Information Regarding Request for Refund of Social Security Tax

What is the Information Regarding Request For Refund Of Social Security Tax

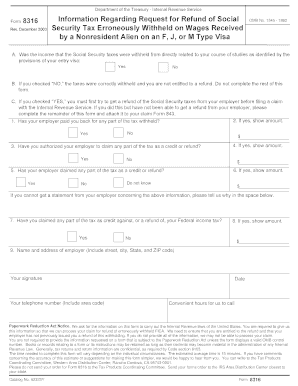

The Information Regarding Request For Refund Of Social Security Tax is a crucial document for individuals and businesses seeking to reclaim overpaid Social Security taxes. This form provides guidelines on eligibility, necessary documentation, and the process for submitting a refund request. Understanding this information is essential for ensuring compliance with IRS regulations and maximizing potential refunds.

Steps to complete the Information Regarding Request For Refund Of Social Security Tax

Completing the request for a refund of Social Security tax involves several key steps:

- Gather necessary documentation, including proof of overpayment and identification.

- Fill out the required forms accurately, ensuring all information is complete.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate method, whether online or by mail.

Required Documents

To successfully process a refund request, several documents are typically required:

- Proof of income and tax payments, such as W-2 forms or tax returns.

- Identification documents, including a Social Security card or driver's license.

- Any correspondence from the IRS regarding tax payments or refunds.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for ensuring your refund request is processed in a timely manner. Generally, the IRS sets specific deadlines for submitting refund requests, which can vary based on the tax year. It is advisable to check the IRS website or consult with a tax professional for the most current deadlines related to Social Security tax refunds.

IRS Guidelines

The IRS provides specific guidelines for requesting a refund of Social Security tax. These guidelines outline eligibility criteria, acceptable documentation, and the process for submitting a request. Familiarizing yourself with these guidelines can help streamline the refund process and reduce the likelihood of delays or rejections.

Eligibility Criteria

Eligibility for a refund of Social Security tax typically depends on several factors, including:

- The amount of tax paid compared to the income level.

- Whether the individual was employed in multiple jobs during the tax year.

- Any applicable tax treaties that may affect the refund process.

Form Submission Methods (Online / Mail / In-Person)

There are various methods for submitting the request for a refund of Social Security tax. Individuals can choose to file online through the IRS website, mail the completed forms to the appropriate IRS address, or, in some cases, submit the forms in person at designated IRS offices. Each method has its own processing times and requirements, so it is important to select the most suitable option for your situation.

Quick guide on how to complete information regarding request for refund of social security tax

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute to conventional printed and signed documents, as you can obtain the proper format and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The most efficient way to modify and eSign [SKS] without hassle

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Construct your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to preserve your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Edit and eSign [SKS] and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Information Regarding Request For Refund Of Social Security Tax

Create this form in 5 minutes!

How to create an eSignature for the information regarding request for refund of social security tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How is US tax refund calculated?

Simple Summary. Every year, your refund is calculated as the amount withheld for federal income tax, minus your total federal income tax for the year. A large portion of the money being withheld from each of your paychecks does not actually go toward federal income tax.

-

How much is tax return in USA?

ing to filing season statistics reported by the IRS, the average tax refund in the 2023 tax season—for tax year 2022—was $2,753. The average direct deposit tax refund was slightly higher than the overall average, at $2,827.

-

What is the average tax refund for Americans?

Average federal tax refund, ranked by state RankStateAverage refund for tax year 202010California$4,03011Illinois$3,94612New Jersey$3,85813Louisiana$3,79246 more rows • Mar 10, 2023

-

What is the tax return in the United States?

Tax returns in the United States are reports filed with the Internal Revenue Service (IRS) or with the state or local tax collection agency (California Franchise Tax Board, for example) containing information used to calculate income tax or other taxes.

-

What is the tax refund in the US?

A tax refund is a reimbursement to taxpayers who have overpaid their taxes, often due to having employers withhold too much from paychecks. The U.S. Treasury estimates that nearly three-fourths of taxpayers are over-withheld, resulting in a tax refund for millions.

Get more for Information Regarding Request For Refund Of Social Security Tax

- Email baseballoperationscooperstowndreamspark form

- Bronze award indd girl scouts of the usa girlscouts form

- Chapter 4 entrants and drivers indycar com form

- Pel 108 cad pel ob 108 form

- Application for donation sponsorship form

- July 17 19 grand cayman marriott beach resort grand cayman cayman islands mtg aaae form

- Recipe submission form for the rochester public market

- Mentoring is a process of transferring skills and gis safety portal form

Find out other Information Regarding Request For Refund Of Social Security Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors