Michigan Department of Treasury 3581 Rev Form

What is the Michigan Department Of Treasury 3581 Rev

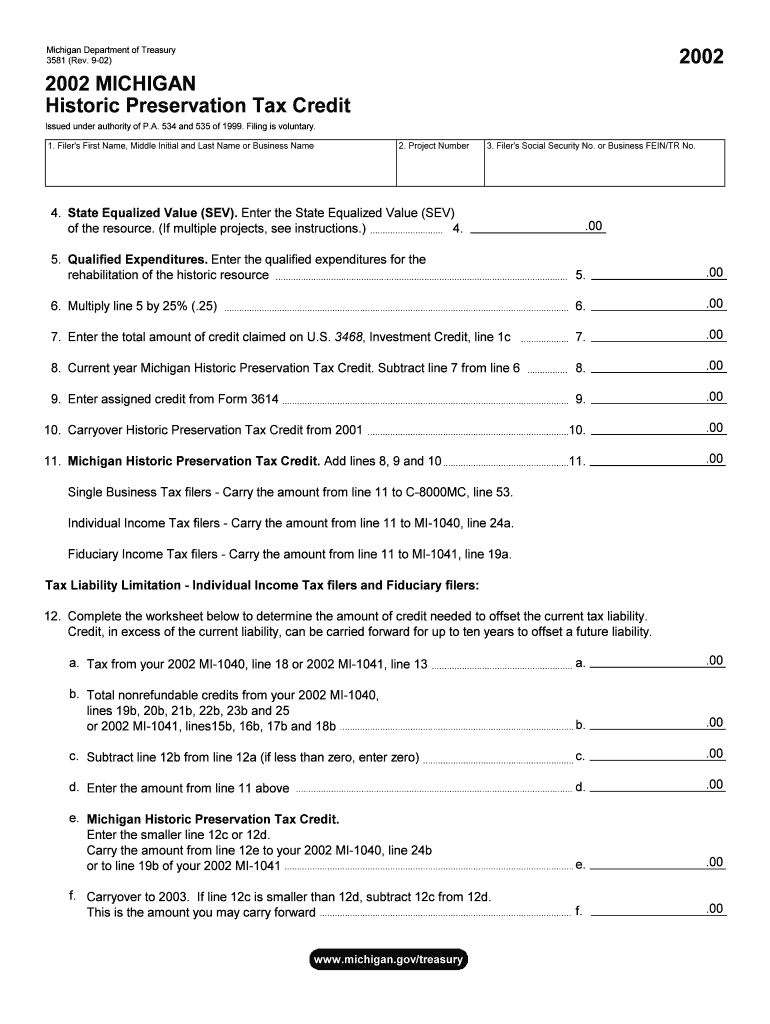

The Michigan Department Of Treasury 3581 Rev is a form utilized primarily for tax-related purposes within the state of Michigan. This document is essential for individuals and businesses to report specific financial information to the state treasury. It serves as a means for taxpayers to disclose income, deductions, and other relevant financial data necessary for accurate tax assessment. Understanding the purpose of this form is crucial for compliance with state tax regulations.

How to use the Michigan Department Of Treasury 3581 Rev

Using the Michigan Department Of Treasury 3581 Rev involves several straightforward steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. It is important to follow the specific guidelines provided by the Michigan Department of Treasury to ensure proper processing.

Steps to complete the Michigan Department Of Treasury 3581 Rev

Completing the Michigan Department Of Treasury 3581 Rev requires careful attention to detail. Follow these steps to ensure accuracy:

- Collect all relevant financial documents.

- Fill out personal identification information at the top of the form.

- Report income, deductions, and any other required financial data in the designated sections.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Michigan Department Of Treasury 3581 Rev

The legal use of the Michigan Department Of Treasury 3581 Rev is strictly defined by state tax laws. This form must be used by individuals and businesses to report income and other financial information accurately. Failure to use the form correctly can result in penalties or legal repercussions. It is essential to adhere to the guidelines set forth by the Michigan Department of Treasury to ensure compliance with state regulations.

Key elements of the Michigan Department Of Treasury 3581 Rev

Several key elements are crucial to the Michigan Department Of Treasury 3581 Rev. These include:

- Taxpayer identification information, including name and address.

- Detailed reporting of income sources.

- Sections for deductions and credits applicable to the taxpayer.

- Signature and date fields to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Department Of Treasury 3581 Rev are critical for compliance. Typically, the form must be submitted by April fifteenth for individuals, aligning with federal tax deadlines. Businesses may have different deadlines based on their fiscal year. It is advisable to check the Michigan Department of Treasury's official resources for any updates or changes to these deadlines.

Quick guide on how to complete michigan department of treasury 3581 rev

Prepare [SKS] effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents promptly without any delays. Handle [SKS] on any platform with the airSlate SignNow Android or iOS applications and enhance any document-oriented operation today.

How to alter and eSign [SKS] without hassle

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of the documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan department of treasury 3581 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Department Of Treasury 3581 Rev. form?

The Michigan Department Of Treasury 3581 Rev. form is a crucial document used for various tax-related purposes in Michigan. It helps businesses and individuals report specific financial information to the state treasury. Understanding this form is essential for compliance and accurate tax reporting.

-

How can airSlate SignNow help with the Michigan Department Of Treasury 3581 Rev. form?

airSlate SignNow simplifies the process of completing and submitting the Michigan Department Of Treasury 3581 Rev. form. With our eSigning capabilities, you can easily fill out, sign, and send the form electronically, ensuring a smooth and efficient submission process.

-

What are the pricing options for using airSlate SignNow for the Michigan Department Of Treasury 3581 Rev. form?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing the necessary features to manage the Michigan Department Of Treasury 3581 Rev. form efficiently.

-

What features does airSlate SignNow offer for managing the Michigan Department Of Treasury 3581 Rev. form?

Our platform provides a range of features including customizable templates, secure eSigning, and document tracking specifically for the Michigan Department Of Treasury 3581 Rev. form. These features enhance productivity and ensure that your documents are handled securely and efficiently.

-

Are there any integrations available with airSlate SignNow for the Michigan Department Of Treasury 3581 Rev. form?

Yes, airSlate SignNow integrates seamlessly with various applications to streamline the process of managing the Michigan Department Of Treasury 3581 Rev. form. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the Michigan Department Of Treasury 3581 Rev. form?

Using airSlate SignNow for the Michigan Department Of Treasury 3581 Rev. form offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are processed quickly and securely, allowing you to focus on your business.

-

Is airSlate SignNow compliant with Michigan regulations for the Michigan Department Of Treasury 3581 Rev. form?

Absolutely! airSlate SignNow is designed to comply with all relevant Michigan regulations, including those pertaining to the Michigan Department Of Treasury 3581 Rev. form. Our commitment to compliance ensures that your documents meet state requirements.

Get more for Michigan Department Of Treasury 3581 Rev

- Criminal history disclosure form 407514776

- Distance learning proctor request form for csi cla

- Pdf transcript request form st thomas aquinas college

- Dept id state form

- Speech language pathology observation hours verification form bw

- V1 standard verification worksheet triton form

- Application for admission at the university of north florida form

- Marymount transcript request form

Find out other Michigan Department Of Treasury 3581 Rev

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple