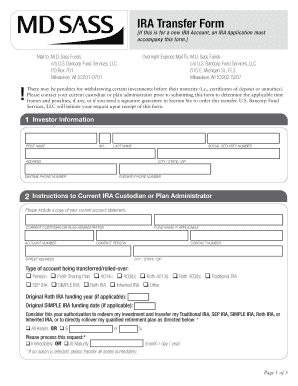

If This is for a New IRA Account, an IRA Application Must Form

Understanding the IRA Application Process

The IRA application process is essential for individuals looking to establish a new Individual Retirement Account (IRA). This application must include personal information such as your name, address, Social Security number, and date of birth. Additionally, you will need to specify the type of IRA you wish to open, whether it is a traditional IRA or a Roth IRA. Understanding these requirements helps ensure a smooth application process.

Required Documents for IRA Application

When applying for a new IRA account, certain documents are necessary to verify your identity and eligibility. Typically, you will need to provide:

- A government-issued photo ID, such as a driver's license or passport

- Proof of income, which may include recent pay stubs or tax returns

- Social Security number for tax identification purposes

Having these documents ready can expedite the application process and help avoid delays.

Steps to Complete the IRA Application

Completing the IRA application involves several key steps:

- Gather the required documents mentioned earlier.

- Fill out the application form accurately, ensuring all information is correct.

- Choose your investment options and contribution amounts.

- Review the application for completeness and accuracy.

- Submit the application through your chosen method, whether online or by mail.

Following these steps can help ensure that your application is processed efficiently.

Eligibility Criteria for Opening an IRA

To qualify for opening a new IRA account, individuals must meet specific eligibility criteria. Generally, you must be under the age of seventy and have earned income from employment or self-employment. There are also income limits that apply, particularly for Roth IRAs, which may restrict high earners from contributing directly. Understanding these criteria is crucial for a successful application.

Form Submission Methods

Submitting your IRA application can be done through various methods, depending on the financial institution. Common options include:

- Online submission through the institution's secure portal

- Mailing a physical application to the designated address

- In-person submission at a local branch office

Each method has its advantages, so consider which option best fits your needs and timeline.

IRS Guidelines for IRA Applications

The Internal Revenue Service (IRS) provides guidelines that govern the establishment and management of IRAs. These guidelines include contribution limits, tax implications, and withdrawal rules. Familiarizing yourself with these regulations can help you make informed decisions regarding your retirement savings and ensure compliance with federal laws.

Quick guide on how to complete if this is for a new ira account an ira application must

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive details using features that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to If This Is For A New IRA Account, An IRA Application Must

Create this form in 5 minutes!

How to create an eSignature for the if this is for a new ira account an ira application must

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the requirements for an IRA?

Who is eligible to contribute to a Traditional IRA? Anyone with an earned income and their spouses, if married and filing jointly, can contribute to a Traditional IRA. There is no age limit.

-

What are the new rules for inherited IRA distributions in July 2024?

The July 19, 2024, regulations specify that if the account holder was taking required minimum distributions (RMDs) at the time of their death, the beneficiary must continue to take annual RMDs based on the deceased's schedule until the end of the 10-year period.

-

What are the new IRA contribution rules?

The combined annual contribution limit for Roth and traditional IRAs for the 2024 tax year is $7,000, or $8,000 if you're age 50 or older. Those limits reflect an increase of $500 over the 2023 limit of $6,500 ($7,500 if you are 50 or older).

-

What are the new IRA distribution rules?

When must I receive my required minimum distribution from my IRA? (updated March 14, 2023) You must take your first required minimum distribution for the year in which you signNow age 72 (73 if you signNow age 72 after Dec. 31, 2022). However, you can delay taking the first RMD until April 1 of the following year.

-

How do I transfer my IRA to a new account?

Contact the new plan administrator if you want to transfer an existing IRA. You will have to provide some basic information, such as your personal details along with information about your current account. You may have to fill out some paperwork, but the new company will handle the transaction for you.

-

What are the rules for IRA withdrawal in 2024?

However, for 2024 and later years, RMDs are no longer required from designated Roth accounts. 2023 RMDs due by April 1, 2024, are still required. Your required minimum distribution is the minimum amount you must withdraw from your account each year. You can withdraw more than the minimum required amount.

-

What is the new law on IRA distributions?

The change in required minimum distribution (RMD) age from IRAs and qualified employer sponsored retirement plans (QRP) such as 401(k), 403(b), and governmental 457(b). The RMD age increased to age 73 in 2023 and will increase to age 75 in 2033.

-

What is the new IRA inheritance rule?

The 10-year rule requires that all assets in the inherited IRA must be fully withdrawn by the end of the 10th year following the original IRA owner's death. (If the death occurred in 2019 or earlier, the 10-year rule was a five-year rule.)

Get more for If This Is For A New IRA Account, An IRA Application Must

- North dakota century code t04 1c57 form

- Sixty second legislative assembly of north dakota in regular legis nd form

- Sixty second legislative assembly of north dakota in regular legis nd 65996 form

- Sixty second legislative assembly of north dakota in regular legis nd 66001 form

- Certificate of authority application foreign limited liability form

- Sixty first legislative assembly of north dakota in regular legis nd form

- 32 03 01 north dakota legislative branch legis nd form

- 0100 sixtieth legislative assembly of north dakota introduced by representatives koppelman gulleson thoreson senators dever form

Find out other If This Is For A New IRA Account, An IRA Application Must

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement