Chapter 3 More Compound Interest Topics Form

Understanding Chapter 3 More Compound Interest Topics

The Chapter 3 More Compound Interest Topics focuses on advanced concepts related to compound interest, which is crucial for both personal and business financial planning. This chapter delves into the mathematical principles of compound interest, exploring how it differs from simple interest and the implications of compounding frequency. Understanding these topics can help individuals and businesses make informed decisions regarding savings, investments, and loans.

How to Utilize Chapter 3 More Compound Interest Topics

To effectively use the Chapter 3 More Compound Interest Topics, individuals should familiarize themselves with key formulas and concepts. This involves practicing calculations for different compounding periods, such as annually, semi-annually, quarterly, and monthly. Additionally, applying these principles to real-life scenarios, such as retirement savings or loan payments, can enhance understanding and practical application.

Key Elements of Chapter 3 More Compound Interest Topics

Several key elements define the Chapter 3 More Compound Interest Topics. These include:

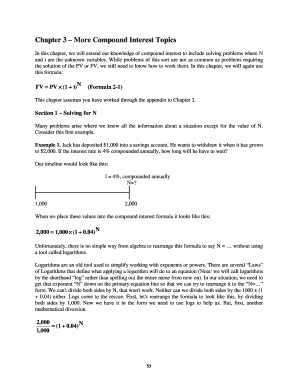

- Compound Interest Formula: The formula for calculating compound interest is A = P(1 + r/n)^(nt), where A is the amount of money accumulated after n years, including interest.

- Compounding Frequency: The frequency with which interest is calculated and added to the principal affects the total interest earned or paid.

- Effective Annual Rate (EAR): This rate reflects the true return on an investment or cost of a loan when compounding is taken into account.

Examples of Using Chapter 3 More Compound Interest Topics

Practical examples can illustrate the application of compound interest concepts. For instance, consider an investment of one thousand dollars at an annual interest rate of five percent, compounded annually. After ten years, the investment will grow to approximately one thousand six hundred fifty dollars. This example highlights the power of compounding over time, emphasizing the importance of starting investments early.

IRS Guidelines Related to Chapter 3 More Compound Interest Topics

The IRS provides guidelines that may affect how individuals and businesses report income generated from investments that utilize compound interest. Understanding these guidelines ensures compliance with tax obligations. For example, interest earned on savings accounts must be reported as income, and specific forms may be required for reporting investment income.

Filing Deadlines and Important Dates

Awareness of filing deadlines is essential for individuals and businesses dealing with compound interest topics. Key dates include the annual tax return deadline, typically April fifteenth for individuals, and various deadlines for estimated tax payments. Being mindful of these dates helps avoid penalties and ensures timely compliance with tax regulations.

Quick guide on how to complete chapter 3 more compound interest topics

Complete Chapter 3 More Compound Interest Topics effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Chapter 3 More Compound Interest Topics on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Chapter 3 More Compound Interest Topics with ease

- Find Chapter 3 More Compound Interest Topics and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important parts of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Chapter 3 More Compound Interest Topics and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chapter 3 more compound interest topics

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is covered in Chapter 3 More Compound Interest Topics?

Chapter 3 More Compound Interest Topics delves into advanced concepts of compound interest, including calculations, applications, and real-world examples. This chapter is designed to enhance your understanding of how compound interest works and its implications in financial decision-making.

-

How can airSlate SignNow help with managing documents related to Chapter 3 More Compound Interest Topics?

airSlate SignNow provides a seamless platform for sending and eSigning documents related to Chapter 3 More Compound Interest Topics. With its user-friendly interface, you can easily manage contracts, agreements, and educational materials, ensuring that all your documentation is organized and accessible.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you're a small business or a large enterprise, you can find a plan that fits your budget while providing access to features that support your understanding of Chapter 3 More Compound Interest Topics.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage. These tools enhance your ability to manage documents related to Chapter 3 More Compound Interest Topics efficiently and effectively.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow offers integrations with various software tools, enhancing your workflow. This means you can easily connect your document management processes related to Chapter 3 More Compound Interest Topics with other applications you already use.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. These advantages are particularly useful when dealing with documents related to Chapter 3 More Compound Interest Topics, allowing for quick and secure transactions.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to manage your documents on the go. This is especially beneficial for accessing materials related to Chapter 3 More Compound Interest Topics anytime, anywhere, ensuring you stay informed and productive.

Get more for Chapter 3 More Compound Interest Topics

- La g nesis del paisaje medieval en lava la formaci n de la red

- 20 supporting information retrieval in peer to peer systems l3s

- Sample lesson plan template rock hill schools form

- Sisseton wahpeton oyate enrollment form

- Homework contract template form

- Honeybook contract template form

- Honorarium contract template form

- Homework high school contract template form

Find out other Chapter 3 More Compound Interest Topics

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney