and accounting software, to streamline the process of managing Form N 848, Rev , Power Of Attorney Intuit. This means you can access your documents and data from multiple platforms easily.

-

Can I store completed Form N 848, Rev , Power Of Attorney Intuit documents in airSlate SignNow?

Yes, airSlate SignNow provides secure storage for all your completed documents, including Form N 848, Rev , Power Of Attorney Intuit. This ensures that you can access your signed forms anytime and can share them with stakeholders when necessary without worrying about data loss.

-

Is airSlate SignNow user-friendly for completing Form N 848, Rev , Power Of Attorney Intuit?

Yes, airSlate SignNow is designed with user experience in mind. Its easy-to-navigate interface allows you to complete and eSign Form N 848, Rev , Power Of Attorney Intuit without any technical expertise. Users of all levels can quickly get accustomed to the platform.

Get more for Form N 848, Rev , Power Of Attorney Intuit

Find out other Form N 848, Rev , Power Of Attorney Intuit

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application