W21095C Request Form TAX YEARS REQUESTED Branch 2023-2026

Understanding the AppleOne W-2 Form

The AppleOne W-2 form is a crucial document for employees who have worked through AppleOne. This form reports an employee's annual wages and the taxes withheld from their paychecks. It is essential for tax filing purposes, as it provides the necessary information for individuals to accurately report their earnings to the IRS. Employees should ensure they receive their W-2 form by the end of January each year, as it is required for completing tax returns.

Steps to Obtain Your AppleOne W-2

To obtain your AppleOne W-2, follow these steps:

- Check your email for any notifications from AppleOne regarding the availability of your W-2.

- Log into your AppleOne employee portal, if available, to access your W-2 online.

- If you cannot find your W-2 online, contact AppleOne's customer service for assistance.

- Ensure that your contact information is up to date to receive your W-2 by mail if you prefer that method.

How to Complete the AppleOne W-2 Form

Completing your AppleOne W-2 form involves several key steps. First, gather all necessary documents, including previous pay stubs and any other relevant tax documents. Next, enter your personal information accurately, ensuring your name and Social Security number match IRS records. Review the earnings and tax withholding sections to confirm that all amounts are correct. Finally, sign and date the form before submitting it with your tax return.

Legal Considerations for the AppleOne W-2 Form

The AppleOne W-2 form must comply with federal and state tax regulations. Employers are legally required to provide W-2 forms to employees by January 31 each year. Failure to do so can result in penalties for the employer. Employees should retain their W-2 forms for at least three years, as they may be needed for future tax audits or inquiries. Understanding these legal obligations helps ensure compliance and protects both employees and employers.

Common Issues with the AppleOne W-2 Form

Employees may encounter various issues with their AppleOne W-2 forms. Common problems include incorrect personal information, discrepancies in reported earnings, or missing forms altogether. If you notice any errors, it is important to contact AppleOne immediately to request a correction. Additionally, if you do not receive your W-2 by the end of January, reach out to ensure it was issued and sent to the correct address.

Filing Your Taxes with the AppleOne W-2

When filing your taxes, the information from your AppleOne W-2 form is essential. Use the reported wages and tax withheld to accurately complete your tax return. If you are using tax software, input the W-2 information as prompted. If you are filing by mail, attach a copy of your W-2 to your tax return. Ensure that you keep a copy of your W-2 for your records, as it may be needed for future reference or audits.

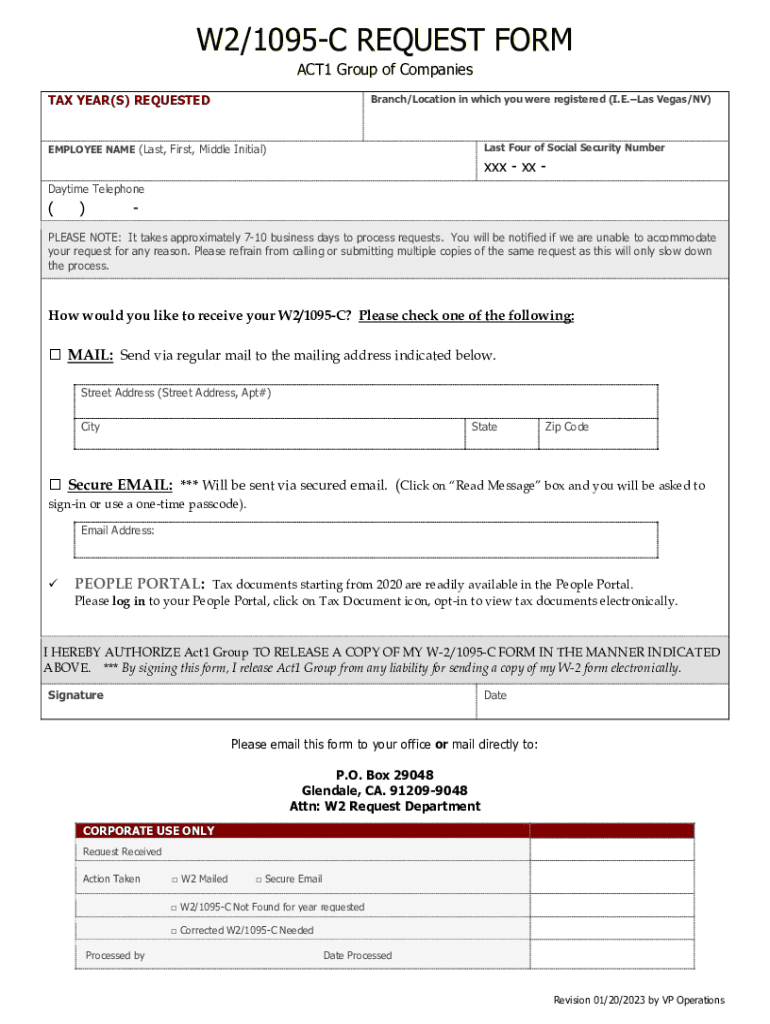

Quick guide on how to complete w21095c request form tax years requested branch

Easily Prepare W21095C Request Form TAX YEARS REQUESTED Branch on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it on the internet. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents swiftly without delays. Manage W21095C Request Form TAX YEARS REQUESTED Branch on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

Effortlessly Edit and eSign W21095C Request Form TAX YEARS REQUESTED Branch

- Obtain W21095C Request Form TAX YEARS REQUESTED Branch and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and select the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Edit and eSign W21095C Request Form TAX YEARS REQUESTED Branch, ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w21095c request form tax years requested branch

Create this form in 5 minutes!

How to create an eSignature for the w21095c request form tax years requested branch

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the name of form 4506-T which can be obtained for any year by a request from the IRS?

Taxpayers using a fiscal tax year must file Form 4506-T, Request for Transcript of Tax Return, to request a return transcript. Use Form 4506-T to request tax return transcripts, tax account information, W-2 information, 1099 information, verification of non-filing, and record of account. Customer File Number.

-

Can I look up old tax returns online?

You can access your personal tax records online or by mail, including transcripts of past tax returns, tax account information, wage and income statements, and verification of non-filing letters.

-

How to file 1099 for previous years?

If you are looking for 1099s from earlier years, you can contact the IRS and order a “wage and income transcript”. The transcript should include all of the income that you had as long as it was reported to the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS.

-

How do I get my tax documents from previous years?

Online is the fastest and easiest way to get your transcript. All transcript types are also available by mail by submitting Form 4506-T, Request for Transcript of Tax Return. Additionally, Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript can be used to request just a tax return transcript.

-

How do I access old IRS forms?

IRS routine access procedures Use the Get Transcript tool. Send a completed Form 4506-T. In addition to the tax return and account transcripts available through the Get Transcript tool, you may also request wage and income transcripts and a verification of non-filing letter. Call. Individuals: 800-908-9946.

-

How do I get my tax forms from previous years?

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.

-

How far back can you request IRS transcripts?

Get a federal tax transcript You can get transcripts of the last 10 tax years. Transcripts are free.

-

How can I get my tax transcript online immediately?

1. The taxpayer must go to https://.irs.gov/ and click on “Get Your Tax Record”. 2. Scroll down and click on “Get Transcript Online”.

Get more for W21095C Request Form TAX YEARS REQUESTED Branch

- Compassion satisfaction fatigue self test for helpers form

- Calema 2 900 form

- The electronic personnel security questionnaire is a form

- B does the work activity require an bmocb yosemite epa form

- Residential tenancy application form first national real estate

- Svab form nh 12 mississippi state veterans affairs board vab ms

- Proof of student status to be completed by an offi form

- Supervisors injury investigation report form

Find out other W21095C Request Form TAX YEARS REQUESTED Branch

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure