76 Product Cost Analysis Template Excel Page 5 2017-2026

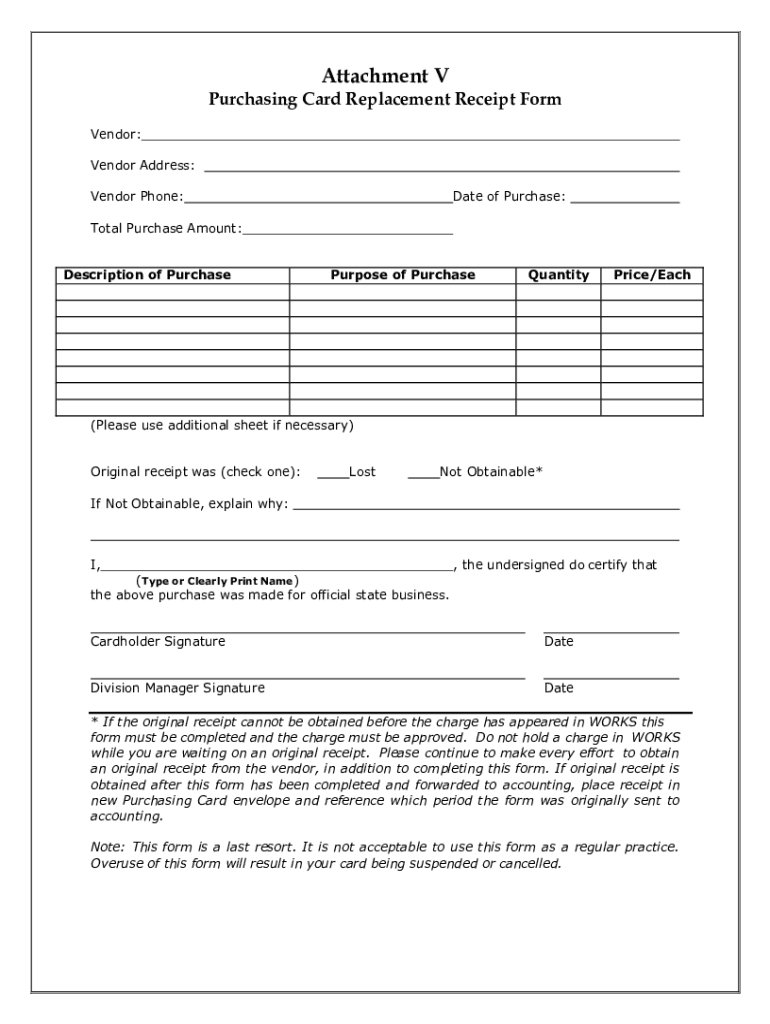

Understanding the Lost Receipt Form

The lost receipt form is a crucial document used to report and validate expenses when a receipt is missing. This form is particularly important for businesses and individuals who need to maintain accurate financial records for tax purposes or reimbursement requests. By completing this form, users can provide a detailed account of the transaction, including the date, amount, and purpose of the expense, ensuring compliance with financial regulations.

Key Components of the Lost Receipt Form

A well-structured lost receipt form typically includes several key elements:

- Date of Transaction: The specific date when the purchase was made.

- Amount: The total cost of the item or service purchased.

- Vendor Information: The name and contact details of the business where the purchase occurred.

- Description of the Item: A brief description of what was purchased.

- Reason for Missing Receipt: An explanation of why the receipt cannot be provided.

- Signature: The user’s signature to confirm the accuracy of the information provided.

Steps to Complete the Lost Receipt Form

Filling out a lost receipt form involves several straightforward steps:

- Gather all relevant information regarding the transaction, including date, amount, and vendor details.

- Fill out the form with accurate information, ensuring all sections are completed.

- Provide a clear reason for the missing receipt to justify the claim.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate the information.

- Submit the form according to your organization’s guidelines, whether electronically or in hard copy.

Legal Considerations for Using the Lost Receipt Form

When utilizing a lost receipt form, it is essential to be aware of the legal implications. This form may be subject to scrutiny during audits or financial reviews. Users should ensure that all information provided is truthful and accurate to avoid potential penalties for misrepresentation. Additionally, organizations may have specific policies regarding the acceptance of lost receipt forms, so it is advisable to consult with a financial advisor or legal expert if uncertain.

Common Use Cases for the Lost Receipt Form

The lost receipt form is commonly used in various scenarios, including:

- Employees seeking reimbursement for business-related expenses without receipts.

- Individuals claiming deductions on their tax returns where receipts are unavailable.

- Businesses managing expense reports that require documentation for missing purchases.

Obtaining a Lost Receipt Form

Lost receipt forms can typically be obtained from several sources:

- Your employer’s finance or accounting department, which may have a standardized template.

- Online resources that provide downloadable and printable versions of the form.

- Financial software that may include a lost receipt form as part of their expense tracking features.

Quick guide on how to complete 76 product cost analysis template excel page 5

Effortlessly Prepare 76 Product Cost Analysis Template Excel Page 5 on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage 76 Product Cost Analysis Template Excel Page 5 on any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Modify and eSign 76 Product Cost Analysis Template Excel Page 5 with Ease

- Obtain 76 Product Cost Analysis Template Excel Page 5 and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using features that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your edits.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, and errors that require reprinting. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Modify and eSign 76 Product Cost Analysis Template Excel Page 5 and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 76 product cost analysis template excel page 5

Create this form in 5 minutes!

How to create an eSignature for the 76 product cost analysis template excel page 5

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How to set up a cost-benefit analysis in Excel?

Steps of Cost Benefit Analysis Project Using Excel or Google Sheets Step 1: Identify the Project. ... Step 2: Identify the Costs. ... Step 3: Identify the Benefits. ... Step 4: Calculate the Net Benefit. ... Step 5: Analyze the Results. ... Step 6: Make a Decision.

-

How do you run a cost analysis in Excel?

Steps of Cost Benefit Analysis Project Using Excel or Google Sheets Step 1: Identify the Project. ... Step 2: Identify the Costs. ... Step 3: Identify the Benefits. ... Step 4: Calculate the Net Benefit. ... Step 5: Analyze the Results. ... Step 6: Make a Decision.

-

What is the formula for cost based analysis?

The cost-benefit analysis involves comparing the monetary benefits of a project to the costs. The formula to calculate the cost-benefit analysis ratio divides the projected present value (PV) of benefit by the present value (PV) of cost attributable to a project.

-

How to perform a cost analysis?

Follow these six steps to help you perform a successful cost-based analysis. Step 1: Understand the cost of maintaining the status quo. ... Step 2: Identify costs. ... Step 3: Identify benefits. ... Step 4: Assign a monetary value to the costs and benefits. ... Step 5: Create a timeline for expected costs and revenue.

-

What is the formula for cost analysis in Excel?

Step 1: Calculate the future benefits. Step 2: Calculate the present and future costs. Step 3: Calculate the present value of future costs and benefits. Benefit-Cost Ratio = ∑ Present Value of Future Benefits / ∑ Present Value of Future Costs.

-

What is a cost analysis worksheet?

A cost-benefit analysis template is a structured document or spreadsheet for businesses or individuals to assess the cost and benefits of a project, expense decision, or investment.

Get more for 76 Product Cost Analysis Template Excel Page 5

- Net profit tax return form

- Applications ampamp forms cosmetology state of wyoming

- Maximizing the benefits of housing vouchers in new york form

- Reiq contract template form

- Relationship contract template form

- Relocation contract template form

- Relationship dat contract template form

- Remix contract template form

Find out other 76 Product Cost Analysis Template Excel Page 5

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT