New York State Department of Taxation and Finance Yonkers Nonresident Earnings Tax Return for the Full Year January 1, , through Form

Understanding the New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return

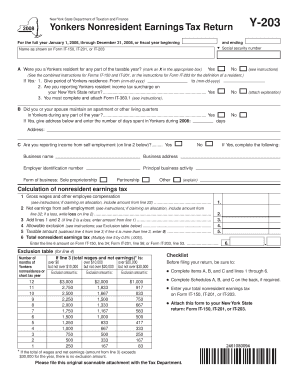

The New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return is a specific tax form required for individuals who earn income in Yonkers but reside outside of New York State. This form is essential for accurately reporting earnings and ensuring compliance with local tax regulations. It typically covers a full calendar year, from January first to December thirty-first, or a fiscal year beginning on a specified date. Completing this form correctly helps avoid potential penalties and ensures that the appropriate taxes are paid to the city of Yonkers.

How to Use the Yonkers Nonresident Earnings Tax Return

Using the Yonkers Nonresident Earnings Tax Return involves several steps to ensure accurate completion. Taxpayers must gather all relevant income documentation, including W-2 forms and any 1099 statements. Once the necessary documents are collected, individuals can fill out the form by providing personal information, income details, and any applicable deductions. It is important to review the instructions carefully to ensure all sections are completed accurately. Filing can be done electronically or via mail, depending on the taxpayer's preference.

Steps to Complete the Yonkers Nonresident Earnings Tax Return

Completing the Yonkers Nonresident Earnings Tax Return requires a systematic approach:

- Gather all necessary income documents, such as W-2s and 1099s.

- Obtain the latest version of the Yonkers Nonresident Earnings Tax Return form.

- Fill in personal information, including your name, address, and social security number.

- Report all income earned in Yonkers, ensuring accuracy in figures.

- Include any eligible deductions that may apply to your situation.

- Review the completed form for accuracy and completeness.

- Submit the form either electronically or by mailing it to the appropriate tax office.

Required Documents for Filing

When filing the Yonkers Nonresident Earnings Tax Return, several documents are typically required to support the information provided. These documents include:

- W-2 forms from all employers.

- 1099 forms for any additional income received.

- Documentation for any deductions claimed, such as receipts or statements.

- Proof of residency outside of New York State, if applicable.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the Yonkers Nonresident Earnings Tax Return. Generally, the return is due on April fifteenth of the following year for calendar year filers. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be mindful of any extensions that may apply and ensure timely submission to avoid penalties.

Penalties for Non-Compliance

Failure to file the Yonkers Nonresident Earnings Tax Return or inaccuracies in reporting can result in penalties. These can include fines, interest on unpaid taxes, and potential legal action. It is advisable to file on time and ensure all information is accurate to avoid these consequences. Understanding the implications of non-compliance can help taxpayers remain diligent in their filing responsibilities.

Quick guide on how to complete new york state department of taxation and finance yonkers nonresident earnings tax return for the full year january 1 through 6240735

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed files, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Handle [SKS] across any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Modify and eSign [SKS] Seamlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Mark important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you'd like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and eSign [SKS] and ensure outstanding communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation and finance yonkers nonresident earnings tax return for the full year january 1 through 6240735

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the non resident tax return for NY State?

You must file Form IT-203, Nonresident and Part-Year Resident Income Tax Return, if you: were not a resident of New York State and received income during the tax year from New York State sources, or. moved into or out of New York State during the tax year.

-

Is Yonkers subject to NYC tax?

Residents of Yonkers are subject to the Yonkers Resident Withholding Tax. This tax must be included in paychecks for all employees who live in Yonkers. This tax applies to any services performed or employment in New York City or elsewhere in New York State.

-

Does Yonkers NY have a local income tax?

New York has nine income tax rates: 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3% and 10.9%. New York City and Yonkers have their own local income tax in addition to the state tax.

-

Do you pay New York City income tax if you live in Westchester?

Westchester County has no personal income tax*, a factor which helps companies attract skilled, highly-paid employees. The personal income tax is graduated in New York State. New York City has an additional graduated income tax on residents and nonresidents who work in the city.

-

Why do taxes ask about Yonkers?

The NY state tax return requires that you indicate whether you were a resident of Yonkers (which is in Westchester County) because Yonkers has it's own city tax. When you select that you were a resident of New York City, this automatically means you are not a resident of Yonkers.

-

Who pays Yonkers nonresident tax?

If you earned wages in Yonkers or carried on a trade or business there (either as an individual or a member of a partnership) during the part of the year that you were not a Yonkers resident, you may have to pay the Yonkers nonresident earnings tax.

-

Is Yonkers part of NYC for tax purposes?

New York has nine income tax rates: 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3% and 10.9%. New York City and Yonkers have their own local income tax in addition to the state tax.

-

Are you reporting Yonkers resident tax on your New York State return?

Yonkers residents are subject to a Yonkers resident income tax surcharge that is computed and reported on their New York State tax return.

Get more for New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return For The Full Year January 1, , Through

- Certificates pennsylvania department of health pagov form

- Oscme form

- Nhep planning for success job readiness portfolio form

- Form gm 509b fill online printable fillable blankpdffiller

- Form 2202a central registry third party

- Form gm 509b

- New hampshire central registry name search form

- Physician update form

Find out other New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return For The Full Year January 1, , Through

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney