540 ES Voucher 1 at Bottom of Page Form

What is the 540 ES Voucher 1 At Bottom Of Page

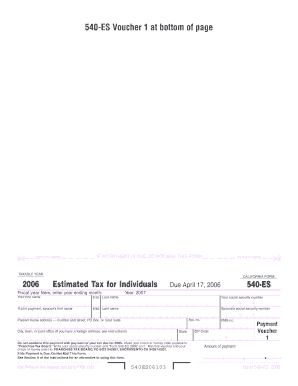

The 540 ES Voucher 1 is a payment voucher used by individuals in California to remit estimated tax payments to the state. It is specifically designed for taxpayers who expect to owe tax for the year and wish to make quarterly payments. This form is essential for ensuring compliance with California tax laws and helps taxpayers avoid penalties associated with underpayment. The voucher includes details such as the taxpayer's identification number, payment amount, and the tax year for which the payment is being made.

How to use the 540 ES Voucher 1 At Bottom Of Page

To use the 540 ES Voucher 1, taxpayers must first calculate their estimated tax liability for the upcoming year. After determining the amount owed, they can fill out the voucher with their personal information, including name, address, and Social Security number. It is crucial to ensure that the payment amount is accurate and corresponds to the calculated estimated tax. Once completed, the voucher should be submitted along with the payment to the designated address provided on the form.

Steps to complete the 540 ES Voucher 1 At Bottom Of Page

Completing the 540 ES Voucher 1 involves several key steps:

- Calculate your estimated tax liability based on your expected income and deductions for the year.

- Fill in your personal information, including your name, address, and Social Security number.

- Enter the amount you are paying for the estimated tax period.

- Review the information for accuracy to avoid any mistakes.

- Submit the voucher along with your payment to the address specified on the form.

Filing Deadlines / Important Dates

Filing deadlines for the 540 ES Voucher 1 are crucial for avoiding penalties. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. Taxpayers should mark these dates on their calendars to ensure timely submission. Late payments may incur interest and penalties, making it important to adhere to these deadlines.

Legal use of the 540 ES Voucher 1 At Bottom Of Page

The 540 ES Voucher 1 is legally recognized by the California Franchise Tax Board as a valid method for submitting estimated tax payments. Taxpayers are required to use this form if they expect to owe tax for the year and wish to avoid penalties. Proper use of the voucher ensures compliance with state tax laws and helps maintain good standing with tax authorities.

Examples of using the 540 ES Voucher 1 At Bottom Of Page

Examples of using the 540 ES Voucher 1 include individuals who are self-employed and anticipate owing taxes based on their income. For instance, a freelance graphic designer may use the voucher to pay estimated taxes quarterly based on their projected earnings. Another example is retirees who have income from investments and need to remit estimated payments to avoid underpayment penalties.

Quick guide on how to complete 540 es voucher 1 at bottom of page

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without unnecessary delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications, and streamline any document-related procedure today.

How to edit and eSign [SKS] without breaking a sweat

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and eSign [SKS] and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 540 ES Voucher 1 At Bottom Of Page

Create this form in 5 minutes!

How to create an eSignature for the 540 es voucher 1 at bottom of page

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 540 ES Voucher 1 At Bottom Of Page?

The 540 ES Voucher 1 At Bottom Of Page is a specific document used for tax purposes in California. It allows taxpayers to make estimated tax payments to the state. Understanding this voucher is crucial for ensuring compliance and avoiding penalties.

-

How can I access the 540 ES Voucher 1 At Bottom Of Page?

You can easily access the 540 ES Voucher 1 At Bottom Of Page through the airSlate SignNow platform. Simply log in to your account, navigate to the tax documents section, and download the voucher directly. This streamlined process saves you time and ensures you have the correct form.

-

What are the benefits of using airSlate SignNow for the 540 ES Voucher 1 At Bottom Of Page?

Using airSlate SignNow for the 540 ES Voucher 1 At Bottom Of Page offers several benefits, including ease of use and cost-effectiveness. The platform allows you to eSign documents quickly, ensuring that your tax payments are submitted on time. Additionally, it provides a secure environment for managing sensitive information.

-

Is there a cost associated with the 540 ES Voucher 1 At Bottom Of Page?

Accessing the 540 ES Voucher 1 At Bottom Of Page through airSlate SignNow is part of our subscription service. While there is a nominal fee for using the platform, the convenience and efficiency it provides can save you money in the long run. Check our pricing page for detailed information on subscription plans.

-

Can I integrate airSlate SignNow with other software for the 540 ES Voucher 1 At Bottom Of Page?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to manage the 540 ES Voucher 1 At Bottom Of Page alongside your other business tools. This integration helps streamline your workflow and ensures that all your documents are in one place. Explore our integration options to find the best fit for your needs.

-

How does airSlate SignNow ensure the security of the 540 ES Voucher 1 At Bottom Of Page?

airSlate SignNow prioritizes the security of your documents, including the 540 ES Voucher 1 At Bottom Of Page. We use advanced encryption and secure servers to protect your data from unauthorized access. You can trust that your sensitive information is safe while using our platform.

-

What features does airSlate SignNow offer for managing the 540 ES Voucher 1 At Bottom Of Page?

airSlate SignNow provides a range of features for managing the 540 ES Voucher 1 At Bottom Of Page, including eSigning, document tracking, and templates. These tools help you efficiently handle your tax documents and ensure that everything is completed accurately and on time. Our user-friendly interface makes it easy to navigate these features.

Get more for 540 ES Voucher 1 At Bottom Of Page

- Inspection request form atlanta ga

- County of sacramento department of community development building form

- Occupancy statement peachtree mortgage services inc form

- Department of the army ep 500 1 1 u s army corps of form

- Contract paragon systems hscee4 08 a 00001 ice form

- This form is the final site visit form required by the state of georgia and must be

- Permit department of planning amp community development form

- Missouri birth and death certificates form

Find out other 540 ES Voucher 1 At Bottom Of Page

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy