Form 706 NA Rev

What is the Form 706 NA Rev

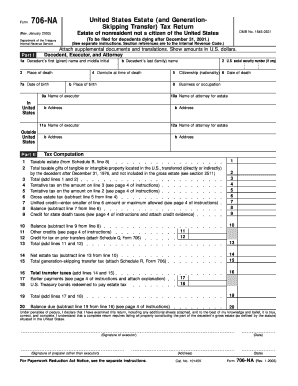

The Form 706 NA Rev is a United States tax form used to report the estate tax for non-resident aliens. This form is essential for calculating the tax owed on the value of an estate that exceeds the applicable exemption limit. It is specifically designed for estates that are not subject to U.S. estate tax laws in the same way as those of U.S. citizens or residents. Understanding this form is crucial for executors and administrators of estates that include U.S. assets or have U.S. beneficiaries.

How to use the Form 706 NA Rev

Using the Form 706 NA Rev involves several steps. First, gather all necessary financial information regarding the deceased's assets, liabilities, and any deductions applicable to the estate. This includes real estate, bank accounts, investments, and any debts owed by the deceased. Next, complete the form by accurately reporting the fair market value of the estate's assets and any deductions. Finally, ensure the form is signed by the executor or administrator before submission to the IRS.

Steps to complete the Form 706 NA Rev

Completing the Form 706 NA Rev requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents and valuations of the estate's assets.

- Fill out the identification section with the decedent's information.

- List all assets, including real estate and personal property, with their fair market values.

- Include any debts and allowable deductions, such as funeral expenses and administrative costs.

- Calculate the total value of the estate and the tax owed, if applicable.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

The filing deadline for the Form 706 NA Rev is typically nine months after the date of death of the decedent. It is important to be aware of this deadline to avoid penalties. If additional time is needed, an extension may be requested, but this must be done before the original due date. Keeping track of these dates is essential for compliance with IRS regulations.

Required Documents

To successfully complete and file the Form 706 NA Rev, certain documents are required. These include:

- Death certificate of the decedent.

- Valuations of all assets, including appraisals for real estate and personal property.

- Documentation of any debts owed by the decedent.

- Records of any prior gifts or transfers that may affect the estate tax calculation.

- Proof of any deductions claimed, such as funeral expenses.

Legal use of the Form 706 NA Rev

The Form 706 NA Rev serves a legal purpose in the estate settlement process. It is required by the IRS to determine the estate tax liability for non-resident aliens. Filing this form accurately ensures compliance with U.S. tax laws and helps avoid potential legal issues or penalties. Executors must understand the legal implications of the information reported on this form, as it can affect the distribution of the estate's assets.

Quick guide on how to complete form 706 na rev

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Handle [SKS] on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 706 NA Rev

Create this form in 5 minutes!

How to create an eSignature for the form 706 na rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who signs 706 if there is no executor?

IRC Section 2203 states: “(t)he term 'executor' … means the executor or administrator of the decedent, or, if there is no executor or administrator appointed, qualified and acting within the United States, then any person in actual or constructive possession of any property of the decedent.”

-

What triggers an estate tax return?

An estate tax return is required if the gross value of the estate is over a certain threshold. For individuals who die in 2025, the threshold is $13.99 million (up from $13.61 million in 2024). Almost anything belonging to the deceased with a tangible cash value is included in the value of the estate.

-

Does IRS require an estate tax return?

A filing is required if the gross estate of the decedent, increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the decedent's death, as shown in the table below.

-

What is form 706 na?

Form 706-NA is used to compute estate and generation-skipping transfer (GST) tax liability for nonresident not a citizen (NRNC) decedents. The estate tax is imposed on the transfer of the decedent's taxable estate rather than on the receipt of any part of it.

-

What assets are not subject to estate tax?

Certain retirement accounts, such as IRAs, 401(k)s, and other qualified plans, often avoid estate tax. These accounts typically pass directly to named beneficiaries, bypassing probate and staying outside your taxable estate.

-

Who must file a 706 tax return?

File Form 706 for the estates of decedents who were either U.S. citizens or U.S. residents at the time of death. For estate tax purposes, a resident is someone who had a domicile in the United States at the time of death.

-

How much can you inherit without paying federal taxes?

In 2024, the first $13,610,000 of an estate is exempt from taxes, up from $12,920,000 in 2023. Estate taxes are based on the size of the estate. It's a progressive tax, just like our federal income tax. That means that the larger the estate, the higher the tax rate it is subject to.

-

What triggers estate tax?

Currently, assets worth $13.61 million or more per individual are subject to federal estate tax. Some states also levy estate taxes. The federal estate tax exemption amount is scheduled to sunset at the end of 2025.

Get more for Form 706 NA Rev

- 30 day notice of termination of lease your lease form

- Marijuana business individual history form

- Creek nation tanf form

- Muscogee creek nation tanf okmulgee form

- Building permit application form

- County contact phone number form

- City of dayton ohio journeyman registration form

- Community portal fcdjfs franklin county ohio form

Find out other Form 706 NA Rev

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast