Form it 254 , Claim for Residential Fuel Oil Storage Tank Tax Ny

What is the Form IT-254, Claim For Residential Fuel Oil Storage Tank Tax NY

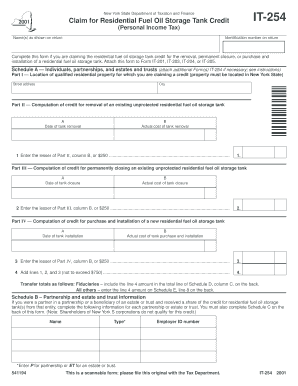

The Form IT-254 is a tax form used in New York State that allows taxpayers to claim a credit for the tax paid on residential fuel oil storage tanks. This form is specifically designed for individuals who have installed or maintained a residential fuel oil storage tank and are seeking reimbursement for the associated tax expenses. The credit is intended to alleviate some of the financial burdens related to the installation and upkeep of these tanks, promoting safe and efficient energy use in residential settings.

How to use the Form IT-254, Claim For Residential Fuel Oil Storage Tank Tax NY

Using Form IT-254 requires careful attention to detail to ensure that all necessary information is accurately provided. Taxpayers must complete the form by entering their personal information, details about the fuel oil storage tank, and the amount of tax paid. It is important to follow the instructions provided with the form closely, as any inaccuracies may delay the processing of the claim. Once completed, the form can be submitted to the New York State Department of Taxation and Finance for review.

Steps to complete the Form IT-254, Claim For Residential Fuel Oil Storage Tank Tax NY

Completing the Form IT-254 involves several key steps:

- Gather necessary documentation, including proof of tax payment and details about the fuel oil storage tank.

- Fill out the personal information section, ensuring accuracy in your name, address, and taxpayer identification number.

- Provide specifics about the fuel oil storage tank, including its capacity and installation date.

- Calculate the total tax paid and enter this amount on the form.

- Review the completed form for any errors or omissions before submission.

Eligibility Criteria

To be eligible to use Form IT-254, taxpayers must meet certain criteria. The individual must be a resident of New York State and have incurred tax expenses related to a residential fuel oil storage tank. The tank must be used for residential purposes, and the claim must be supported by documentation proving the tax payment. Additionally, the installation of the tank should comply with local regulations and safety standards.

Required Documents

When submitting Form IT-254, specific documents are required to support the claim. These typically include:

- Proof of tax payment, such as receipts or invoices.

- Documentation of the installation of the fuel oil storage tank, including permits if applicable.

- Any additional forms or statements that may be required by the New York State Department of Taxation and Finance.

Form Submission Methods

Form IT-254 can be submitted through various methods to accommodate different preferences. Taxpayers have the option to submit the form online through the New York State Department of Taxation and Finance website, by mail, or in person at designated offices. Each method has specific guidelines regarding processing times and requirements, so it is essential to choose the method that best suits the taxpayer's needs.

Quick guide on how to complete form it 254 claim for residential fuel oil storage tank tax ny

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as a perfect eco-conscious alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Alter and Electronically Sign [SKS]

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive details using the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes just seconds and is as legally binding as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form—via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or mislaid documents, tedious searches for forms, or errors that necessitate creating new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any chosen device. Edit and eSign [SKS] and ensure clear communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 254 claim for residential fuel oil storage tank tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 254, Claim For Residential Fuel Oil Storage Tank Tax NY?

Form IT 254 is a tax form used in New York State to claim a credit for residential fuel oil storage tank taxes. This form is essential for homeowners who have paid tax on their residential fuel oil storage tanks, allowing them to receive a refund. It is crucial to understand its requirements and to fill it out correctly to ensure your claim is processed smoothly.

-

How can airSlate SignNow assist with Form IT 254, Claim For Residential Fuel Oil Storage Tank Tax NY?

airSlate SignNow provides an easy-to-use platform to eSign and manage your Form IT 254 digitally. With our solution, you can quickly upload your completed form, sign it securely, and send it to the appropriate tax authority. This streamlined process reduces paperwork, saving you time and effort.

-

What features does airSlate SignNow offer for managing Form IT 254?

airSlate SignNow offers features like document templates, eSignature capabilities, and cloud storage for your Form IT 254 documents. You can easily collaborate with others, track changes, and ensure compliance with tax requirements. These features make handling your tax forms much more efficient and organized.

-

Is there a cost associated with using airSlate SignNow for Form IT 254?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. These plans provide access to features necessary for eSigning and managing documents like Form IT 254. Overall, it remains a cost-effective solution for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other software when processing Form IT 254?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow when handling Form IT 254. Whether you're using accounting software or other document management systems, our platform can streamline your processes.

-

What are the benefits of using airSlate SignNow for my tax-related documents?

Using airSlate SignNow for your tax-related documents, including Form IT 254, provides numerous benefits such as enhanced security, ease of use, and efficiency. You can sign and send documents electronically, reducing the risk of loss or delay. This means you can focus more on your tax strategy rather than the logistical details of document handling.

-

Is airSlate SignNow compliant with current tax regulations for Form IT 254?

Yes, airSlate SignNow is designed to meet regulatory standards, including those relevant to Form IT 254. Our platform prioritizes compliance, ensuring that all eSigned documents meet necessary legal requirements. This commitment helps you confidently navigate the tax filing process.

Get more for Form IT 254 , Claim For Residential Fuel Oil Storage Tank Tax Ny

- Marketing practicum final report form

- Dynacare laboratories client supply order form

- Trade request for chief access via w e x channels pa7 hmrc gov form

- Ct 33 d fillable form

- Ust inventory reconciliation form ct gov ct

- Melaleuca com uk form

- Les schwab retail credit application form

- Coaching request form

Find out other Form IT 254 , Claim For Residential Fuel Oil Storage Tank Tax Ny

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy