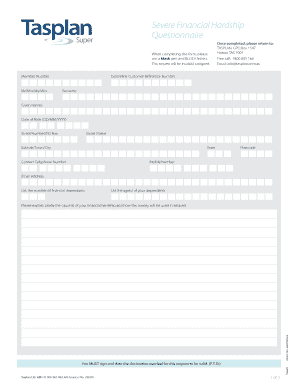

Hardship Questionnaire Form

What is the financial hardship questionnaire?

The financial hardship questionnaire is a document designed to assess an individual's or a household's financial situation during times of economic difficulty. It typically includes questions about income, expenses, assets, and liabilities. This form is often used by lenders, government agencies, and non-profit organizations to determine eligibility for assistance programs, loan modifications, or other forms of financial relief. By providing a comprehensive view of one's financial circumstances, the questionnaire helps organizations make informed decisions regarding support and resources.

How to use the financial hardship questionnaire

Using the financial hardship questionnaire involves several steps to ensure accurate and complete information is provided. Begin by gathering necessary financial documents, such as pay stubs, bank statements, and bills. Next, fill out the questionnaire honestly, detailing your current income, monthly expenses, and any significant financial changes. Be sure to include any relevant information about dependents or special circumstances that may affect your financial situation. Once completed, review the questionnaire for accuracy before submitting it to the appropriate agency or lender.

Key elements of the financial hardship questionnaire

Several key elements are typically included in a financial hardship questionnaire. These may consist of:

- Personal information: Name, address, and contact details.

- Income details: Sources of income, including employment, government assistance, and any other financial support.

- Expense breakdown: Monthly expenses, including housing, utilities, transportation, and healthcare.

- Asset information: Any savings, investments, or valuable possessions that may be relevant.

- Liabilities: Outstanding debts, such as credit cards, loans, and mortgages.

These elements help create a complete picture of the individual's financial situation, enabling better assessment and support.

Steps to complete the financial hardship questionnaire

Completing the financial hardship questionnaire involves a systematic approach to ensure all necessary information is accurately captured. Follow these steps:

- Gather documentation: Collect all relevant financial documents, including income statements and bills.

- Read instructions: Review any provided guidelines to understand how to fill out the questionnaire correctly.

- Complete the form: Fill in all sections of the questionnaire, providing detailed and honest answers.

- Review your responses: Check for accuracy and completeness, ensuring all necessary information is included.

- Submit the questionnaire: Send the completed form to the designated agency or lender, following their submission guidelines.

Eligibility criteria

Eligibility criteria for using the financial hardship questionnaire can vary depending on the organization or program requesting the form. Generally, criteria may include:

- Demonstrating a significant reduction in income due to job loss, illness, or other unforeseen circumstances.

- Having monthly expenses that exceed income, leading to financial strain.

- Being a resident of the United States and meeting any specific state or local requirements.

Understanding these criteria is essential for individuals seeking assistance, as it helps determine their eligibility for various financial relief programs.

Legal use of the financial hardship questionnaire

The financial hardship questionnaire is often used in legal contexts, such as bankruptcy filings or loan modifications. In these situations, it serves as a formal declaration of an individual's financial state. Accurate completion is crucial, as providing false information can lead to legal repercussions. Organizations that request this questionnaire may use the information to comply with federal and state regulations, ensuring that assistance is provided to those genuinely in need. It is advisable to consult with a legal professional if there are concerns about the implications of submitting this form.

Quick guide on how to complete hardship questionnaire

Effortlessly Prepare Hardship Questionnaire on Any Device

Online document handling has gained traction among businesses and individuals alike. It serves as a superb environmentally friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Hardship Questionnaire on any device with the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The Easiest Way to Modify and eSign Hardship Questionnaire Effortlessly

- Find Hardship Questionnaire and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your updates.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Hardship Questionnaire and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hardship questionnaire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What qualifies as extreme hardship?

The BIA has held that factors that may contribute to the finding of exceptional and extremely unusual hardship include if the applicant has elderly parents who rely solely on him or her support, if the applicant has a qualifying child with very serious health issues or special needs at school, or if the applicant's ...

-

What is a hardship questionnaire?

HARDSHIP is a modular instrument incorporating demographic enquiry, diagnostic questions based on ICHD-3 beta criteria, and enquiries into each of the following as components of headache-attributed burden: symptom burden; health-care utilization; disability and productive time losses; impact on education, career and ...

-

What questions are asked for immigration hardship?

QUESTIONS RELATED TO HEALTH 1) How are the health conditions in the area where you will return? 2) Do you or anyone in your family suffer from a medical condition? 3) What type of treatment are you or someone in your family receiving? 4) How often are you or the person in your family being treated?

-

How to write a hardship letter to USCIS?

It is important to be as specific as possible when describing the extreme hardship that would be caused. The USCIS or consular officer reviewing your case will want to see evidence that this hardship is real and signNow. This may include, for example, letters from family members or medical professionals.

-

What does USCIS consider financial hardship?

Some examples of extreme financial hardship include: A medical emergency or illness affecting the noncitizen or the noncitizen's dependents; Unemployment; signNow loss of work hours and wages (change in employment status);

-

What is proof of hardship for immigration?

Letters from medical professionals, as evidence of physical and/or emotional conditions that will lead to extreme hardship to the U.S. relative. Copies of tax returns and/or pay statements as evidence of your household income. Copies of statements showing any debts that need to be settled in the United States.

Get more for Hardship Questionnaire

Find out other Hardship Questionnaire

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation