Data Classification R State Pension Assets Gov Ie 2020-2026

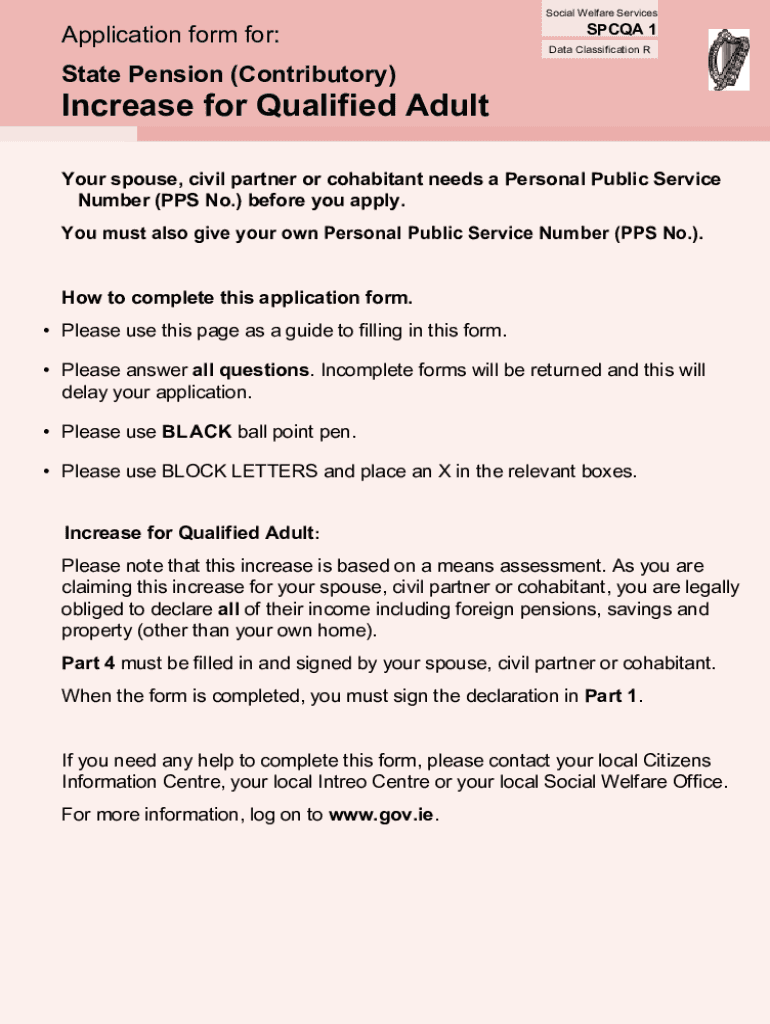

Understanding the spcqa1 Form

The spcqa1 form is primarily associated with social welfare and state pension contributory increases in Ireland. It serves as a crucial document for individuals seeking to apply for benefits related to their state pension. Understanding the purpose and requirements of this form is essential for ensuring that applicants can successfully navigate the application process.

Eligibility Criteria for the spcqa1 Form

To qualify for the benefits associated with the spcqa1 form, applicants must meet specific eligibility criteria. Generally, this includes having made sufficient contributions to the state pension system and being of the appropriate age. Applicants should verify their contribution history and ensure they meet the necessary requirements before submitting the form.

Steps to Complete the spcqa1 Form

Completing the spcqa1 form involves several key steps. First, gather all required documentation, including proof of identity and contribution records. Next, fill out the form accurately, ensuring that all sections are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form through the designated method, whether online or via mail.

Required Documents for the spcqa1 Form

When applying with the spcqa1 form, applicants must provide several important documents. This typically includes:

- Proof of identity, such as a government-issued ID

- Records of state pension contributions

- Any additional documentation that supports the application, such as previous correspondence with social services

Having these documents ready will facilitate a smoother application process.

Form Submission Methods

The spcqa1 form can be submitted through various methods, depending on the preferences of the applicant. Common submission methods include:

- Online submission through the official government portal

- Mailing the completed form to the designated social services office

- In-person submission at local social welfare offices

Choosing the most convenient method can help ensure timely processing of the application.

Key Elements of the spcqa1 Form

The spcqa1 form consists of several key elements that applicants must be aware of. These include personal information fields, contribution history, and specific questions related to eligibility for state pension benefits. Understanding these elements is crucial for accurately completing the form and ensuring that all necessary information is provided.

Common Issues and Considerations

Applicants should be aware of common issues that may arise when completing the spcqa1 form. These can include incomplete information, missing documentation, or errors in the submission. It is advisable to double-check all entries and to seek assistance if there are any uncertainties regarding the application process. Being proactive can help prevent delays and ensure a successful outcome.

Quick guide on how to complete data classification r state pension assets gov ie

Effortlessly Prepare Data Classification R State Pension Assets gov ie on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Data Classification R State Pension Assets gov ie on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Edit and eSign Data Classification R State Pension Assets gov ie with Ease

- Obtain Data Classification R State Pension Assets gov ie and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Data Classification R State Pension Assets gov ie and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct data classification r state pension assets gov ie

Create this form in 5 minutes!

How to create an eSignature for the data classification r state pension assets gov ie

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How much is full state pension in Ireland?

Weekly rate of State Pension (Contributory) Yearly average PRSI contributionsPersonal rate per weekIncrease for a qualified adult* (over 66) 48 or over €277.30 €248.60 40-47 €271.90 €236.10 30-39 €249.30 €223.90 20-29 €236.10 €210.702 more rows • Nov 6, 2024

-

How much will the Irish State Pension be in 2024?

From January 2024, the State Pension (Contributory) personal rate increased by €12 per week to €277.30 per week. It is equal to an annual increase of €624. Prior to 1st January 2024, the State Pension (Contributory) personal rate was €265.30 per week2.

-

What is the difference between an contributory and a non-contributory state pension in Ireland?

The State Pension (Non-contributory) is a means tested payment. It may be available to you if you do not qualify for State Pension (Contributory) based on your social insurance contribution record or if you qualify for a reduced rate of the State Pension (Contributory).

-

What is State Pension in Ireland?

State Pension (Contributory) is a weekly payment based on your social insurance contribution record. It is not a means tested payment so your payment will not be impacted by any additional income you may have.

-

How many years contributions do I need for full state pension?

If your National Insurance record started after April 2016 you will need 35 qualifying years to get the full rate of new State Pension.

-

How much is a full contributory State Pension in Ireland?

Weekly rate of State Pension (Contributory) Yearly average PRSI contributionsPersonal rate per weekIncrease for a qualified adult* (under 66) 48 or over €277.30 €184.70 40-47 €271.90 €175.80 30-39 €249.30 €167.20 20-29 €236.10 €156.502 more rows • Nov 6, 2024

-

Can I claim for my wife on my State Pension in Ireland?

In addition to the State Contributory Pension your wife could apply for Qualified Adult Dependant payment , but this is means tested on your wife's means (not on your means). so assuming she is not earning, and is financially dependent on you, then assets in her name or 50% of assets held jointly are considered.

-

How much is the contributory pension in Ireland in 2024?

Pensions State Pension (Contributory)Maximum weekly rate, € 2024 2025 Personal rate - under age 80 277.30 289.30 Personal rate - aged 80 and over 287.30 299.30 Increase for Qualified Adult - under 66 184.70 192.701 more row • Oct 1, 2024

Get more for Data Classification R State Pension Assets gov ie

- Skierowanie na badania lekarskie word 092015 luxmedpl form

- Referral form baylor health care system

- American express icc centurion card application form

- M i c r o s o f t w o r d o p r a f o r m blairstown blairstown nj form

- Form uc 25 205724

- Application for kentucky certificate of title registration form

- City of columbus tax exemption certificate youngstown form

- Whitmer signs repeal of nations only immunity law that form

Find out other Data Classification R State Pension Assets gov ie

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online