Alabama Department of Revenue Printable Form 40a 2004

What is the Alabama Department Of Revenue Printable Form 40a

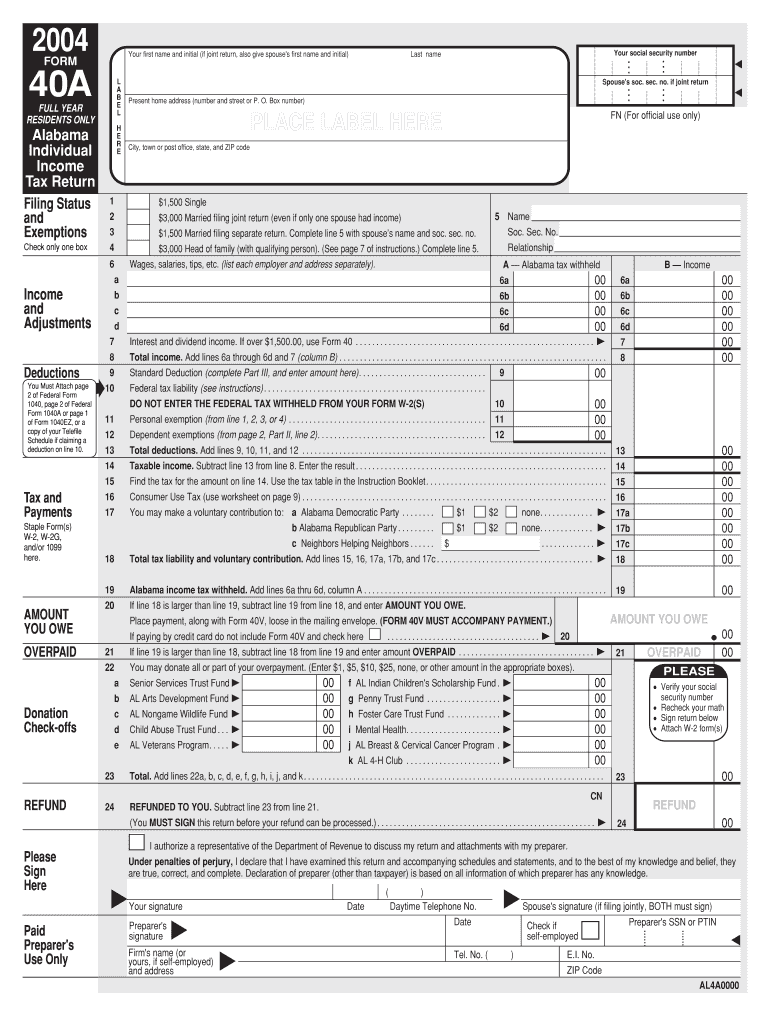

The Alabama Department of Revenue Printable Form 40a is a tax document used by individuals to report their income and calculate their state income tax liability. This form is specifically designed for residents of Alabama and is essential for ensuring compliance with state tax regulations. Form 40a is typically utilized by taxpayers who have a straightforward tax situation, such as those who do not itemize deductions. The form includes sections for personal information, income sources, and applicable deductions, making it a vital tool for accurate tax reporting.

Steps to complete the Alabama Department Of Revenue Printable Form 40a

Completing the Alabama Form 40a involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, carefully fill out your personal information at the top of the form, including your name, address, and Social Security number. Then, report your total income in the designated section, ensuring that all sources of income are accounted for. After that, apply any deductions you qualify for, such as standard deductions or credits. Finally, review the completed form for accuracy before submitting it to the Alabama Department of Revenue.

Legal use of the Alabama Department Of Revenue Printable Form 40a

The legal use of the Alabama Form 40a is governed by state tax laws, which require accurate reporting of income and tax liability. To ensure that the form is legally binding, it must be signed and dated by the taxpayer. Electronic signatures are also acceptable, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). It is important to retain a copy of the completed form for your records, as it may be needed for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Alabama Form 40a are crucial for taxpayers to avoid penalties. Typically, the deadline for submitting your state income tax return is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers who need additional time to file can request an extension, but they must still pay any taxes owed by the original deadline to avoid interest and penalties. It is advisable to keep track of these important dates to ensure timely compliance with state tax obligations.

Required Documents

To complete the Alabama Form 40a, several documents are required to provide accurate information. These include W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation of any other income sources. Additionally, taxpayers should gather records of deductible expenses, such as medical bills, mortgage interest statements, and charitable contributions. Having these documents on hand will facilitate a smoother and more accurate completion of the form.

Form Submission Methods (Online / Mail / In-Person)

The Alabama Form 40a can be submitted through various methods, providing flexibility for taxpayers. The form can be filed electronically through the Alabama Department of Revenue's online portal, which is a convenient option for many. Alternatively, taxpayers may choose to print the form and mail it to the appropriate address provided by the department. In-person submissions are also accepted at local tax offices. Each method has its own processing times, so it is important to choose the one that aligns with your filing preferences and deadlines.

Quick guide on how to complete alabama state tax return form 40a

Prepare Alabama Department Of Revenue Printable Form 40a seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essentials to create, adjust, and eSign your documents swiftly without delays. Manage Alabama Department Of Revenue Printable Form 40a on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign Alabama Department Of Revenue Printable Form 40a with ease

- Obtain Alabama Department Of Revenue Printable Form 40a and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in only a few clicks from any device of your choice. Adjust and eSign Alabama Department Of Revenue Printable Form 40a and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alabama state tax return form 40a

FAQs

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

Create this form in 5 minutes!

How to create an eSignature for the alabama state tax return form 40a

How to create an electronic signature for the Alabama State Tax Return Form 40a online

How to make an electronic signature for the Alabama State Tax Return Form 40a in Chrome

How to generate an electronic signature for signing the Alabama State Tax Return Form 40a in Gmail

How to create an eSignature for the Alabama State Tax Return Form 40a right from your smartphone

How to generate an eSignature for the Alabama State Tax Return Form 40a on iOS devices

How to create an eSignature for the Alabama State Tax Return Form 40a on Android OS

People also ask

-

What is the Alabama Form 40?

The Alabama Form 40 is the state's individual income tax return form. It is used by residents to report their income, claim deductions, and calculate tax liability. airSlate SignNow can streamline the process of filling out and submitting the Alabama Form 40 electronically.

-

How can airSlate SignNow help with the Alabama Form 40?

Using airSlate SignNow, you can easily create, send, and eSign the Alabama Form 40. The platform offers a user-friendly interface that simplifies document preparation and collaboration, ensuring your forms are completed accurately and efficiently.

-

Is airSlate SignNow cost-effective for filing Alabama Form 40?

Yes, airSlate SignNow provides a cost-effective solution for managing the Alabama Form 40. Our pricing plans are designed to meet various business needs, allowing you to file your taxes without incurring unnecessary costs.

-

What features does airSlate SignNow offer for Alabama Form 40 submissions?

airSlate SignNow offers several key features for Alabama Form 40 submissions, including electronic signatures, template creation, and real-time tracking. These features help ensure that your tax documents are completed and submitted on time.

-

Can I integrate airSlate SignNow with other tools for managing Alabama Form 40?

Absolutely! airSlate SignNow integrates seamlessly with many popular business applications, enabling you to manage your Alabama Form 40 alongside other financial and tax-related tools. This integration helps create a more streamlined workflow.

-

How secure is airSlate SignNow when handling Alabama Form 40?

airSlate SignNow prioritizes security and compliance by using advanced encryption and secure storage solutions. When dealing with sensitive information like the Alabama Form 40, you can trust that your data is protected.

-

What benefits does using airSlate SignNow provide for Alabama Form 40 users?

Using airSlate SignNow for your Alabama Form 40 allows for greater efficiency and accuracy in your tax filing process. With features like eSigning and document templates, you can save time and reduce the risk of errors.

Get more for Alabama Department Of Revenue Printable Form 40a

Find out other Alabama Department Of Revenue Printable Form 40a

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement