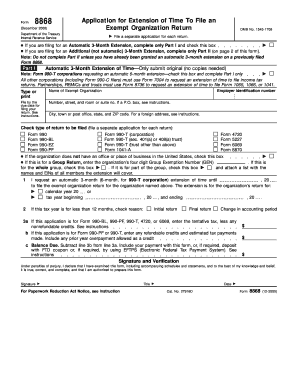

Form 8868 Rev December Application for Extension of Time to File an Exempt Organization Return

Understanding Form 8868 Rev December

Form 8868 Rev December is an important document used by exempt organizations in the United States to request an extension of time to file their annual return. This form is particularly relevant for organizations recognized under section 501(c) of the Internal Revenue Code, which includes charities, educational institutions, and other nonprofit entities. By submitting this form, organizations can secure an additional six months to file their returns, ensuring they remain compliant with IRS regulations while managing their financial reporting responsibilities.

How to Complete Form 8868 Rev December

Completing Form 8868 Rev December involves several key steps. First, organizations must provide their name, address, and Employer Identification Number (EIN) at the top of the form. Next, they need to indicate the type of return for which they are requesting an extension. It is essential to accurately fill out all required fields to avoid processing delays. After filling out the form, organizations should review it for accuracy and completeness before submission.

Filing Deadlines for Form 8868 Rev December

The deadline for submitting Form 8868 Rev December typically aligns with the original due date of the organization's annual return. For most organizations, this means the form should be filed by the 15th day of the fifth month after the end of their tax year. For example, if an organization's tax year ends on December 31, the form would be due by May 15 of the following year. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with IRS requirements.

Submission Methods for Form 8868 Rev December

Organizations can submit Form 8868 Rev December through various methods. The form can be filed electronically using IRS e-file options, which is often the fastest method. Alternatively, organizations may choose to mail the completed form to the appropriate IRS address, depending on their location. It is important to keep a copy of the submitted form for record-keeping purposes, regardless of the submission method chosen.

Key Elements of Form 8868 Rev December

Form 8868 Rev December includes several key elements that organizations must understand. These include the identification section, where the organization's details are provided, and the extension request section, where the specific return type is indicated. Additionally, organizations must sign and date the form, confirming that the information provided is accurate. Understanding these elements helps ensure a smooth filing process.

Eligibility for Using Form 8868 Rev December

To be eligible to use Form 8868 Rev December, an organization must be classified as an exempt organization under section 501(c) of the Internal Revenue Code. This includes nonprofits, charities, and other organizations that meet specific criteria set by the IRS. Organizations that do not meet these criteria or are not required to file an annual return are not eligible to use this form for an extension.

Quick guide on how to complete form 8868 rev december application for extension of time to file an exempt organization return

Effortlessly prepare [SKS] on any device

Managing documents online has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the requisite form and securely store it on the internet. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without hassle. Handle [SKS] on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related operation today.

How to effortlessly modify and eSign [SKS]

- Find [SKS] and click Get Form to initiate.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Modify and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8868 Rev December Application For Extension Of Time To File An Exempt Organization Return

Create this form in 5 minutes!

How to create an eSignature for the form 8868 rev december application for extension of time to file an exempt organization return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8868 Rev December Application For Extension Of Time To File An Exempt Organization Return?

The Form 8868 Rev December Application For Extension Of Time To File An Exempt Organization Return is a form used by exempt organizations to request an extension for filing their annual return. This form allows organizations additional time to prepare their tax documents without incurring penalties. Understanding this form is crucial for compliance and maintaining tax-exempt status.

-

How can airSlate SignNow help with the Form 8868 Rev December Application?

airSlate SignNow provides an efficient platform for completing and eSigning the Form 8868 Rev December Application For Extension Of Time To File An Exempt Organization Return. Our user-friendly interface simplifies the process, ensuring that your application is filled out correctly and submitted on time. This helps organizations avoid penalties and maintain compliance.

-

What are the pricing options for using airSlate SignNow for Form 8868?

airSlate SignNow offers flexible pricing plans that cater to various organizational needs, including those needing to file the Form 8868 Rev December Application For Extension Of Time To File An Exempt Organization Return. Our plans are designed to be cost-effective, ensuring that you get the best value for your document management and eSigning needs. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Form 8868?

With airSlate SignNow, you can easily manage the Form 8868 Rev December Application For Extension Of Time To File An Exempt Organization Return through features like customizable templates, secure eSigning, and document tracking. These features streamline the filing process, making it easier for organizations to stay organized and compliant. Additionally, our platform ensures that all documents are securely stored and easily accessible.

-

Are there any integrations available with airSlate SignNow for Form 8868?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your ability to manage the Form 8868 Rev December Application For Extension Of Time To File An Exempt Organization Return. These integrations allow for smooth data transfer and improved workflow efficiency. You can connect with tools you already use, making the filing process even more convenient.

-

What are the benefits of using airSlate SignNow for filing Form 8868?

Using airSlate SignNow for the Form 8868 Rev December Application For Extension Of Time To File An Exempt Organization Return offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform minimizes the risk of errors and ensures that your application is submitted correctly and on time. This allows organizations to focus on their mission rather than administrative tasks.

-

Is airSlate SignNow secure for filing sensitive documents like Form 8868?

Absolutely! airSlate SignNow prioritizes security, ensuring that your Form 8868 Rev December Application For Extension Of Time To File An Exempt Organization Return and other sensitive documents are protected. We utilize advanced encryption and security protocols to safeguard your data. You can trust that your information is safe while using our platform.

Get more for Form 8868 Rev December Application For Extension Of Time To File An Exempt Organization Return

- Florida standard promissory note template form

- Owner builder affidavit city of pompano beach mypompanobeach form

- State certified registration form state certified contractor registration form

- Fl building permit application form

- Application for permit 10 01 16 pdf southern manatee fire form

- Www ocfl netpermitslicensespermittingandpermitting and construction forms ocfl

- Town of acton massachusetts state building code 780 cmr form

- Www uslegalforms com form library 474849 httpsget httpsapi12 ilovepdf comv1download us legal forms

Find out other Form 8868 Rev December Application For Extension Of Time To File An Exempt Organization Return

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation