Beaufort County Treasurer Form

Understanding the Beaufort County Treasurer

The Beaufort County Treasurer is responsible for managing the collection and distribution of property taxes in Beaufort County, South Carolina. This office plays a crucial role in ensuring that local government services are funded through effective tax collection. The Treasurer's responsibilities also include overseeing the county's financial operations, maintaining accurate financial records, and providing financial reports to the county council.

How to Use the Beaufort County Treasurer's Services

To utilize the services offered by the Beaufort County Treasurer, residents can visit the official website or the physical office located in Beaufort. The office provides various services, including tax bill inquiries, payment options, and information on property tax assessments. Residents can also access online services to view their tax statements, make payments, and update their address information, which is essential for receiving accurate tax bills.

Required Documents for Address Change

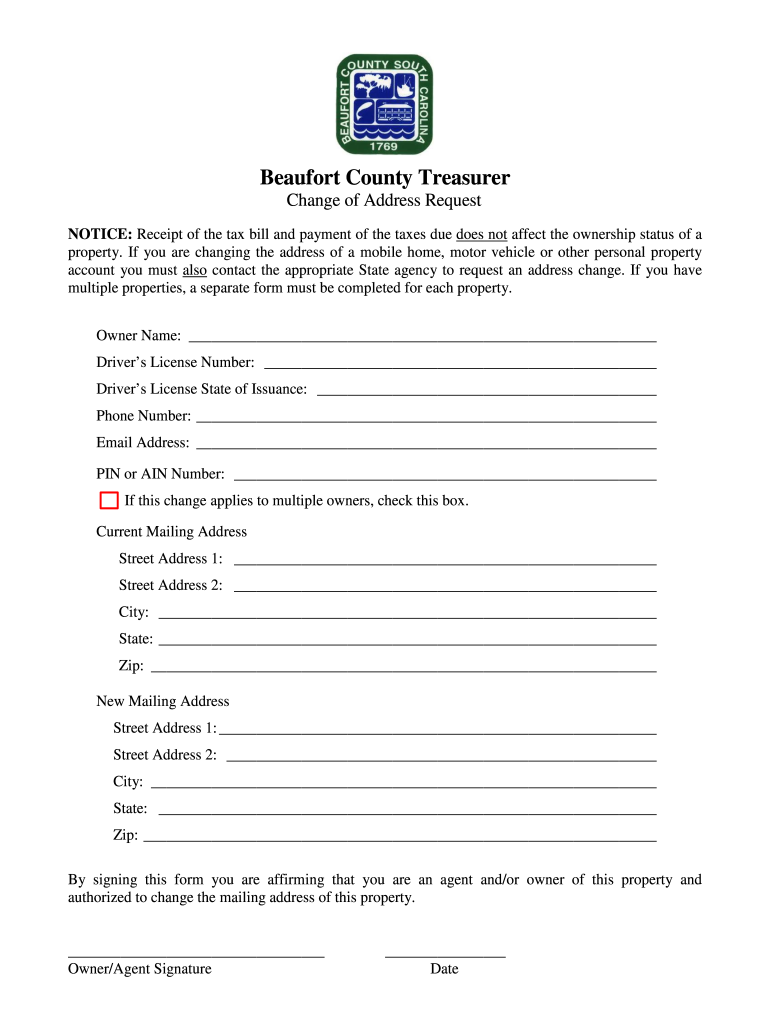

When changing your address with the Beaufort County Treasurer, it is important to have the necessary documents ready. Typically, you will need to provide proof of identity, such as a government-issued ID, and documentation that verifies your new address, such as a utility bill or lease agreement. Having these documents prepared can streamline the process and ensure that your address is updated accurately in the county records.

Steps to Change Your Address with the Beaufort County Treasurer

Changing your address with the Beaufort County Treasurer involves a series of straightforward steps:

- Gather the required documents, including proof of identity and address verification.

- Visit the Beaufort County Treasurer's website or office to access the address change form.

- Complete the form with your current and new address information.

- Submit the form either online, by mail, or in person, along with any required documentation.

- Confirm that your address has been updated by checking your tax statement or contacting the office.

Form Submission Methods

Residents can submit their address change forms to the Beaufort County Treasurer through various methods. The options typically include:

- Online: Fill out and submit the form directly on the Treasurer's website.

- Mail: Send the completed form and documents to the Treasurer's office via postal service.

- In-Person: Visit the Treasurer's office to submit the form and documents directly.

Penalties for Non-Compliance

Failing to update your address with the Beaufort County Treasurer can result in several penalties. These may include receiving tax bills at your old address, leading to missed payments and potential late fees. Additionally, incorrect address information can complicate matters related to property assessments and tax liabilities. It is advisable to keep your address updated to avoid any unnecessary complications.

Quick guide on how to complete beaufort county treasurer

Finalize Beaufort County Treasurer effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources needed to create, amend, and electronically sign your documents promptly without any holdups. Handle Beaufort County Treasurer on any device using airSlate SignNow's Android or iOS applications and enhance any form-based procedure today.

How to modify and electronically sign Beaufort County Treasurer with ease

- Locate Beaufort County Treasurer and then click Get Form to begin.

- Take advantage of the tools we supply to finish your document.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you would like to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Beaufort County Treasurer to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the beaufort county treasurer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How much does Homestead Exemption save you in SC?

The Homestead Exemption Program is a State funded program authorized under Section 12-37-250 of the South Carolina Code of Laws. The program exempts the first $50,000 fair market value of primary residence from all property taxes.

-

How do I change my address with the Treasurer in Beaufort County?

How Do I Change my Mailing Address? Address changes are handled by the Treasurer. For more information please call the Treasurer's Office at 843-255-2600.

-

What are the qualifications for Homestead Exemption?

Qualifying for the homestead exemption is simple: the home must be your primary residence, you must live in it as of January 1st for the tax year you're applying, and you must submit your application by march 31st of that year. it's an easy way to protect your home and potentially reduce taxes! Moving to or wi.

-

What is the 6% exemption in Beaufort County?

How is the 6% Property Exemption (Assessable Transfer of Interest) calculated? The ATI exemption is determined by comparing the fair market value of property when it is sold with the fair market value of the property as shown on the tax roll.

-

How do I email the Beaufort County Treasurer?

Their team manages the Homestead Exemption process, calculates the taxes due, as well as sets the values for all personal property in Beaufort County. They can be signNowed by calling 843-255-2500 but the fastest way to get your questions answered is to email them at BeaufortCountyAuditor@bcgov.net.

-

What is the homestead exemption in Beaufort County, SC?

HOMESTEAD EXEMPTION The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind. Contact your county auditor's office for more information.

-

What are the requirements for Homestead Exemption in South Carolina?

Do I qualify for the Homestead Exemption? To qualify for the Homestead Exemption, statements 1, 2 and 3 must be true. You hold complete fee simple title to your primary legal residence or life estate to your primary legal residence or you are the beneficiary of a trust that holds title to your primary legal residence.

-

How much are property taxes in Beaufort, SC?

Because of homesteading type laws, you can roughly estimate your property taxes. In Beaufort County1: Primary residences are taxed around ½% to ¾% (0.5% to 0.75%) of purchase price. Non-primary residences are taxed around 1¼% to 1½% (1.25% to 1.5%) of purchase price.

Get more for Beaufort County Treasurer

- Confirmation sponsor form sacred heart catholic church

- Humana dental life vison employee application 1 19 09 pdf form

- Klamath falls building department form

- California vision project form

- Student bapplication 2009b usc hospitality form

- Past due balance form

- Request for proposal tug and barge simulation system form

- Transcript request form manchester university manchester

Find out other Beaufort County Treasurer

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple