Usda Ccc 933 Form

Understanding the USDA CCC 926 Form

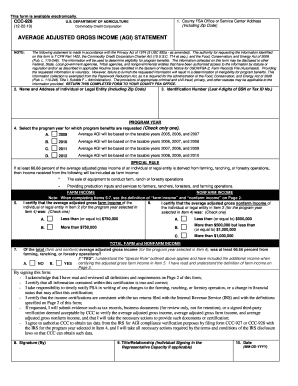

The USDA CCC 926 form, also known as the adjusted gross income statement, is a critical document utilized by farmers and agricultural producers in the United States. This form is essential for reporting adjusted gross income (AGI) to the USDA, particularly when applying for certain programs or benefits. The AGI reported on this form can affect eligibility for various federal assistance programs, making accuracy crucial.

Steps to Complete the USDA CCC 926 Form

Completing the USDA CCC 926 form involves several key steps to ensure that all required information is accurately reported:

- Gather necessary financial documents, including tax returns and income statements.

- Calculate your adjusted gross income by following IRS guidelines.

- Fill out the form with your personal and business information, ensuring all data is correct.

- Review the completed form for any errors or omissions before submission.

Key Elements of the USDA CCC 926 Form

The USDA CCC 926 form includes several important sections that must be filled out accurately. Key elements typically include:

- Personal identification details, such as name, address, and Social Security number or EIN.

- Income details, including wages, dividends, and other sources of income.

- Adjustments to income, which may include contributions to retirement accounts or student loan interest.

- Signature and date, confirming the accuracy of the information provided.

Eligibility Criteria for the USDA CCC 926 Form

To be eligible to submit the USDA CCC 926 form, applicants must meet specific criteria set forth by the USDA. Generally, these criteria include:

- Being an active farmer or agricultural producer in the United States.

- Having a valid Social Security number or Employer Identification Number (EIN).

- Meeting income thresholds as defined by USDA guidelines.

Form Submission Methods

The USDA CCC 926 form can be submitted through various methods, providing flexibility for applicants. Common submission methods include:

- Online submission via the USDA's official website or designated portals.

- Mailing a printed copy of the form to the appropriate USDA office.

- In-person submission at local USDA service centers.

IRS Guidelines for Reporting Income

When completing the USDA CCC 926 form, it is essential to adhere to IRS guidelines for reporting income. These guidelines ensure that the income reported is consistent with federal tax regulations. Key points to consider include:

- Understanding what constitutes adjusted gross income and how to calculate it accurately.

- Familiarizing yourself with allowable deductions that can affect your AGI.

- Keeping detailed records of all income sources and adjustments for reference.

Quick guide on how to complete usda ccc 933 form

Complete Usda Ccc 933 Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Usda Ccc 933 Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to update and electronically sign Usda Ccc 933 Form with ease

- Find Usda Ccc 933 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight signNow sections of your documents or redact sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Update and electronically sign Usda Ccc 933 Form to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the usda ccc 933 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an adjusted gross income statement and why is it important?

An adjusted gross income statement is a crucial financial document that outlines an individual's total income and deductions. It's important for tax purposes as it helps in determining the taxable income and can influence tax planning decisions. Understanding this can aid in maximizing your financial benefits.

-

How can airSlate SignNow assist in generating an adjusted gross income statement?

airSlate SignNow offers an easy-to-use platform that allows users to create, send, and eSign various financial documents, including an adjusted gross income statement. With our customizable templates, you can streamline the process, ensuring that all necessary information is accurately captured and securely signed.

-

Is there a cost associated with creating an adjusted gross income statement using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including plans that allow for seamless generation of essential documents like the adjusted gross income statement. Explore our pricing page to find a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for managing adjusted gross income statements?

airSlate SignNow provides features such as customizable templates, collaboration tools, and secure eSignature options, all of which are ideal for managing your adjusted gross income statement. These features not only save time but also enhance accuracy and compliance in document handling.

-

Can I integrate airSlate SignNow with other accounting software for adjusted gross income statements?

Absolutely! airSlate SignNow supports integrations with various accounting and financial software, making it easier to manage your adjusted gross income statement alongside other financial documents. These integrations can help ensure that your data is consistent and easily accessible across platforms.

-

What are the benefits of using airSlate SignNow for my adjusted gross income statement?

Using airSlate SignNow for your adjusted gross income statement offers numerous benefits, including improved efficiency, enhanced document security, and simplified workflows. Our platform allows you to quickly eSign and share documents, helping you stay organized and focused on your financial goals.

-

Is airSlate SignNow suitable for both individuals and businesses needing adjusted gross income statements?

Yes, airSlate SignNow is suitable for both individuals and businesses looking to create adjusted gross income statements. Whether you're a freelancer or a large corporation, our platform is designed to cater to diverse needs, providing a user-friendly experience for all.

Get more for Usda Ccc 933 Form

- Instructions for form 2555 internal revenue service

- Form 8911 rev december alternative fuel vehicle refueling property credit

- A guide to schedule j form 1040 income averaging for

- Publication 4134 rev 5 low income taxpayer clinic list form

- Form 1041 t allocation of estimated tax payments to beneficiaries under code section 643g 793575050

- Form 4137 social security and medicare tax on unreported tip income 793575115

- Form 720 x the ultimate guide to tax return amendment

- Form 990 schedule h instructions hospitals

Find out other Usda Ccc 933 Form

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP