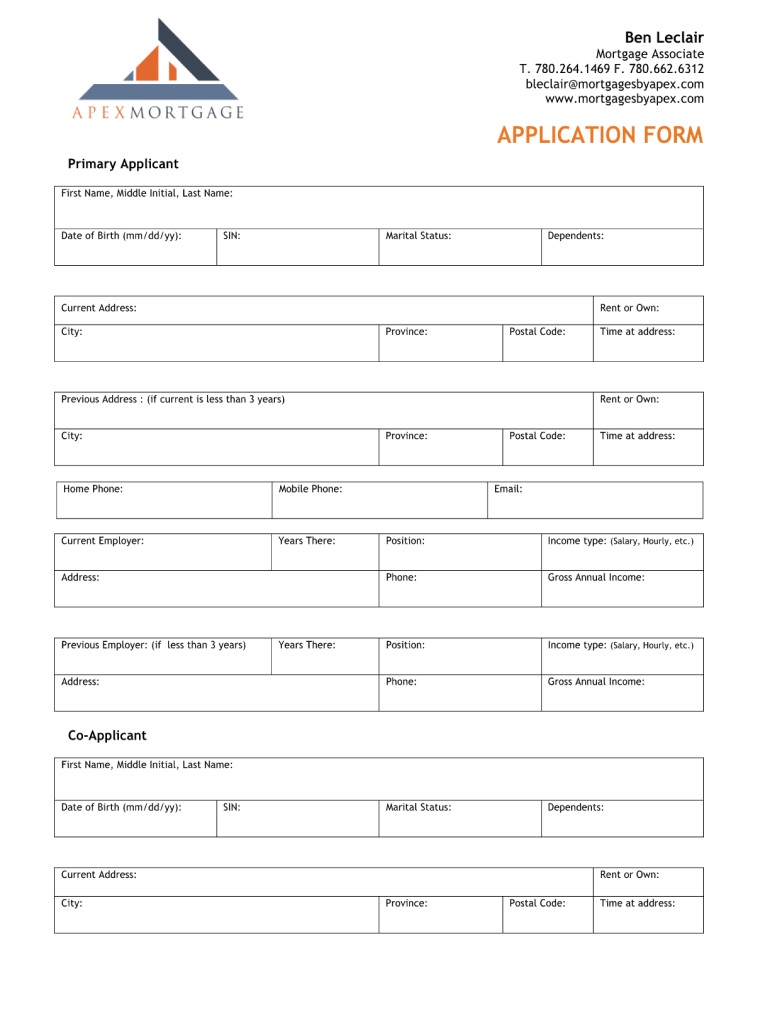

Fill in Mortgage Application Form Online

What is the Canada mortgage application online?

The Canada mortgage application online is a digital form that allows individuals to apply for a mortgage from the comfort of their own home. This application typically requires personal information, financial details, and property specifics, enabling lenders to assess eligibility and loan options. By using an online platform, applicants can streamline the process, reducing the need for physical paperwork and in-person meetings.

Steps to complete the Canada mortgage application online

Completing the Canada mortgage application online involves several key steps:

- Gather necessary documents: Collect personal identification, income statements, and credit history.

- Choose a lender: Research various lenders to find one that meets your needs.

- Fill out the application: Enter your personal and financial information into the online form.

- Review your application: Double-check all entries for accuracy before submission.

- Submit the application: Send your completed application electronically to the lender.

- Await approval: Monitor your email or account for updates regarding your application status.

Required documents for the Canada mortgage application online

When applying for a mortgage online, specific documents are typically required to verify your identity and financial status. These may include:

- Government-issued identification (e.g., driver's license, passport)

- Proof of income (e.g., pay stubs, tax returns)

- Employment verification (e.g., letter from employer)

- Credit report and score

- Bank statements for the last few months

- Information about the property you wish to purchase

Eligibility criteria for the Canada mortgage application online

Eligibility for a mortgage application online generally depends on several factors, including:

- Your credit score, which affects your loan terms and interest rates.

- Your income level, ensuring you can afford monthly payments.

- Your employment stability, which lenders assess to gauge financial reliability.

- The amount of your down payment, as a larger down payment can lead to better loan options.

- The type of property being financed, as some lenders have specific requirements based on property types.

Legal use of the Canada mortgage application online

Using the Canada mortgage application online is legal and widely accepted in the mortgage industry. However, applicants must ensure that they are providing accurate information and that they understand the terms of the mortgage agreement. It is advisable to consult with a financial advisor or legal expert if there are any uncertainties regarding the application process or mortgage terms.

Application process and approval time for the Canada mortgage application online

The application process for a Canada mortgage application online typically involves submitting the required documents and information through a lender's secure portal. Once submitted, the approval time can vary based on the lender's policies, but it usually takes anywhere from a few days to several weeks. Factors influencing the approval time include the completeness of the application, the lender's workload, and any additional verification needed.

Quick guide on how to complete fill in mortgage application form online

Complete Fill In Mortgage Application Form Online effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct forms and securely save them online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Fill In Mortgage Application Form Online on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The best way to modify and eSign Fill In Mortgage Application Form Online effortlessly

- Obtain Fill In Mortgage Application Form Online and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize essential sections of your documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Fill In Mortgage Application Form Online and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fill in mortgage application form online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What completes a mortgage application?

The mortgage application will include basic information such as your name, address and telephone number, employer, income, number of dependents and the name and address of your bank or other financial institution. The application will also detail: Your assets (e.g., mutual funds, RRSPs)

-

How long does it take to fill out a loan application?

Most loan applications only take a few minutes to complete, and funding can be delivered electronically to your bank account within one to three business days. But the exact timeline depends on the type of lender you work with and its underwriting process.

-

How long does a mortgage loan application take?

From application to approval and closing, getting a mortgage can take anywhere from 30 days to 60 days. However, some home purchases can take longer, depending on factors unique to the purchase transaction and the home loan processing time.

-

What not to say when applying for a mortgage?

0:01 1:52 Information about pending legal. Issues This could include potential lawsuits or bankruptcies SuchMoreInformation about pending legal. Issues This could include potential lawsuits or bankruptcies Such disclosures can complicate the loan.

-

How long does a mortgage application take?

How long does a mortgage application take to be approved? The average time for a mortgage to be approved is usually 2 to 6 weeks. It can take as little as 24 hours but this is usually rare. You should expect to wait two weeks on average while the mortgage lender gets the property surveyed and underwrites your mortgage.

-

Can I apply for a mortgage completely online?

You can apply for most types of mortgages online, including conventional, FHA, VA and USDA loans.

-

How long does it take to fill out a mortgage application?

With many mortgage lenders, you can apply for a mortgage online and complete the process in 45 minutes or less — if you have all of your information ready beforehand. That's a big if, of course. But you might well be able to, if you know what the form's going to ask.

-

What is the most commonly used mortgage application?

The 1003 mortgage application is one of the most common forms, also known as the Uniform Residential Loan Application.

Get more for Fill In Mortgage Application Form Online

- Vr700 cook county clerk of the circuit court form

- Utah women and newborn quality collaborativepdsa worksheet form

- Da form 5304 207093608

- Intensive care delirium screening checklist icdsc form

- Doh 4378 form

- School entry health checkup requirement form

- Lease to own home contract template form

- Weekly rental lease agreement template form

Find out other Fill In Mortgage Application Form Online

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT