Form Y 206Yonkers Nonresident Fiduciary Earnings Tax Tax Ny

What is the Form Y-206 Yonkers Nonresident Fiduciary Earnings Tax?

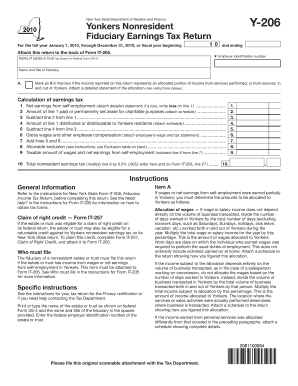

The Form Y-206 is a tax document specifically designed for nonresident fiduciaries who manage earnings derived from sources within Yonkers, New York. This form is essential for reporting and paying the Yonkers Nonresident Fiduciary Earnings Tax. It applies to estates and trusts that earn income in Yonkers but are not residents of the city. Understanding this form is crucial for compliance with local tax regulations and ensuring that fiduciaries fulfill their tax obligations accurately.

Steps to Complete the Form Y-206 Yonkers Nonresident Fiduciary Earnings Tax

Completing the Form Y-206 involves several key steps:

- Begin by gathering all necessary financial documents related to the income generated by the estate or trust.

- Fill out the identifying information, including the name and address of the fiduciary and the estate or trust.

- Report the total earnings from Yonkers sources in the designated sections of the form.

- Calculate the tax due based on the reported earnings, following the applicable tax rates.

- Review the completed form for accuracy before submission.

How to Obtain the Form Y-206 Yonkers Nonresident Fiduciary Earnings Tax

The Form Y-206 can be obtained through several channels. It is available for download from the official Yonkers city tax website. Additionally, physical copies may be available at local tax offices or municipal buildings in Yonkers. Ensure you have the most current version of the form to avoid any compliance issues.

Legal Use of the Form Y-206 Yonkers Nonresident Fiduciary Earnings Tax

The legal use of Form Y-206 is mandated for nonresident fiduciaries managing estates or trusts that earn income in Yonkers. This form serves as a declaration of the income earned and the corresponding tax liability. Proper filing ensures compliance with local tax laws and helps avoid penalties for non-compliance. It is advisable to consult a tax professional if there are uncertainties regarding the legal implications of using this form.

Filing Deadlines / Important Dates

Filing deadlines for Form Y-206 are typically aligned with the tax year deadlines for fiduciaries. Generally, the form must be submitted by the fifteenth day of the fourth month following the close of the tax year. It is important to stay informed about any changes to these deadlines to ensure timely filing and avoid penalties.

Required Documents

To successfully complete the Form Y-206, certain documents are required. These include:

- Financial statements detailing income generated by the estate or trust.

- Records of any deductions or credits applicable to the income reported.

- Identification details of the fiduciary and the estate or trust.

Having these documents ready will facilitate a smoother filing process.

Quick guide on how to complete form y 206yonkers nonresident fiduciary earnings tax tax ny

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without interruptions. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that task.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] and guarantee outstanding communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form Y 206Yonkers Nonresident Fiduciary Earnings Tax Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the form y 206yonkers nonresident fiduciary earnings tax tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form Y 206Yonkers Nonresident Fiduciary Earnings Tax Tax Ny?

Form Y 206Yonkers Nonresident Fiduciary Earnings Tax Tax Ny is a tax form that nonresident fiduciaries in Yonkers must file to report earnings. This form is essential for ensuring compliance with local tax laws, and it helps determine tax liabilities for trusts and estates that generate income in New York.

-

How does airSlate SignNow assist with filing Form Y 206Yonkers Nonresident Fiduciary Earnings Tax Tax Ny?

airSlate SignNow streamlines the process of completing and submitting Form Y 206Yonkers Nonresident Fiduciary Earnings Tax Tax Ny by providing a simple electronic signature solution. With our platform, you can easily fill out and eSign your tax documents, ensuring a quick and compliant filing process.

-

What are the pricing options for airSlate SignNow related to tax forms?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of individuals and businesses needing to process forms like Form Y 206Yonkers Nonresident Fiduciary Earnings Tax Tax Ny. Our pricing is transparent, with options ranging from essential features to advanced capabilities, allowing you to choose what fits your requirements.

-

Are there any features specifically for tax-related documents?

Yes, airSlate SignNow provides features specifically designed for tax-related documents such as Form Y 206Yonkers Nonresident Fiduciary Earnings Tax Tax Ny. Users can benefit from templates, automated workflows, and customizable signing options, all aimed at simplifying the tax filing process.

-

Can airSlate SignNow integrate with accounting software for tax filing?

Absolutely! airSlate SignNow can integrate with various accounting software programs, facilitating seamless data transfer necessary for filing Form Y 206Yonkers Nonresident Fiduciary Earnings Tax Tax Ny. This integration helps streamline your tax preparation and filing processes.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for your tax forms, including Form Y 206Yonkers Nonresident Fiduciary Earnings Tax Tax Ny, offers several benefits, including efficiency, secure electronic signatures, and compliance assurance. Our platform reduces paperwork, minimizes errors, and saves you time during tax season.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow employs industry-standard security measures to protect your sensitive tax information, including data related to Form Y 206Yonkers Nonresident Fiduciary Earnings Tax Tax Ny. With encryption and secure storage protocols, your documents are well-protected throughout the signing process.

Get more for Form Y 206Yonkers Nonresident Fiduciary Earnings Tax Tax Ny

- Mathworksheets4kids form

- H 4d1 model form for 1026 20c bankersonline com

- Alabama board of nursing reinstatement form

- Ohio bmv 2610 form

- Msysa premier player registration pdf form

- Mw permit application guilford county government co guilford nc form

- Chapter sprint round form

- Merchant processing application and agreement mpa first data form

Find out other Form Y 206Yonkers Nonresident Fiduciary Earnings Tax Tax Ny

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form