Standard Btl Mortgage Deed Example Form

What is the Standard Btl Mortgage Deed Example

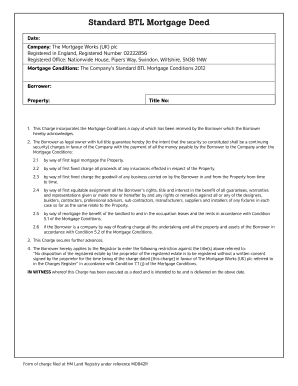

A standard buy-to-let (BTL) mortgage deed is a legal document that outlines the terms and conditions of a mortgage specifically for properties intended for rental purposes. This deed serves as a binding agreement between the lender and the borrower, detailing the rights and responsibilities of both parties. The signed mortgage deed example typically includes essential information such as the property address, loan amount, interest rate, and repayment terms. It is crucial for landlords to understand this document, as it governs the financial obligations tied to their rental properties.

Key Elements of the Standard Btl Mortgage Deed Example

The key elements of a standard BTL mortgage deed example include:

- Property Description: A detailed description of the property being mortgaged, including its location and any distinguishing features.

- Loan Amount: The total amount of money borrowed from the lender to purchase the property.

- Interest Rate: The rate at which interest will accrue on the loan, which can be fixed or variable.

- Repayment Terms: The schedule and method for repaying the loan, including any penalties for late payments.

- Borrower and Lender Information: Names and contact details of both parties involved in the agreement.

- Signatures: The document must be signed by both the borrower and a representative of the lender to be legally binding.

Steps to Complete the Standard Btl Mortgage Deed Example

Completing a standard BTL mortgage deed example involves several important steps:

- Gather Necessary Information: Collect all relevant details about the property, loan amount, and personal information.

- Review Terms: Carefully read through the terms and conditions outlined in the deed to ensure clarity and understanding.

- Fill Out the Deed: Input the required information accurately, ensuring that all fields are completed.

- Seek Legal Advice: Consider consulting with a legal professional to review the document before signing.

- Sign the Document: Both parties should sign the deed in the presence of a witness if required by state law.

- Submit the Deed: Send the completed deed to the lender and retain a copy for personal records.

Legal Use of the Standard Btl Mortgage Deed Example

The legal use of a standard BTL mortgage deed example is to formalize the lending agreement between the borrower and the lender. This document is essential for protecting the lender's interest in the property, as it grants them the right to take possession if the borrower defaults on the loan. Additionally, the deed must comply with state-specific regulations regarding property transactions and mortgage agreements. Understanding the legal implications of the mortgage deed is vital for landlords to ensure they are meeting all obligations and protecting their investment.

How to Obtain the Standard Btl Mortgage Deed Example

Obtaining a standard BTL mortgage deed example can typically be done through the following methods:

- From the Lender: Most lenders provide a standard mortgage deed template upon request when applying for a loan.

- Online Resources: Various legal websites offer downloadable templates that can be customized to fit specific needs.

- Real Estate Professionals: Real estate agents or attorneys can provide guidance and access to the appropriate forms.

Examples of Using the Standard Btl Mortgage Deed Example

Examples of using a standard BTL mortgage deed example include:

- Purchasing Rental Properties: Landlords use the deed when acquiring properties intended for rental income.

- Refinancing Existing Mortgages: Property owners may need to complete a new deed when refinancing their mortgage to secure better terms.

- Transferring Ownership: When transferring ownership of a rental property, a new mortgage deed may be required to reflect the change in parties.

Quick guide on how to complete standard btl mortgage deed example

Complete Standard Btl Mortgage Deed Example seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly without delays. Manage Standard Btl Mortgage Deed Example on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Standard Btl Mortgage Deed Example with ease

- Locate Standard Btl Mortgage Deed Example and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Modify and eSign Standard Btl Mortgage Deed Example and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the standard btl mortgage deed example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Can my girlfriend witness my signature?

[4] Whilst there is no statutory requirement for a witness to be “independent” (i.e. unconnected to the parties or subject matter of the deed), given that a witness may be called upon to give unbiased evidence about the signing, it is considered best practice for a witness to be independent and, ideally, not a spouse, ...

-

What is a mortgagee deed?

What Is a Mortgage Deed? A mortgage is a loan extended to someone in order to purchase a property. A mortgage deed is a legally binding document outlining the terms of a mortgage that puts a lien on the house until the lender repays the loan in full.

-

Who can witness signing a mortgage deed?

Your Independent Adult Witness could be a neighbour, friend, work colleague or anyone else that fits into the above criteria. Your witness must be over the age of 18 and they must not be a relative/family member.

-

What is the difference between a mortgage deed and a deed of trust?

The two main differences between a mortgage and a deed of trust are: a mortgage involves two parties, while a deed of trust has three, and. mortgages are usually foreclosed judicially, while deeds of trust typically go through a nonjudicial foreclosure process (but not always).

-

Can a friend witness a deed?

The witness must be an independent and impartial third party, and meet the following witness eligibility requirements: They must be over 18 years of age. They must be of sound mind. They must not be a family member or partner of the person signing the deed.

-

What happens after a mortgage deed is signed?

Signing a mortgage deed prepares you to formalise your commitment to the mortgage lender, outlining the terms and conditions of your loan. On completion of your purchase, you'll be entering into a legal agreement to repay the borrowed amount of money over an agreed-upon period.

-

Can a friend witness a mortgage deed signature?

Your Independent Adult Witness could be a neighbour, friend, work colleague or anyone else that fits into the above criteria. Your witness must be over the age of 18 and they must not be a relative/family member.

-

Can two signatories use the same witness?

The same witness may witness each individual signature. However, each signature should be separately attested, unless it's absolutely clear by express wording on the face of the attestation that the witness is witnessing both or all signatures in the presence of the named signatories.

Get more for Standard Btl Mortgage Deed Example

- Hamilton angling hunting association form

- Ccfl child care proposed weekly attendance schedule for form

- Summer camp form 16 breslau mennonite church breslaumc

- Permission to register kwantlen polytechnic form

- Season registration form kids christian hockey league kidshockey

- Rmt intake 4 docx form

- Roe web client employer consent form fill out ampamp sign online

- Responsible driver program registration and inform

Find out other Standard Btl Mortgage Deed Example

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed

- How To eSign Wyoming LLC Operating Agreement

- eSignature North Dakota Quitclaim Deed Fast

- How Can I eSignature Iowa Warranty Deed

- Can I eSignature New Hampshire Warranty Deed

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free