Schedule NR, Nonresident and Part Year Resident Schedule Schedule NR, Nonresident and Part Year Resident Schedule Form

Understanding the Schedule NR, Nonresident And Part Year Resident Schedule

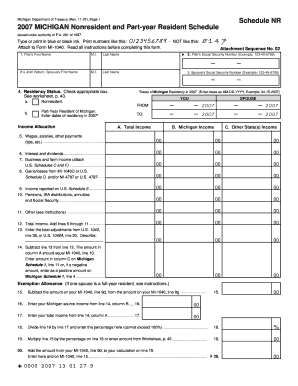

The Schedule NR, Nonresident And Part Year Resident Schedule is a tax form used by individuals who are not full-time residents of a state but have earned income within that state. This form is essential for accurately reporting income and calculating tax liabilities for nonresidents and part-year residents. It allows these taxpayers to determine the portion of their income that is taxable in the state where they have earned it. Understanding this form is crucial for compliance with state tax laws and for ensuring that taxpayers pay the correct amount of taxes owed.

Steps to Complete the Schedule NR

Completing the Schedule NR involves several key steps. First, gather all relevant financial documents, including W-2 forms and any other income statements. Next, identify the income earned while residing in the state, as only this income is subject to state tax. Fill out the form by providing personal information, including your name, address, and Social Security number. Report your total income and then calculate the taxable amount based on the guidelines provided in the form. Finally, review your entries for accuracy before submitting the form to the appropriate state tax authority.

Obtaining the Schedule NR

The Schedule NR can be obtained from the official state tax authority's website or through tax preparation software. Many states provide downloadable PDF versions of the form, which can be filled out electronically or printed for manual completion. Additionally, tax professionals can assist in obtaining this form and ensuring it is filled out correctly. It is advisable to check the specific state's requirements, as each state may have different procedures for obtaining and submitting the Schedule NR.

Key Elements of the Schedule NR

Several key elements are essential when filling out the Schedule NR. These include personal identification information, details about income earned in the state, and any deductions or credits applicable to nonresidents. Taxpayers must also indicate the period of residency within the state. Understanding these components is vital to accurately report income and comply with tax regulations. Each section of the form is designed to capture specific information, ensuring that taxpayers provide a complete picture of their financial situation.

Filing Deadlines for the Schedule NR

Filing deadlines for the Schedule NR vary by state, but generally, taxpayers must submit their forms by the same deadline as their federal tax returns. It is crucial to be aware of these dates to avoid penalties and interest for late filing. Some states may offer extensions, but these typically require a separate application. Keeping track of filing deadlines ensures that taxpayers remain compliant with state tax laws and avoid unnecessary complications.

IRS Guidelines for Nonresidents

The IRS provides guidelines that are particularly relevant for nonresidents. These guidelines outline how nonresidents should report their income and the specific forms required for different types of income. Understanding these regulations is important for accurately completing the Schedule NR and ensuring compliance with both federal and state tax laws. Nonresidents should refer to IRS publications and resources for detailed information on their tax obligations.

Quick guide on how to complete schedule nr nonresident and part year resident schedule schedule nr nonresident and part year resident schedule

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to generate, edit, and eSign your documents swiftly without interruptions. Manage [SKS] on any platform using airSlate SignNow apps for Android or iOS and enhance any document-focused procedure today.

The simplest method to modify and eSign [SKS] without effort

- Obtain [SKS] and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or a link invitation, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign [SKS] and guarantee excellent communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule NR, Nonresident And Part Year Resident Schedule Schedule NR, Nonresident And Part Year Resident Schedule

Create this form in 5 minutes!

How to create an eSignature for the schedule nr nonresident and part year resident schedule schedule nr nonresident and part year resident schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Does NR mean non resident?

For early childhood children receiving services from a nonresident district (including ECSE), the attending district should report the children as non-residents (NR) and report the domicile district in the resident district field.

-

How do I change my residency status on TurboTax?

You should complete DD Form 2058 and file it with the finance office in order for your LES and W-2 to reflect your new domicile. Still have questions? Use your Intuit Account to sign in to TurboTax. By selecting Sign in, you agree to our Terms and acknowledge our Privacy Statement.

-

Can I use TurboTax if I live in one state and work in another?

Learn where to file state income taxes, even if you're in the military, or earned money in multiple states. TurboTax will calculate how much you owe to the different states where you have earned income.

-

How do you determine what state you are a resident of?

Your state of residence is determined by: Where you're registered to vote (or could be legally registered) Where you lived for most of the year. Where your mail is delivered.

-

What is the schedule NR for 1040?

If you file Form 1040-NR, use Schedule NEC (Form 1040-NR) to figure your tax on income that is not effectively connected with a U.S. trade or business and to figure your capital gains and losses from sales or exchanges of property that is not effectively connected with a U.S. business.

-

What is a nonresident or part-year resident of New York?

A Nonresident of New York is an individual that was not domiciled nor maintained a permanent place of abode in New York during the tax year. A Part-Year Resident is an individual that meets the definition of resident or nonresident for only part of the year.

-

What qualifies as a part-year resident in TurboTax?

You are a part-year resident of a state if your permanent home is located there for a portion of the tax year, for example, if you move from one state to another.

-

How do I file taxes if I move halfway through the year?

When you move from one state to another during a tax year, you might need to file taxes in both states. Typically, you'll file a part-year resident return in each state, which accounts for the income you earned while you were a resident there.

Get more for Schedule NR, Nonresident And Part Year Resident Schedule Schedule NR, Nonresident And Part Year Resident Schedule

Find out other Schedule NR, Nonresident And Part Year Resident Schedule Schedule NR, Nonresident And Part Year Resident Schedule

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form