Form INT 5 Farmers Cooperative Credit Associations Intangible Property Tax Return

What is the Form INT 5 Farmers Cooperative Credit Associations Intangible Property Tax Return

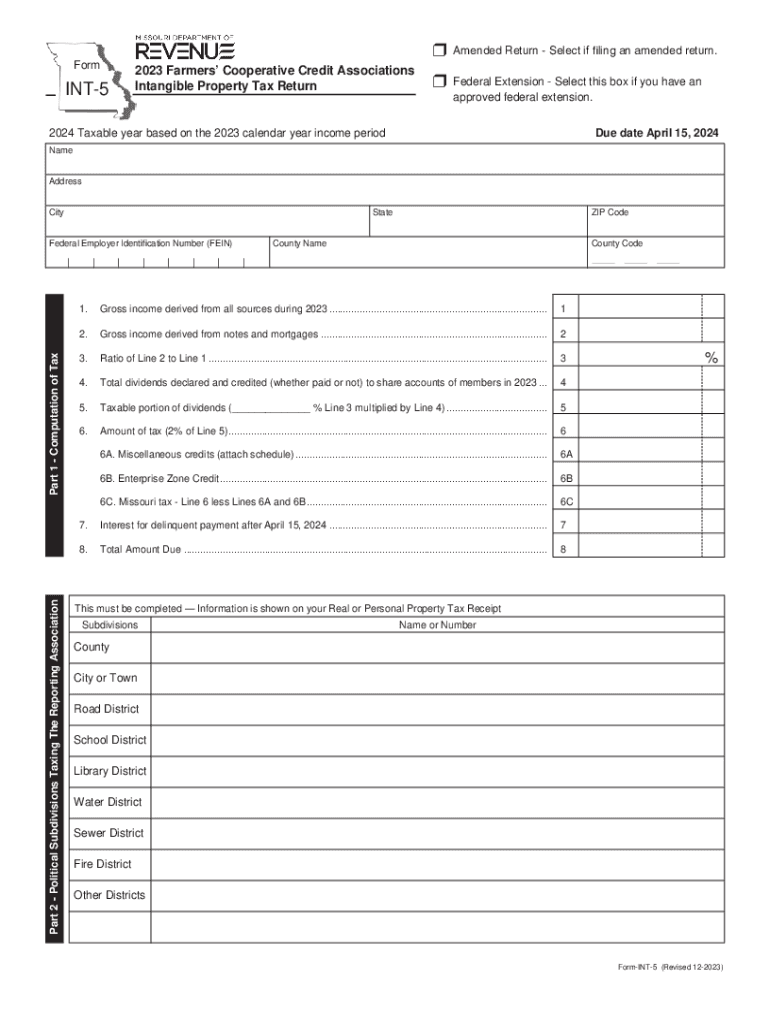

The Form INT 5 is a specific tax return used by Farmers Cooperative Credit Associations in the United States to report intangible property for tax purposes. This form is essential for these entities to comply with state tax regulations concerning intangible assets. Intangible property may include items such as patents, trademarks, and certain financial instruments. Proper completion of this form ensures that the association accurately reports its intangible assets and fulfills its tax obligations.

How to use the Form INT 5 Farmers Cooperative Credit Associations Intangible Property Tax Return

Using the Form INT 5 involves several steps to ensure compliance with tax regulations. First, gather all necessary information regarding the intangible assets held by the cooperative. This includes details about the types of intangible property, their values, and any relevant documentation. Next, complete the form by entering the required information in the designated fields. After filling out the form, review it for accuracy and completeness before submission. Finally, submit the form to the appropriate state tax authority by the specified deadline.

Steps to complete the Form INT 5 Farmers Cooperative Credit Associations Intangible Property Tax Return

Completing the Form INT 5 requires careful attention to detail. Follow these steps for accurate submission:

- Collect all relevant documentation regarding intangible assets.

- Fill out the identification section with the cooperative's name, address, and tax identification number.

- List all intangible assets, providing descriptions and valuations as required.

- Calculate the total value of intangible property and ensure it aligns with your records.

- Review the form for any errors or omissions before finalizing.

Filing Deadlines / Important Dates

Filing deadlines for the Form INT 5 can vary by state. It is crucial for Farmers Cooperative Credit Associations to be aware of these dates to avoid penalties. Generally, the form must be submitted by a specified date each year, often coinciding with the annual tax filing period. Associations should check their state’s tax authority website for specific deadlines to ensure timely submission.

Legal use of the Form INT 5 Farmers Cooperative Credit Associations Intangible Property Tax Return

The legal use of the Form INT 5 is governed by state tax laws that require Farmers Cooperative Credit Associations to report their intangible assets accurately. Failing to submit this form or providing incorrect information can lead to legal penalties, including fines or increased tax liabilities. It is important for associations to understand their legal responsibilities regarding intangible property taxation to maintain compliance.

Required Documents

To complete the Form INT 5, several documents are typically required. These may include:

- Financial statements detailing the value of intangible assets.

- Legal documents related to the ownership of intangible property.

- Previous tax returns that may provide context for current filings.

- Any correspondence with state tax authorities regarding intangible property.

Who Issues the Form

The Form INT 5 is issued by state tax authorities. Each state may have its own version of the form, tailored to its specific tax regulations regarding intangible property. Farmers Cooperative Credit Associations should ensure they are using the correct version applicable to their state to avoid compliance issues.

Quick guide on how to complete form int 5 farmers cooperative credit associations intangible property tax return

Effortlessly Prepare Form INT 5 Farmers Cooperative Credit Associations Intangible Property Tax Return on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can obtain the required form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Form INT 5 Farmers Cooperative Credit Associations Intangible Property Tax Return on any platform with airSlate SignNow mobile applications for Android or iOS and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Form INT 5 Farmers Cooperative Credit Associations Intangible Property Tax Return Effortlessly

- Locate Form INT 5 Farmers Cooperative Credit Associations Intangible Property Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form INT 5 Farmers Cooperative Credit Associations Intangible Property Tax Return and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form int 5 farmers cooperative credit associations intangible property tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

Get more for Form INT 5 Farmers Cooperative Credit Associations Intangible Property Tax Return

- Tjnf 2 sfusd research apllication rev2012 sfusd form

- Direct deposit computershare form

- Cms 20031pdffillercom form

- Application for specialty plates dmv dmv ne form

- Va form 10 5345a

- Adddrop form baylor university baylor

- Graduation sunday recognition form tanner chapel ame church tannerchapel

- Greenwich library community survey greenwichlibrary form

Find out other Form INT 5 Farmers Cooperative Credit Associations Intangible Property Tax Return

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure