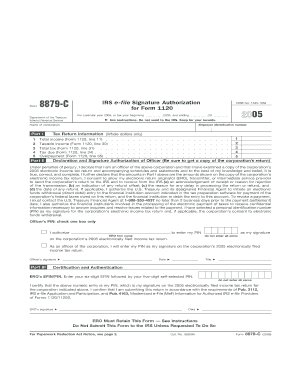

Form 8879 C, Fill in Capable IRS E File Signature Authorization for Form 1120

What is the Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120

The Form 8879 C is a crucial document for businesses that file Form 1120, the U.S. Corporation Income Tax Return. This form serves as an e-file signature authorization, allowing taxpayers to electronically sign their tax returns. By using Form 8879 C, businesses can streamline the filing process, ensuring that their returns are submitted accurately and on time. This form is particularly beneficial for corporations that prefer the convenience of electronic filing while maintaining compliance with IRS requirements.

How to use the Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120

Using Form 8879 C involves a straightforward process. Initially, the business must complete Form 1120, ensuring all financial information is accurate. Once the Form 1120 is prepared, the taxpayer can fill out Form 8879 C to authorize the e-filing of their return. This form must include the taxpayer's name, title, and signature, along with the date of signing. After completing Form 8879 C, it should be submitted electronically alongside Form 1120 to the IRS. It is essential to retain a copy of both forms for your records.

Steps to complete the Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120

Completing Form 8879 C involves several key steps:

- Prepare Form 1120 with accurate financial data for the tax year.

- Access Form 8879 C and enter the required information, including the business name and taxpayer details.

- Sign and date the form, confirming your authorization for e-filing.

- Submit Form 8879 C electronically along with Form 1120 to the IRS.

- Keep a copy of both forms for your records, as they may be needed for future reference.

Legal use of the Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120

Form 8879 C is legally recognized by the IRS as a valid signature authorization for e-filing corporate tax returns. It ensures that the taxpayer has consented to the electronic submission of their Form 1120. This legal standing helps protect both the taxpayer and the IRS by providing a clear record of the authorization. It is crucial for businesses to understand that using this form correctly is essential for compliance with IRS regulations, avoiding potential penalties for improper filing.

Key elements of the Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120

Several key elements must be included in Form 8879 C to ensure its validity:

- Taxpayer Information: This includes the name, title, and Employer Identification Number (EIN) of the business.

- Signature: The form must be signed by the authorized individual, typically the principal officer of the corporation.

- Date: The date of signing must be clearly indicated to establish the timeline of authorization.

- Confirmation of Accuracy: The signer must confirm that the information on Form 1120 is accurate and complete.

Filing Deadlines / Important Dates

It is important for businesses to be aware of the filing deadlines associated with Form 8879 C and Form 1120. Generally, Form 1120 must be filed by the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically means a due date of April 15. If additional time is needed, businesses can file for an extension, but they must still submit Form 8879 C by the original due date to avoid penalties.

Quick guide on how to complete form 8879 c fill in capable irs e file signature authorization for form 1120

Easily Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign [SKS] Effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120

Create this form in 5 minutes!

How to create an eSignature for the form 8879 c fill in capable irs e file signature authorization for form 1120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120?

Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120, is an electronic authorization form that allows a business taxpayer to approve the e-filing of their corporate income tax return. This form simplifies the process, ensuring that signatures are securely obtained and stored. By utilizing this form, business owners can conveniently approve their documents online.

-

How can airSlate SignNow help with Form 8879 C?

airSlate SignNow provides an efficient platform to fill out and eSign Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120. With its user-friendly interface, you can easily input information, add signatures, and send the form for e-filing. This streamlines the process and reduces the hassle of traditional paperwork.

-

What are the benefits of using airSlate SignNow for Form 8879 C?

By using airSlate SignNow for Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120, you benefit from enhanced security, faster processing times, and ease of use. The platform allows for secure storage and retrieval of forms, ensuring compliance with IRS requirements. This solution can also save your business signNow time and costs associated with paper filing.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different business needs, making it affordable for any size of company. These plans include features tailored specifically for managing and eSigning documents like Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120. You can choose a plan that suits your budget and frequency of use.

-

Is airSlate SignNow compliant with IRS requirements for Form 8879 C?

Yes, airSlate SignNow is fully compliant with IRS requirements for Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120. The platform uses secure encryption to protect sensitive information and facilitates legally binding electronic signatures. This compliance ensures your electronic filings are valid and meet all necessary regulations.

-

Can I integrate airSlate SignNow with other tools for a better workflow?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms, enhancing your workflow while working with Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120. Whether you use CRM systems or cloud storage solutions, the integrations help streamline processes and improve efficiency.

-

How does airSlate SignNow ensure the security of Form 8879 C submissions?

airSlate SignNow employs advanced security measures, including encryption and multi-factor authentication, to secure Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120 submissions. Your data is protected against unauthorized access while stored and during transmission. This security framework gives users peace of mind about the safety of their sensitive financial information.

Get more for Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120

- Saudi business visa formal undertaking london londonchamber co

- Community center cleaning checklist form

- Tes agreement form

- Rampp nmdc ltd donimalai iron ore mine donimalai township form

- Blank prescription form template australiapdf download books blank prescription form template australia pdf imaginedragon esy

- How to renew your drivers license online form

- Aubagio start form

- Tesoro filler form

Find out other Form 8879 C, Fill In Capable IRS E File Signature Authorization For Form 1120

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word