Revenue NSW Audits for Foreign Person Surcharge 2023-2026

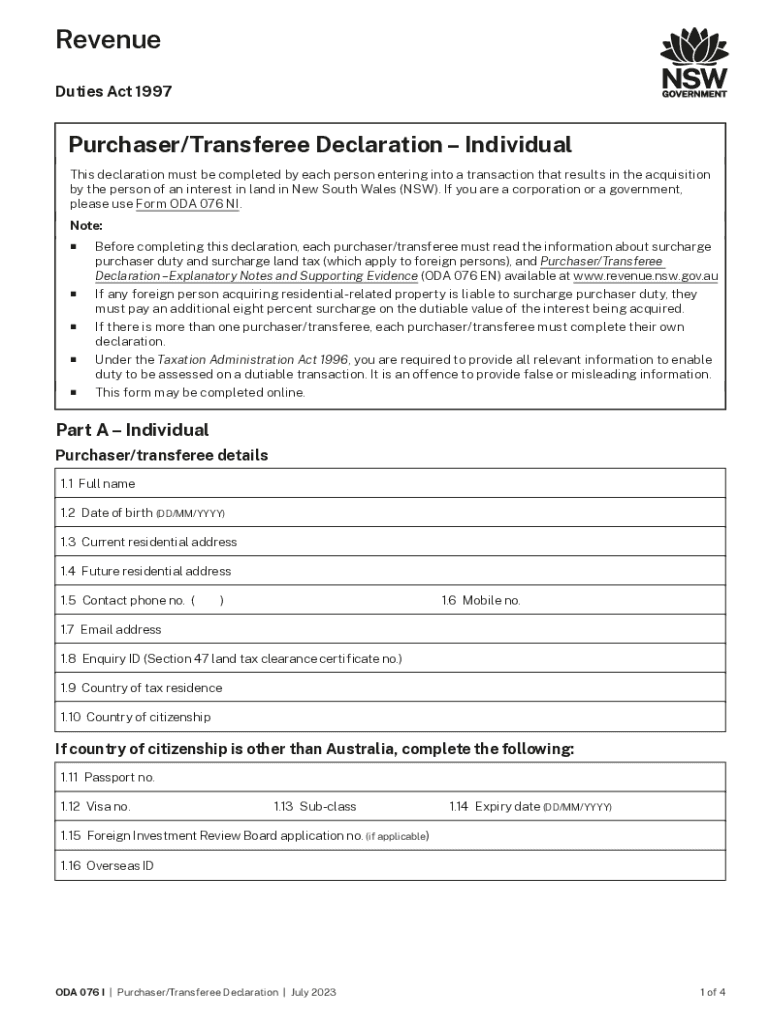

What is the purchaser declaration individual?

The purchaser declaration individual is a legal document used in real estate transactions in the United States. It serves to confirm the identity and status of the buyer, particularly in relation to tax obligations and compliance with local regulations. This declaration is essential for ensuring that the transaction adheres to state laws, especially concerning foreign ownership and taxation. By completing this form, individuals affirm their eligibility to purchase property and disclose any relevant information that may affect the transaction.

Key elements of the purchaser declaration individual

Several key elements must be included in the purchaser declaration individual to ensure its validity and compliance with legal requirements. These elements typically include:

- Purchaser Information: Full name, address, and contact details of the individual making the purchase.

- Property Details: Description of the property being purchased, including address and legal description.

- Declaration of Status: A statement confirming the purchaser's status as an individual, including tax residency and any applicable exemptions.

- Signature and Date: The purchaser must sign and date the declaration to validate the information provided.

Steps to complete the purchaser declaration individual

Completing the purchaser declaration individual involves several straightforward steps. It is important to follow these steps carefully to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary personal details and property information.

- Fill Out the Form: Complete the purchaser declaration form with accurate information, ensuring all sections are filled out.

- Review the Declaration: Double-check the information for accuracy and completeness before signing.

- Sign and Date: The purchaser must sign and date the form to confirm the declaration is true and correct.

- Submit the Form: Provide the completed form to the appropriate authority or real estate agent as required.

Legal use of the purchaser declaration individual

The purchaser declaration individual is legally binding and must be used in accordance with state laws governing real estate transactions. Failure to provide accurate information or to complete the form may result in penalties or complications in the transaction process. It is crucial for purchasers to understand their obligations and ensure that the declaration reflects their true status to avoid legal issues.

Required documents for the purchaser declaration individual

When filling out the purchaser declaration individual, certain documents may be required to support the information provided. These documents can include:

- Identification: A government-issued ID, such as a driver's license or passport, to verify the identity of the purchaser.

- Proof of Residency: Documentation proving the purchaser's residency status, which may include utility bills or tax returns.

- Property Details: Any relevant documents related to the property being purchased, such as the sales contract or title information.

Penalties for non-compliance

Non-compliance with the requirements of the purchaser declaration individual can lead to significant penalties. These may include fines, delays in the property transaction, or even legal action. It is essential for purchasers to ensure that their declaration is accurate and submitted on time to avoid these consequences.

Quick guide on how to complete revenue nsw audits for foreign person surcharge

Complete Revenue NSW Audits For Foreign Person Surcharge effortlessly on any gadget

Online document management has surged in popularity among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Revenue NSW Audits For Foreign Person Surcharge on any gadget using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Revenue NSW Audits For Foreign Person Surcharge with ease

- Find Revenue NSW Audits For Foreign Person Surcharge and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Modify and eSign Revenue NSW Audits For Foreign Person Surcharge and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenue nsw audits for foreign person surcharge

Create this form in 5 minutes!

How to create an eSignature for the revenue nsw audits for foreign person surcharge

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the foreign ownership surcharge in Australia?

How is the foreign ownership surcharge calculated? The foreign ownership surcharge is calculated based on the value of the interest in residential land, being the value used for duty purposes. The 7% foreign ownership surcharge is in addition to any duty payable.

-

How much is foreign surcharge in Australia?

Foreign surcharge duty is imposed at rates of between 1.5%–8%, depending on the type of land and the jurisdiction. In addition, Victoria, NSW, Queensland, Tasmania and the ACT have all introduced a foreign surcharge land tax which is payable in addition to land tax.

-

What is the foreign property tax in Australia?

The rate of non-resident tax in Australia for 2023-2024 is: $0 – $120,000: 32.5% $120,001 – $180,000: 37% Above $180,000: 45%

-

What is the foreign investor surcharge in NSW?

New South Wales From 1 January 2025, foreign purchasers of residential land will pay an additional 9% duty, while foreign owners of residential land will pay an additional 5% surcharge land tax from the start of the 2025 land tax year.

-

Who is exempt from the surcharge of land tax in NSW?

You may also be fully or partially exempt from the surcharge if you belong to one of the following categories: you're an exempt permanent resident. you're Australian-based developers that are foreign persons. you're purchasing residential land used for a commercial purpose.

-

What is the foreign owner surcharge in South Australia?

The foreign ownership surcharge is calculated based on the value of the interest in residential land, being the value used for duty purposes. The 7% foreign ownership surcharge is in addition to any duty payable.

-

What are the rules for foreign ownership in Australia?

Foreign persons generally require approval before acquiring an interest of 10 per cent or more in a listed land entity, or 5 per cent or more in an unlisted land entity where the value of the investment is above the relevant monetary threshold. investors from certain free trade agreement partners.

-

Is the land tax surcharged in NSW 2024?

The proposed changes will increase surcharge land tax from 4% to 5% effective from the 2025 land tax year (i.e., for land held at midnight on 31 December 2024). Again, this will make the NSW surcharge land tax rate the highest in Australia, albeit it still only applies to residential land.

Get more for Revenue NSW Audits For Foreign Person Surcharge

- Rehabilitation review application wisconsin fillable form

- Responsible land disturber certification responsible land disturber application fairfaxcounty form

- Fwacreditexpressawwfwcom form

- Filling station electrical periodic inspection report niceic form

- F245 051 000 approved ime examiner update lni wa form

- Town of harrison mooring permit application form

- Athlete sponsorship contract template form

- Form 1040 sr 793950810

Find out other Revenue NSW Audits For Foreign Person Surcharge

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed