Form 1041 Schedule K 1 Beneficiary's Share of Income, Deductions, Credits, Etc

What is the Form 1041 Schedule K-1 Beneficiary's Share Of Income, Deductions, Credits, Etc

The Form 1041 Schedule K-1 is a crucial document for beneficiaries of estates and trusts. It reports each beneficiary's share of income, deductions, and credits from the estate or trust. This information is essential for beneficiaries when they prepare their individual tax returns. The form provides a detailed breakdown of the income types, including interest, dividends, and capital gains, as well as any deductions or credits that may apply. Understanding this form is vital for accurate tax reporting and compliance with IRS regulations.

Steps to Complete the Form 1041 Schedule K-1 Beneficiary's Share Of Income, Deductions, Credits, Etc

Completing the Form 1041 Schedule K-1 involves several steps:

- Gather necessary information about the estate or trust, including its EIN and the beneficiary's identifying details.

- Identify the types of income distributed to the beneficiary, such as ordinary income, capital gains, and tax-exempt income.

- Calculate the beneficiary's share of deductions and credits, ensuring accurate reporting of any applicable amounts.

- Fill out the form accurately, ensuring all sections are completed, including the beneficiary's share of income and deductions.

- Provide copies of the completed Schedule K-1 to the beneficiaries and retain a copy for the estate or trust records.

How to Obtain the Form 1041 Schedule K-1 Beneficiary's Share Of Income, Deductions, Credits, Etc

The Form 1041 Schedule K-1 can be obtained through the IRS website or from tax professionals who handle estate and trust filings. It is typically provided by the estate or trust administrator to the beneficiaries. It is important to ensure that the correct version of the form is used, as updates may occur annually. Beneficiaries should request their Schedule K-1 from the executor or trustee if they have not received it by the time they need to file their tax returns.

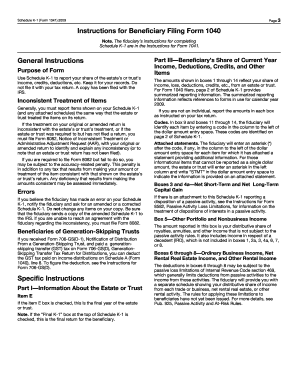

IRS Guidelines for the Form 1041 Schedule K-1 Beneficiary's Share Of Income, Deductions, Credits, Etc

The IRS provides specific guidelines for completing and filing the Form 1041 Schedule K-1. These guidelines outline the information required on the form, including how to report different types of income and deductions. It is important to follow these guidelines closely to ensure compliance with tax laws. Additionally, the IRS specifies deadlines for issuing Schedule K-1 to beneficiaries, which typically aligns with the filing deadline for Form 1041. Beneficiaries should consult these guidelines to understand their responsibilities and ensure accurate reporting on their individual tax returns.

Key Elements of the Form 1041 Schedule K-1 Beneficiary's Share Of Income, Deductions, Credits, Etc

Key elements of the Form 1041 Schedule K-1 include:

- The name and identification number of the estate or trust.

- The beneficiary's name, address, and taxpayer identification number.

- A detailed account of the income types distributed, including ordinary income, capital gains, and other relevant categories.

- Information on any deductions and credits allocated to the beneficiary.

- Signature of the fiduciary or trustee, certifying the accuracy of the information provided.

Legal Use of the Form 1041 Schedule K-1 Beneficiary's Share Of Income, Deductions, Credits, Etc

The legal use of the Form 1041 Schedule K-1 is primarily for tax reporting purposes. Beneficiaries must report the information provided on the Schedule K-1 when filing their individual income tax returns. Failure to accurately report this information can lead to penalties or audits by the IRS. Additionally, the form serves as a legal document that outlines the beneficiary's entitlement to income and deductions from the estate or trust, which can be important in legal disputes or estate settlements.

Quick guide on how to complete form 1041 schedule k 1 beneficiarys share of income deductions credits etc

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize relevant parts of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds equivalent legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Choose your preferred method to send your form via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Modify and eSign [SKS] to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 Schedule K 1 Beneficiary's Share Of Income, Deductions, Credits, Etc

Create this form in 5 minutes!

How to create an eSignature for the form 1041 schedule k 1 beneficiarys share of income deductions credits etc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule k1 partner's share of income?

Schedule K-1 is an Internal Revenue Service (IRS) tax form issued annually for an investment in a partnership. The purpose of Schedule K-1 is to report each partner's share of the partnership's earnings, losses, deductions, and credits. Schedule K-1 serves a similar purpose as Form 1099.

-

What expenses are deductible on estate 1041?

On Form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees, fiduciary fees and itemized deductions. After the section on deductions is complete you'll get to the kicker – taxes and payments.

-

Is a schedule K considered income?

Depending on the scenario, income on a Schedule K-1 may be treated as self-employment income, earned income, or investment income. The IRS requires that Schedule K-1 forms are filed by pass-through entities by March 15th each year unless an extension is filed.

-

What is a Schedule k1 beneficiary's share of income deductions credits etc?

The estate or trust uses Schedule K-1 (541) to report your share of the estate's or trust's income, deductions, credits, etc. Your name, address, and tax identification number, as well as the estate's or trust's name, address, and tax identification number, should be entered on the Schedule K-1 (541).

-

What is the income distribution deduction on form 1041?

The income distribution deduction determines the amount of any distributions taxed to the beneficiaries. For this reason, a trust or decedent's estate is sometimes referred to as a “pass-through entity.” The beneficiary, and not the trust or decedent's estate, pays income tax on their distributive share of income.

-

What is a Schedule k1 beneficiary's share of income deductions credits etc?

The estate or trust uses Schedule K-1 (541) to report your share of the estate's or trust's income, deductions, credits, etc. Your name, address, and tax identification number, as well as the estate's or trust's name, address, and tax identification number, should be entered on the Schedule K-1 (541).

-

What deductions can I claim with a K1?

You may be allowed to deduct unreimbursed ordinary and necessary expenses you paid on behalf of the partnership (including qualified expenses for the business use of your home) if you were required to pay these expenses under the partnership agreement and they are trade or business expenses under section 162.

-

What is Schedule K partners share of income deductions and credits?

Schedule K-1 is an Internal Revenue Service (IRS) tax form issued annually to the individuals in business partnerships. The purpose of Schedule K-1 is to report each partner's share of the partnership's earnings, losses, deductions, and credits.

Get more for Form 1041 Schedule K 1 Beneficiary's Share Of Income, Deductions, Credits, Etc

- File a business certificatelowell ma city of lowell form

- Fillable online city of lowell building permit application form

- Noble street festival vendor application the city of form

- Affidavit of non use arkansas 504298978 form

- Bella vista permits form

- Town of hamilton building permit application s 7 1 a form

- Mayor s work group on panhandling northampton ma form

- Www mass govorgsdepartment of labor relationsdepartment of labor relations mass gov form

Find out other Form 1041 Schedule K 1 Beneficiary's Share Of Income, Deductions, Credits, Etc

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA