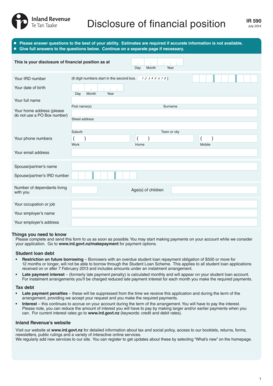

Ir590 2014

What is the IR590?

The IR590 is a specific form used primarily in the context of tax reporting and compliance in the United States. It is essential for individuals and businesses to accurately report certain financial information to the Internal Revenue Service (IRS). This form helps ensure that taxpayers meet their obligations under U.S. tax law. Understanding the IR590 is crucial for anyone involved in tax preparation or financial reporting.

How to Use the IR590

Using the IR590 involves several key steps. First, gather all necessary financial documents that pertain to the information required on the form. This may include income statements, expense reports, and any relevant tax documents. Next, carefully fill out the IR590, ensuring that all information is accurate and complete. After completing the form, it should be reviewed for any errors before submission to the IRS. Proper use of the IR590 can help avoid penalties and ensure compliance with tax regulations.

Steps to Complete the IR590

Completing the IR590 requires a methodical approach. Follow these steps:

- Collect all relevant financial documents.

- Read the instructions carefully to understand the requirements.

- Fill out the form, ensuring accuracy in all entries.

- Review the completed form for any mistakes or omissions.

- Submit the form by the appropriate deadline, either electronically or by mail.

Taking these steps can help ensure that the IR590 is completed correctly and submitted on time.

Legal Use of the IR590

The IR590 must be used in accordance with IRS regulations. It is designed to collect specific information that is legally required for tax reporting purposes. Failing to use the form correctly can lead to legal repercussions, including fines or audits. It is important for taxpayers to understand the legal implications of the IR590 and to ensure that all information reported is truthful and accurate.

Filing Deadlines / Important Dates

Filing deadlines for the IR590 are critical for compliance. Typically, the form must be submitted by the tax filing deadline, which is usually April 15th for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing statuses. It is essential to stay informed about any changes to these deadlines to avoid penalties.

Required Documents

When preparing to fill out the IR590, certain documents are required. These may include:

- Income statements, such as W-2s or 1099s.

- Expense documentation relevant to the reporting period.

- Previous tax returns for reference.

- Any additional forms required by the IRS for specific situations.

Having these documents ready can streamline the process of completing the IR590.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the IR590. These guidelines outline the necessary information to include, as well as instructions for proper submission. It is advisable to consult the IRS website or official publications for the most current information regarding the IR590. Adhering to these guidelines is essential for ensuring that the form is accepted and processed without issues.

Quick guide on how to complete ir590

Complete Ir590 effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ir590 on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Ir590 without hassle

- Locate Ir590 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ir590 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ir590

Create this form in 5 minutes!

How to create an eSignature for the ir590

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

Get more for Ir590

- About savings and investment form pc1h pension credit

- Form 115 tandem student declarationdoc

- Intern application form bunac oldwebsite bunac

- Ex61 form

- Sjfk form

- Fillable bank details form for bacs bacs bank details form

- Dol georgia govchild labor employmentchild labor employment certificate instructionsgeorgia form

- Accident form click penkridge junior football club

Find out other Ir590

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document