Ce of State Tax Commissioner Schedule RZ Booklet Renaissance Zone Act Exemptions and Tax Credits This Booklet Contains Schedule Form

Understanding the Schedule RZ Booklet

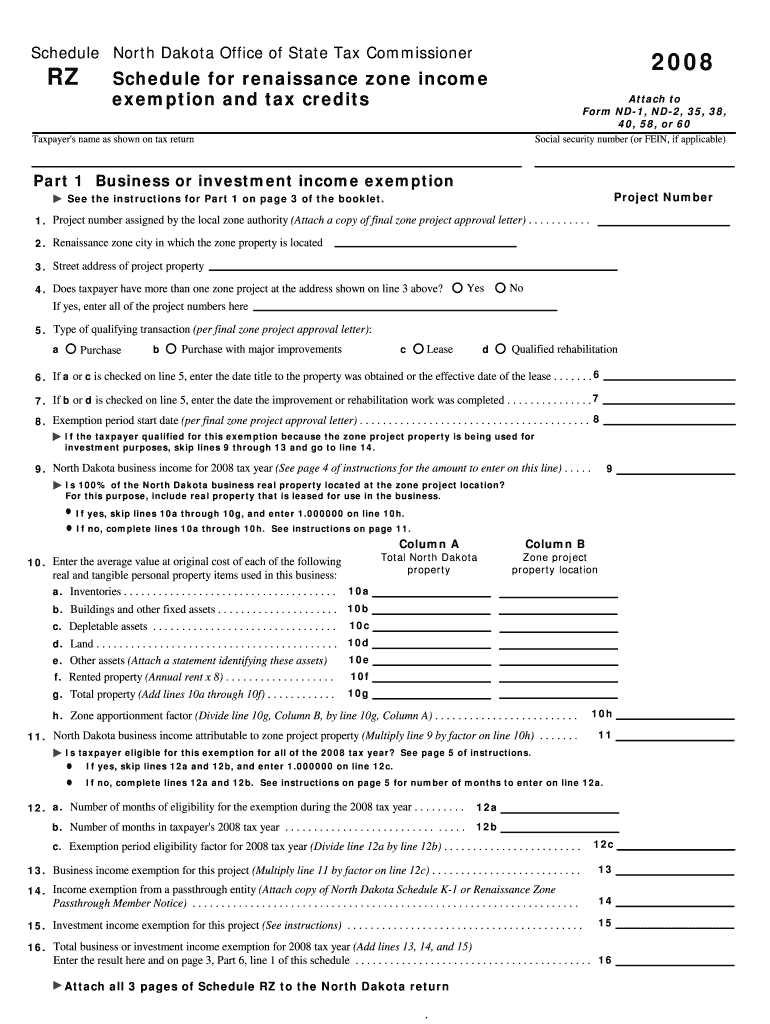

The Ce Of State Tax Commissioner Schedule RZ Booklet provides essential information regarding the Renaissance Zone Act, which offers exemptions and tax credits to eligible businesses and individuals. This booklet includes Schedule RZ and its instructions, which are crucial for taxpayers seeking to benefit from the Renaissance Zone incentives. The Schedule RZ is a supplemental form that must be completed and attached to the North tax form, ensuring compliance with state regulations.

Obtaining the Schedule RZ Booklet

To obtain the Ce Of State Tax Commissioner Schedule RZ Booklet, individuals can visit the official state tax website or contact the state tax commissioner’s office directly. The booklet is usually available in both digital and printed formats, allowing taxpayers to choose the method that best suits their needs. It is important to ensure that the most current version of the booklet is used to avoid any discrepancies in the application process.

Steps to Complete Schedule RZ

Completing the Schedule RZ involves several key steps:

- Gather necessary documentation, including proof of residency and eligibility for Renaissance Zone benefits.

- Fill out the Schedule RZ form accurately, ensuring all information is complete and correct.

- Attach the completed Schedule RZ to the North tax form as required.

- Review the entire submission for accuracy before filing.

Following these steps will help ensure that taxpayers can successfully apply for the exemptions and credits available under the Renaissance Zone Act.

Legal Use of Schedule RZ

The Schedule RZ must be used in accordance with state laws governing the Renaissance Zone Act. Taxpayers should familiarize themselves with the legal requirements and eligibility criteria outlined in the booklet. Misuse or incorrect submission of the Schedule RZ can lead to penalties or denial of tax benefits, making it crucial to adhere to all guidelines provided.

Key Elements of Schedule RZ

Several key elements are included in the Schedule RZ that taxpayers should pay attention to:

- Eligibility criteria for exemptions and credits.

- Detailed instructions for completing the form.

- Information on required documentation to support claims.

- Contact information for assistance and inquiries.

Understanding these elements will help taxpayers navigate the application process more effectively.

Filing Deadlines and Important Dates

It is essential to be aware of filing deadlines associated with the Schedule RZ. Taxpayers should check the state tax authority's website for specific dates related to the Renaissance Zone Act. Missing a deadline can result in the loss of potential tax benefits, so keeping track of these important dates is crucial for compliance.

Eligibility Criteria for Renaissance Zone Benefits

Eligibility for exemptions and tax credits under the Renaissance Zone Act typically includes specific criteria such as location within designated Renaissance Zones, business type, and investment levels. Taxpayers must review these criteria carefully in the Schedule RZ Booklet to ensure they qualify before submitting their application.

Quick guide on how to complete ce of state tax commissioner schedule rz booklet renaissance zone act exemptions and tax credits this booklet contains schedule

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the features required to create, alter, and eSign your documents swiftly without any hold-ups. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks instantly.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries of lost or misplaced documents, cumbersome form searching, or mistakes that require reprinting new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ce of state tax commissioner schedule rz booklet renaissance zone act exemptions and tax credits this booklet contains schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ce Of State Tax Commissioner Schedule RZ Booklet Renaissance Zone Act Exemptions And Tax Credits?

The Ce Of State Tax Commissioner Schedule RZ Booklet Renaissance Zone Act Exemptions And Tax Credits is a comprehensive guide that outlines the exemptions and tax credits available under the Renaissance Zone Act. This booklet contains Schedule RZ and its instructions, which are essential for taxpayers looking to benefit from these incentives.

-

How do I complete the Schedule RZ form?

To complete the Schedule RZ form, you must follow the instructions provided in the Ce Of State Tax Commissioner Schedule RZ Booklet Renaissance Zone Act Exemptions And Tax Credits. Ensure that you gather all necessary information and documentation before filling out the supplemental form, as it must be attached to your North tax return.

-

Are there any costs associated with obtaining the Schedule RZ Booklet?

The Ce Of State Tax Commissioner Schedule RZ Booklet Renaissance Zone Act Exemptions And Tax Credits is typically available for free through state tax offices or online. However, if you require assistance in completing the form or understanding the exemptions, there may be fees for professional services.

-

What benefits do the Renaissance Zone Act exemptions provide?

The exemptions outlined in the Ce Of State Tax Commissioner Schedule RZ Booklet Renaissance Zone Act Exemptions And Tax Credits can signNowly reduce your tax liability. These benefits are designed to encourage investment and development in designated Renaissance Zones, making it an attractive option for businesses.

-

Can I eSign the Schedule RZ form?

Yes, you can eSign the Schedule RZ form using airSlate SignNow's easy-to-use platform. This allows you to complete and submit your Ce Of State Tax Commissioner Schedule RZ Booklet Renaissance Zone Act Exemptions And Tax Credits quickly and securely, streamlining the process.

-

What integrations does airSlate SignNow offer for tax document management?

airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage documents related to the Ce Of State Tax Commissioner Schedule RZ Booklet Renaissance Zone Act Exemptions And Tax Credits. This ensures that your tax filings are organized and easily accessible.

-

How can I ensure compliance when using the Schedule RZ form?

To ensure compliance when using the Schedule RZ form, refer to the guidelines in the Ce Of State Tax Commissioner Schedule RZ Booklet Renaissance Zone Act Exemptions And Tax Credits. Additionally, consider consulting with a tax professional to verify that all information is accurate and complete before submission.

Get more for Ce Of State Tax Commissioner Schedule RZ Booklet Renaissance Zone Act Exemptions And Tax Credits This Booklet Contains Schedule

- Concession certificate form

- Ipl fertilizer dealership form

- Brigance comprehensive inventory of basic skills pdf form

- Vmou marksheet download form

- Church rental agreement template form

- Ncc medical certificate pdf form

- Lic pension plus proposal form

- Form 22 the patents act 1970 39 of 1970 ampamp ipindia nic

Find out other Ce Of State Tax Commissioner Schedule RZ Booklet Renaissance Zone Act Exemptions And Tax Credits This Booklet Contains Schedule

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation