AR1075 Deduction for Tuition Paid to Post Secondary Educational Institutions ARKANSAS INDIVIDUAL INCOME TAX RETURN One Form Per

Understanding the AR1075 Deduction for Tuition Paid

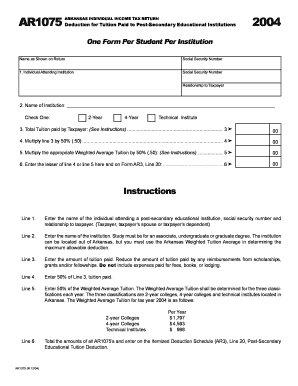

The AR1075 Deduction for Tuition Paid to Post Secondary Educational Institutions is a tax benefit available to Arkansas residents. This deduction allows taxpayers to reduce their taxable income by the amount paid for tuition at eligible institutions. It is specifically designed to support individuals pursuing higher education and can significantly impact tax liability. To qualify, the tuition must be for courses taken at accredited post-secondary institutions within the state.

Steps to Complete the AR1075 Deduction Form

Completing the AR1075 form involves several key steps. First, gather all necessary documentation, including proof of tuition payments and enrollment details. Next, accurately fill out the form, ensuring that the name and Social Security number match those on your tax return. Each student must have a separate form for each institution attended. After completing the form, review it for accuracy before submission. Finally, submit the form along with your Arkansas Individual Income Tax Return.

Eligibility Criteria for the AR1075 Deduction

To qualify for the AR1075 Deduction, certain eligibility criteria must be met. The taxpayer must be a resident of Arkansas and have incurred tuition expenses at an accredited post-secondary institution. The deduction applies to undergraduate and graduate programs, but it does not cover fees or other expenses outside of tuition. Additionally, the student must be enrolled in a degree or certificate program to be eligible for this benefit.

Required Documents for the AR1075 Deduction

When applying for the AR1075 Deduction, specific documents are required to substantiate your claim. These include receipts or statements from the educational institution detailing tuition payments made during the tax year. It is also advisable to keep records of enrollment status and any correspondence with the institution regarding tuition fees. Having these documents readily available will streamline the filing process and help ensure compliance with state tax regulations.

Filing Deadlines for the AR1075 Deduction

Timely filing is crucial for claiming the AR1075 Deduction. The deadline for submitting your Arkansas Individual Income Tax Return, including the AR1075 form, typically aligns with the federal tax deadline, which is generally April fifteenth. If you require additional time, you may file for an extension, but it is important to ensure that the AR1075 form is submitted by the extended deadline to avoid penalties.

Form Submission Methods for the AR1075 Deduction

The AR1075 Deduction form can be submitted through various methods. Taxpayers have the option to file electronically using approved tax software, which can simplify the process and reduce errors. Alternatively, the form can be printed and mailed to the appropriate state tax office. In-person submissions may also be possible at designated tax assistance locations, providing a direct way to ensure that your documents are received.

Quick guide on how to complete ar1075 deduction for tuition paid to post secondary educational institutions arkansas individual income tax return one form per

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers a seamless eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

The easiest way to edit and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and eSign [SKS] to ensure outstanding communication at every phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar1075 deduction for tuition paid to post secondary educational institutions arkansas individual income tax return one form per

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AR1075 Deduction for Tuition Paid to Post Secondary Educational Institutions in Arkansas?

The AR1075 Deduction for Tuition Paid to Post Secondary Educational Institutions is a tax deduction available for Arkansas residents filing their individual income tax return. It allows taxpayers to deduct qualifying tuition expenses paid for their dependents. To claim this deduction, you need to submit one form per student per institution, making sure to provide the required information, including the Name as Shown on Return and the Social Security Number.

-

Who is eligible to claim the AR1075 Deduction?

To be eligible for the AR1075 Deduction, you must be an Arkansas taxpayer who has incurred tuition costs for post-secondary education for a qualifying student. This includes students enrolled in colleges, universities, and other eligible institutions within the state. Remember, only one form per student per institution is required for the deduction on your Arkansas individual income tax return.

-

What expenses qualify for the AR1075 Deduction?

Qualifying expenses for the AR1075 Deduction include enrollment fees and tuition for post-secondary educational institutions in Arkansas. It is essential to keep detailed records of the payments made for tuition to ensure that you can substantiate your claims when filing your Arkansas individual income tax return. Be sure to check the eligibility of the institution and the programs offered.

-

How do I file for the AR1075 Deduction on my tax return?

To file for the AR1075 Deduction on your Arkansas individual income tax return, complete the necessary form, ensuring that you provide one form per student per institution. Gather all relevant tuition payment documentation and include the required personal information, such as the Name as Shown on Return and the Social Security Number on the tax return. This will facilitate the processing of your deduction.

-

What is the deadline for claiming the AR1075 Deduction?

The deadline for claiming the AR1075 Deduction for tuition expenses on your Arkansas individual income tax return typically aligns with the state's tax filing deadline, which is usually April 15th. Ensure that you file your return on or before this date to avoid potential penalties. Additionally, make sure that all forms for students are submitted to claim the deduction accurately.

-

Can I get assistance in submitting the AR1075 Deduction form?

Yes, various resources and professionals can assist you in submitting the AR1075 Deduction form for your Arkansas individual income tax return. Tax preparation software may also guide you through the process, making it easier to complete the one form per student per institution. Ensuring accuracy with the Name as Shown on Return and Social Security Number is crucial for successful processing.

-

What benefits does the AR1075 Deduction provide?

The primary benefit of the AR1075 Deduction is the financial relief it offers by reducing your taxable income, ultimately lowering your overall tax liability. This deduction helps families afford the cost of higher education in Arkansas, making post-secondary education more accessible. Always remember to check eligibility and complete the necessary forms properly for effective processing.

Get more for AR1075 Deduction For Tuition Paid To Post Secondary Educational Institutions ARKANSAS INDIVIDUAL INCOME TAX RETURN One Form Per

- Oregon lease agreement official pdf amp wordoregon lease agreement official pdf amp wordoregon lease agreement official pdf amp form

- Www ontariooregon org uploads 122city of ontario oregon form

- Watertownct qscend comcontent3928watertown ct home form

- New credit application form

- Prequal worksheet generic marsha doc baneproperties form

- Security community center 18760 highway 105 form

- Proposed application form

- Hersch lauren form

Find out other AR1075 Deduction For Tuition Paid To Post Secondary Educational Institutions ARKANSAS INDIVIDUAL INCOME TAX RETURN One Form Per

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed