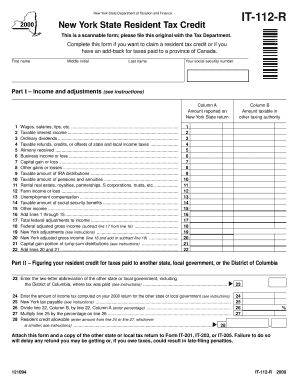

Form it 112 R , New York State Resident Tax Credit, IT112R Tax Ny

What is the Form IT 112 R?

The Form IT 112 R is a tax document used by residents of New York State to claim a tax credit for their personal income tax. This form is specifically designed for individuals who have paid New York State income tax and are eligible for a refund or credit based on their income level and tax payments. The IT 112 R is essential for ensuring that taxpayers receive the appropriate credits that can reduce their overall tax liability.

How to use the Form IT 112 R

To effectively use the Form IT 112 R, taxpayers must first determine their eligibility based on income and other criteria set forth by the New York State Department of Taxation and Finance. After confirming eligibility, individuals should accurately fill out the form, ensuring that all required information is provided. This includes personal details, income information, and any applicable deductions or credits. Once completed, the form can be submitted either electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Form IT 112 R

Completing the Form IT 112 R involves several key steps:

- Gather necessary documents: Collect your income statements, previous tax returns, and any documentation related to deductions or credits.

- Fill out personal information: Enter your name, address, Social Security number, and filing status accurately.

- Report income: Include all sources of income as required, ensuring accuracy to avoid discrepancies.

- Calculate tax credits: Use the guidelines provided with the form to determine the eligible credits you can claim.

- Review and submit: Check for any errors or omissions before submitting the form electronically or by mail.

Eligibility Criteria

To qualify for the tax credit claimed on the Form IT 112 R, individuals must meet specific eligibility criteria set by New York State. Generally, this includes being a resident of New York State for the entire tax year, having a valid Social Security number, and meeting the income thresholds established for the tax credit. Additionally, taxpayers must not be claimed as dependents on another person's tax return.

Required Documents

When preparing to complete the Form IT 112 R, it is important to have the following documents ready:

- Income statements: W-2 forms, 1099 forms, or any other documentation of income earned.

- Previous tax returns: Copies of your prior year's tax returns for reference.

- Proof of residency: Documentation that verifies your residency in New York State.

- Supporting documents for deductions: Any receipts or records that support claims for deductions or credits.

Form Submission Methods

The Form IT 112 R can be submitted through various methods, providing flexibility for taxpayers. Individuals can choose to file electronically using the New York State Department of Taxation and Finance's online services. Alternatively, the form can be printed and mailed to the appropriate tax office. In-person submissions may also be possible at designated tax offices, depending on local regulations and availability.

Quick guide on how to complete it 112 r instructions

Prepare it 112 r instructions effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely archive it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage it 112 r on any device with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The simplest way to edit and eSign ny it 112 r without any hassle

- Obtain it 112 and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign form it 112 r and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 112

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask it 112 r instructions

-

What is airSlate SignNow's 'it 112 r' feature?

The 'it 112 r' feature in airSlate SignNow refers to our tailored eSignature solutions for specific industry needs. This functionality allows users to efficiently handle document signing in compliance with various regulations, streamlining workflows signNowly.

-

How much does airSlate SignNow's 'it 112 r' service cost?

Pricing for airSlate SignNow's 'it 112 r' service is competitive and designed to fit different business budgets. We offer flexible pricing plans, which can be tailored based on user needs and how many documents you expect to process each month.

-

What are the benefits of using airSlate SignNow's 'it 112 r'?

Using airSlate SignNow's 'it 112 r' provides numerous benefits, such as reduced turnaround times for document signing and improved accuracy in your workflows. Additionally, it enhances your business's productivity by allowing teams to focus on more critical tasks, rather than manual signature processes.

-

Can airSlate SignNow's 'it 112 r' integrate with other software?

Yes, airSlate SignNow's 'it 112 r' is designed to integrate seamlessly with a variety of business applications. This ensures that you can easily send and manage your documents alongside popular tools such as CRM systems, project management software, and others.

-

Is airSlate SignNow's 'it 112 r' easy to use for new customers?

Absolutely! airSlate SignNow's 'it 112 r' is user-friendly and designed with new customers in mind. Our intuitive interface enables anyone to quickly learn how to send and eSign documents without extensive training.

-

What security features does airSlate SignNow’s 'it 112 r' offer?

Security is paramount with airSlate SignNow's 'it 112 r'. We use advanced encryption protocols and authentication measures to ensure your documents are safe and comply with industry standards, giving you peace of mind while managing sensitive information.

-

Can I customize my document templates with airSlate SignNow's 'it 112 r'?

Yes, airSlate SignNow's 'it 112 r' allows users to create and customize document templates easily. This feature saves time and ensures consistent branding, so you can deliver professional-looking documents tailored to your specific needs.

Get more for it 112r

- What is sicid form for state of ca

- Kilang yty form

- Thrdpdf revisions for marilynwp to pdf donecsd1001a wpd casb uscourts form

- Disc 015 request for statement of witnesses and evidence for limited civil cases under 25000 judicial council forms courtinfo ca

- Notice of change b 2a form

- Verification of employment new york state department of health form

- Tesda op co 03 f04 form

- Gift certificate collegeaccess529 form

Find out other it112r

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later