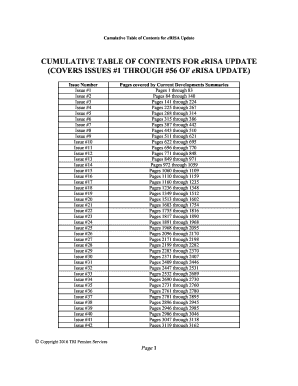

Cumulative Table of Contents for ERISA Update Form

Understanding the Cumulative Table of Contents for ERISA Update

The Cumulative Table of Contents for ERISA Update serves as a comprehensive guide that organizes and outlines the various updates and changes made to the Employee Retirement Income Security Act (ERISA). This document is essential for employers, plan administrators, and legal professionals who need to stay informed about compliance requirements and regulatory changes affecting employee benefit plans. By providing a structured overview, it helps users quickly locate specific updates and understand their implications.

How to Utilize the Cumulative Table of Contents for ERISA Update

To effectively use the Cumulative Table of Contents for ERISA Update, users should start by familiarizing themselves with its structure. The table typically categorizes updates by date and topic, allowing for easy navigation. Users can reference the table to identify relevant sections that apply to their specific plans or compliance needs. It is advisable to regularly check for updates to ensure that all information remains current and that any necessary actions are taken promptly.

Obtaining the Cumulative Table of Contents for ERISA Update

The Cumulative Table of Contents for ERISA Update can be obtained through various government resources, including the Department of Labor's website. Additionally, legal and compliance professionals may provide access to this document as part of their services. It is important to ensure that the version obtained is the most recent to reflect the latest updates and changes in ERISA regulations.

Key Elements of the Cumulative Table of Contents for ERISA Update

Key elements within the Cumulative Table of Contents for ERISA Update include:

- Update Dates: Each entry lists the date of the update, providing a timeline for changes.

- Topics Covered: Topics may range from health benefits to retirement plans, ensuring comprehensive coverage of ERISA provisions.

- References: Sections often include references to specific regulations or guidance documents for further reading.

These elements are crucial for understanding the context and implications of each update, aiding in compliance and planning efforts.

Legal Considerations for the Cumulative Table of Contents for ERISA Update

When using the Cumulative Table of Contents for ERISA Update, it is important to consider the legal implications of the information contained within. Employers and plan administrators must ensure compliance with the latest ERISA regulations to avoid potential penalties. Understanding the legal context of each update helps organizations implement necessary changes in their benefit plans and maintain adherence to federal laws.

Filing Deadlines and Important Dates Related to ERISA Updates

Filing deadlines and important dates associated with ERISA updates are critical for compliance. Users should pay close attention to these dates to ensure timely submissions of required documents. The Cumulative Table of Contents often highlights these deadlines, making it easier for organizations to plan and execute their compliance strategies effectively.

Quick guide on how to complete cumulative table of contents for erisa update

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow supplies all the tools you require to create, edit, and electronically sign your documents quickly without interruptions. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The easiest way to modify and electronically sign [SKS] without effort

- Locate [SKS] and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Cumulative Table Of Contents For ERISA Update

Create this form in 5 minutes!

How to create an eSignature for the cumulative table of contents for erisa update

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the parts of ERISA?

ERISA requires plans to provide participants with plan information including important information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to ...

-

What is the ERISA guidebook?

The ERISA Outline Book (EOB) is a nine-volume reference book and study guide containing 9,600 pages of comprehensive information on qualified plans. It is presented in an easy-to-navigate outline format and is fully indexed.

-

What is Section 3 32 of ERISA?

By its plain terms, ERISA Section 3(32) exempts "a plan established or maintained for its employees by the government of the United States, by the government of any state or political subdivision thereof, or by any agency or instrumentality of any of the foregoing" from ERISA regulation.

-

What is Section 403 C )( 2 of ERISA?

Section 403(c)(2)(A)(ii) permits the return of contributions or payments made by a mistake of fact or law to an employer from a multiemployer plan within 6 months after the date the plan administrator4 determines that such a mistake has occurred.

Get more for Cumulative Table Of Contents For ERISA Update

Find out other Cumulative Table Of Contents For ERISA Update

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template