Land Tax Registration Form

What is the Land Tax Registration Form

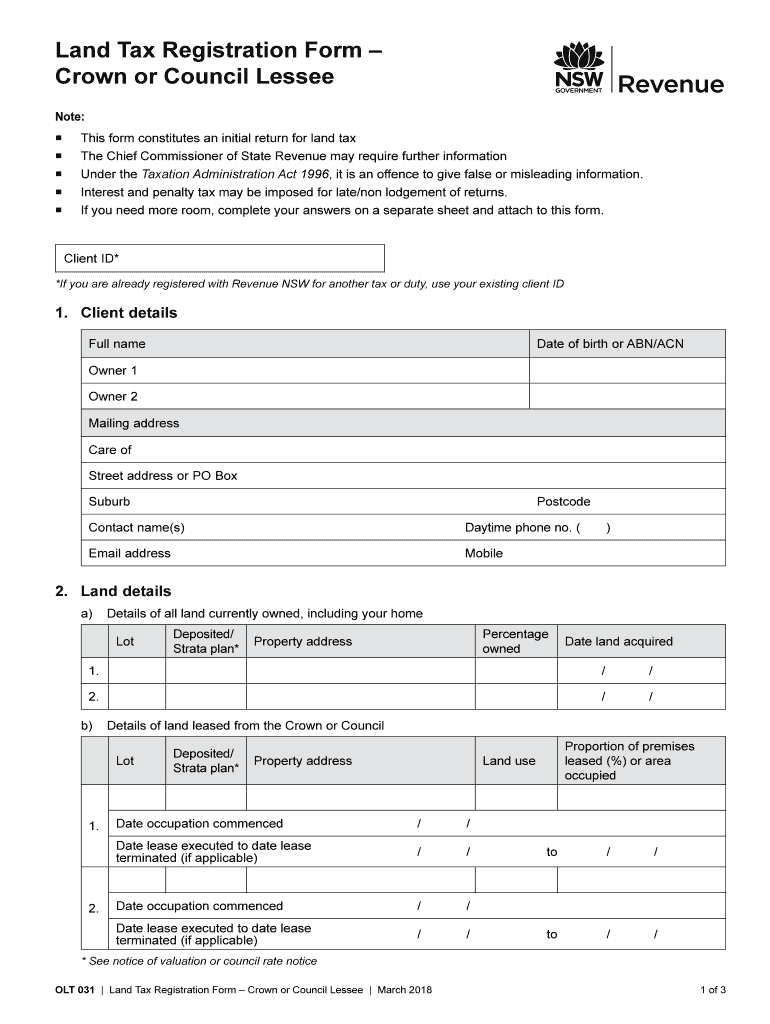

The land tax registration form is a crucial document used by property owners to report their real estate holdings for tax purposes. This form helps local tax authorities assess the value of the property and determine the appropriate tax obligations. By completing this form, property owners ensure compliance with state and local tax laws, facilitating accurate tax assessments and avoiding potential penalties.

Steps to complete the Land Tax Registration Form

Completing the land tax registration form involves several key steps:

- Gather necessary information, including property details such as address, type, and ownership status.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate local tax authority, either online, by mail, or in person, depending on the jurisdiction.

How to obtain the Land Tax Registration Form

Property owners can obtain the land tax registration form from their local tax authority's website or office. Many jurisdictions provide downloadable versions of the form that can be printed and filled out. Additionally, some tax offices may offer physical copies of the form for those who prefer to complete it in person.

Legal use of the Land Tax Registration Form

The land tax registration form is legally required for property owners to report their holdings accurately. Failure to submit this form can result in penalties, including fines or increased tax assessments. It is essential for property owners to understand the legal implications of this form and ensure timely submission to maintain compliance with local tax regulations.

Required Documents

When filling out the land tax registration form, property owners may need to provide supporting documents. These may include:

- Proof of ownership, such as a deed or title.

- Identification documents, like a driver's license or state ID.

- Previous tax statements related to the property.

State-specific rules for the Land Tax Registration Form

Each state in the U.S. has its own rules and regulations regarding the land tax registration form. Property owners should familiarize themselves with their state's specific requirements, including deadlines for submission and any additional documentation needed. This ensures compliance and helps avoid potential issues with local tax authorities.

Quick guide on how to complete land tax registration form

Manage Land Tax Registration Form easily on any device

Digital document management has become popular among organizations and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Land Tax Registration Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Land Tax Registration Form effortlessly

- Obtain Land Tax Registration Form and then click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign Land Tax Registration Form and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the land tax registration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

At what age do you stop paying school taxes in New York state?

To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements.

-

How do I pay my land tax in Texas?

Tax Code Section 31.06 allows property tax payments to be made with United States currency, check, money order, credit card or electronic funds transfer. A tax collector may adopt a policy requiring delinquent taxes be paid with United States currency, credit card or electronic funds transfer.

-

Is there a property tax break for seniors in NY?

The Senior Citizen Homeowners' Exemption (SCHE) provides a reduction of 5 to 50% on New York City's real property tax to seniors age 65 and older. To be eligible for SCHE, you must be 65 or older, earn no more than $58,399 for the last calendar year, and the property must be your primary residence.

-

How do I register my house for local property taxes?

To do so: Click LPT online. Enter your Personal Public Service Number (PPSN), Property ID and PIN. Click 'Login' Click on 'Transfer a Property' Select the 'Register New Property' option from the list of options provided.

-

How do I apply for property tax exemption in NY?

Exemption applications must be filed with your local assessor's office. See our Municipal Profiles for your local assessor's mailing address. Do not file any exemption applications with the NYS Department of Taxation and Finance or with the Office of Real Property Tax Services.

-

What tax breaks do you get when you turn 65?

For the 2022 tax year, seniors filing single or married filing separately get a standard deduction of $14,700. For those who are married and filing jointly, the standard deduction for 65 and older is $25,900. The standard deduction for a widow over 65 is also $25,900 if they qualify.

-

At what age do you stop paying property tax in NYS?

All owners of the property must be 65 or older, unless the owners are spouses or siblings. If you own the property with a spouse or sibling, only one of you must meet this age requirement.

-

Who is exempt from property taxes in NY?

The City of New York offers tax break down known as exemptions to seniors, veterans, clergy members, people with disabilities, and others. Please visit the Property Tax Benefits page for the most up-to-date information about property tax exemptions.

Get more for Land Tax Registration Form

- Cambio di residenza in tempo reale comune di marostica comune marostica vi form

- Gwrra membership application form

- Scuml registration forms

- Insperity w2 form

- Ps form 1314

- Ach transfer vs wire transfer what is the difference form

- Settlement redundancy agreement template form

- Settlement reference agreement template form

Find out other Land Tax Registration Form

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile