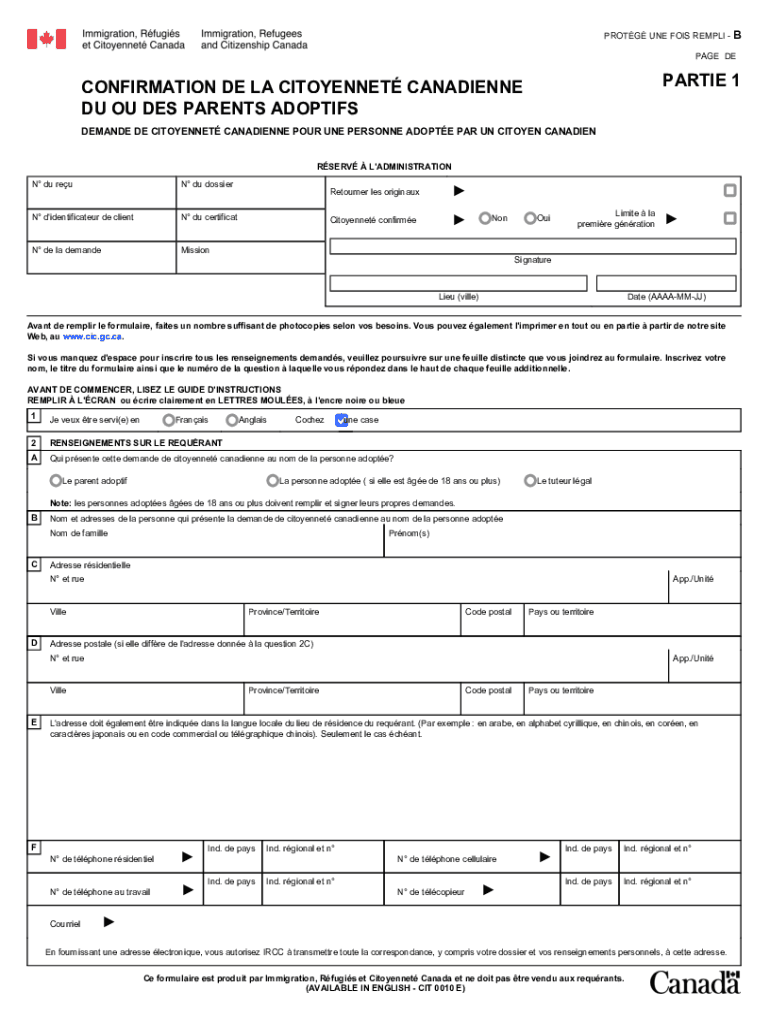

CIT 0010 F Form

What is the CIT 0010 F

The CIT 0010 F is a specific tax form used by businesses and individuals in the United States to report certain financial information to the Internal Revenue Service (IRS). This form is particularly relevant for those who need to disclose specific income, deductions, or credits related to their tax situation. Understanding the purpose of the CIT 0010 F is essential for accurate tax reporting and compliance with federal regulations.

How to use the CIT 0010 F

Using the CIT 0010 F involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and expense records. Next, complete the form by filling in the required fields. It is important to double-check all entries for accuracy before submission. Finally, submit the completed form to the IRS by the specified deadline, ensuring that all supporting documents are included as needed.

Steps to complete the CIT 0010 F

Completing the CIT 0010 F requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, such as receipts and bank statements.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions.

- Attach any necessary supporting documents as required.

- Submit the form by mail or electronically, depending on your preference and the IRS guidelines.

Key elements of the CIT 0010 F

The CIT 0010 F includes several key elements that must be accurately reported. These elements typically consist of income details, deductions, and credits that apply to the taxpayer's situation. Each section of the form is designed to capture specific information, making it crucial to understand what is required in each part. Properly filling out these elements ensures compliance and can help maximize potential tax benefits.

Filing Deadlines / Important Dates

Filing deadlines for the CIT 0010 F are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the following tax year. However, taxpayers should verify any changes or extensions that may apply. Keeping track of important dates ensures that all submissions are made on time, helping to maintain compliance with IRS regulations.

Required Documents

When preparing to file the CIT 0010 F, it is essential to have the necessary documents ready. Required documents may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any additional forms that may support claims made on the CIT 0010 F.

Form Submission Methods

The CIT 0010 F can be submitted through various methods, providing flexibility for taxpayers. Options typically include:

- Online submission via the IRS e-file system.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete cit 0010 f

Easily Prepare CIT 0010 F on Any Device

Digital document management has become a favorite among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Manage CIT 0010 F on any device using the airSlate SignNow apps for Android or iOS and streamline any document-centered process today.

How to Modify and eSign CIT 0010 F Effortlessly

- Find CIT 0010 F and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight essential paragraphs of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal standing as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign CIT 0010 F to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cit 0010 f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

Get more for CIT 0010 F

- Majestic com reports site explorersite explorer ctfassets net summary majestic form

- Uniform order form the thomas coram church of england school thomascoram herts sch

- Soe membership form

- Workplace mediation referral form

- Mcf kcl form

- Rider registration form nelson park riding centre ridinglessonsthanet co

- Fillable online supplemental application form bc housing

- John perkins memorial housing society form

Find out other CIT 0010 F

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter