SCHEDULE N Form 1120 Department of the Treasury Internal Revenue Service OMB No

Understanding the SCHEDULE N Form 1120

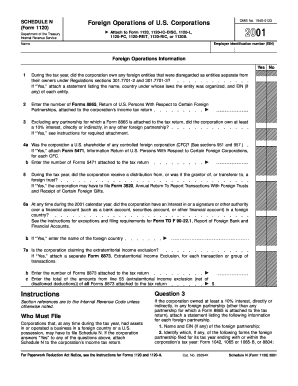

The SCHEDULE N Form 1120 is a crucial document used by corporations to report their foreign operations and transactions. This form is required by the Department of the Treasury and the Internal Revenue Service (IRS) to ensure compliance with U.S. tax laws regarding international business activities. It helps the IRS collect information about the income, expenses, and taxes paid by U.S. corporations operating abroad, thereby facilitating proper tax assessment and compliance.

Steps to Complete the SCHEDULE N Form 1120

Completing the SCHEDULE N Form 1120 involves several systematic steps:

- Gather necessary financial documents, including income statements, balance sheets, and records of foreign transactions.

- Identify the foreign entities and operations that need to be reported on the form.

- Fill out the required sections, ensuring accurate reporting of income, expenses, and taxes associated with foreign operations.

- Review the completed form for accuracy and completeness before submission.

- Submit the form along with the main Form 1120 by the designated filing deadline.

How to Obtain the SCHEDULE N Form 1120

The SCHEDULE N Form 1120 can be obtained directly from the IRS website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, tax preparation software often includes this form, allowing for easier completion and electronic filing. Ensure you have the latest version of the form to comply with current regulations.

Key Elements of the SCHEDULE N Form 1120

Several key elements are essential when completing the SCHEDULE N Form 1120:

- Identification Information: This includes the corporation's name, address, and Employer Identification Number (EIN).

- Foreign Operations: Details about the foreign entities, including their names, addresses, and the nature of business activities.

- Income Reporting: A breakdown of income earned from foreign operations, including dividends, interest, and royalties.

- Tax Information: Information regarding taxes paid to foreign governments and any credits claimed.

Filing Deadlines for the SCHEDULE N Form 1120

The SCHEDULE N Form 1120 must be filed along with the main Form 1120 by the corporate tax return due date. Generally, this deadline is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on April 15. Extensions may be available, but it is important to check IRS guidelines for specific details.

Penalties for Non-Compliance

Failure to file the SCHEDULE N Form 1120 or inaccuracies in the information reported can lead to significant penalties. The IRS may impose fines based on the severity of the non-compliance, which can include monetary penalties and interest on unpaid taxes. It is essential for corporations to ensure accurate and timely filing to avoid these consequences.

Quick guide on how to complete schedule n form 1120 department of the treasury internal revenue service omb no

Complete [SKS] effortlessly on any gadget

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely save it in the cloud. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] without hassle

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to preserve your modifications.

- Choose your method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Edit and eSign [SKS] to guarantee outstanding communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SCHEDULE N Form 1120 Department Of The Treasury Internal Revenue Service OMB No

Create this form in 5 minutes!

How to create an eSignature for the schedule n form 1120 department of the treasury internal revenue service omb no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SCHEDULE N Form 1120 Department Of The Treasury Internal Revenue Service OMB No.?

The SCHEDULE N Form 1120 Department Of The Treasury Internal Revenue Service OMB No. is a tax form used by corporations to report their income and expenses. It is essential for ensuring compliance with federal tax regulations. Understanding this form is crucial for businesses to accurately file their taxes and avoid penalties.

-

How can airSlate SignNow help with the SCHEDULE N Form 1120 Department Of The Treasury Internal Revenue Service OMB No.?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send the SCHEDULE N Form 1120 Department Of The Treasury Internal Revenue Service OMB No. This streamlines the process, reduces paperwork, and ensures that your documents are securely stored and easily accessible.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that support the completion and signing of documents like the SCHEDULE N Form 1120 Department Of The Treasury Internal Revenue Service OMB No. You can choose a plan that fits your budget while ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the management of documents like the SCHEDULE N Form 1120 Department Of The Treasury Internal Revenue Service OMB No., making it easier to collaborate and maintain compliance with tax regulations.

-

Is airSlate SignNow compliant with legal standards for e-signatures?

Yes, airSlate SignNow complies with all legal standards for e-signatures, including the ESIGN Act and UETA. This ensures that documents like the SCHEDULE N Form 1120 Department Of The Treasury Internal Revenue Service OMB No. are legally binding and recognized by the IRS. You can trust that your electronic signatures are secure and valid.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This means you can easily connect it with accounting software to manage documents like the SCHEDULE N Form 1120 Department Of The Treasury Internal Revenue Service OMB No. seamlessly.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the SCHEDULE N Form 1120 Department Of The Treasury Internal Revenue Service OMB No. provides numerous benefits, including time savings and improved accuracy. The platform reduces the risk of errors and ensures that your documents are processed quickly and efficiently, allowing you to focus on your business.

Get more for SCHEDULE N Form 1120 Department Of The Treasury Internal Revenue Service OMB No

- Www bauercomp com sites defaulttraining norfolk request form

- Licenses ampamp permitsowasso ok official website city of form

- Over height fenceretaining wall certification application form

- Af ed 01 pdf form

- Af sv 01 pdf form

- Www idm uct ac zamembergroupsmember groupsinstitute of infectious disease and molecular form

- Www taxformfinder orgnewjerseyform reg c lnew jersey form reg c l request for change of business

- Www tucsonaz govfinanceapplyapply for a business licenseofficial website of the city form

Find out other SCHEDULE N Form 1120 Department Of The Treasury Internal Revenue Service OMB No

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA