Seller's Residency CertificationlExemption Instructions Form

What is the Seller's Residency Certification/Exemption Instructions

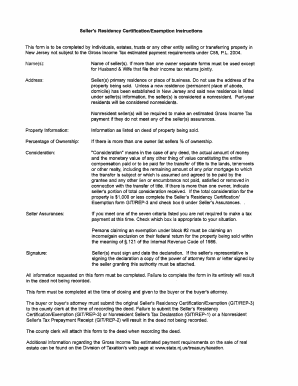

The Seller's Residency Certification/Exemption Instructions are essential documents used in real estate transactions. They help establish the residency status of a seller for tax purposes, particularly when a property is sold. This certification is crucial for determining whether the seller is subject to certain withholding taxes, which can vary based on their residency status. By completing this form, sellers can potentially qualify for exemptions that reduce or eliminate withholding obligations, making the transaction smoother and more financially manageable.

Steps to complete the Seller's Residency Certification/Exemption Instructions

Completing the Seller's Residency Certification/Exemption Instructions involves several key steps:

- Gather necessary information, including the seller's full name, address, and taxpayer identification number.

- Determine the residency status of the seller, which may require reviewing state and federal guidelines.

- Fill out the certification form accurately, ensuring all details are correct and complete.

- Sign and date the form, as required, to validate the information provided.

- Submit the completed form to the appropriate parties involved in the real estate transaction.

Legal use of the Seller's Residency Certification/Exemption Instructions

The legal use of the Seller's Residency Certification/Exemption Instructions is governed by federal and state tax laws. Sellers must ensure that the information provided is truthful and accurate to avoid potential penalties. Misrepresentation or failure to comply with the certification requirements can lead to legal consequences, including fines or additional tax liabilities. It is advisable for sellers to consult with a tax professional or legal advisor to understand their obligations fully.

Required Documents

To complete the Seller's Residency Certification/Exemption Instructions, several documents may be required:

- Proof of identity, such as a driver's license or passport.

- Taxpayer identification number, which may be a Social Security Number (SSN) or Employer Identification Number (EIN).

- Documentation supporting residency status, such as utility bills or lease agreements.

Filing Deadlines / Important Dates

Filing deadlines for the Seller's Residency Certification/Exemption Instructions can vary based on the transaction and local regulations. Generally, it is advisable to complete the certification before the closing date of the real estate transaction. Sellers should consult with their real estate agent or tax advisor to ensure they meet all relevant deadlines and avoid any issues that could arise from late submissions.

Eligibility Criteria

Eligibility for using the Seller's Residency Certification/Exemption Instructions typically includes:

- The seller must be an individual or entity selling real estate.

- The seller must provide accurate information regarding their residency status.

- Compliance with state and federal tax regulations is required to qualify for any exemptions.

Quick guide on how to complete sellers residency certificationlexemption instructions

Effortlessly prepare [SKS] on any device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the right format and securely save it on the internet. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest method to modify and eSign [SKS] with minimal effort

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Seller's Residency CertificationlExemption Instructions

Create this form in 5 minutes!

How to create an eSignature for the sellers residency certificationlexemption instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is considered residency in NJ?

A Resident of New Jersey is an individual that is domiciled in New Jersey for the tax year or an individual that maintains a permanent home in New Jersey and spends more than 183 days in the state. A Nonresident of New Jersey is an individual that was not domiciled in New Jersey.

-

What is a seller's residency certification exemption in NJ for?

Seller's Residency Certification/Exemption Instructions Individuals, estates, trusts, or any other entity selling or transferring property in New Jersey must complete this form if they are not subject to the Gross Income Tax estimated payment requirements under N.J.S.A.

-

What is the non-resident seller tax in NJ?

Tax Withholding Requirements: Nonresidents are required to withhold income tax at the higher of two options: either 10.75% of the reportable gain or 2% of the total consideration. Reporting to the Division of Taxation: Various GIT/REP forms are available to report sales to the Division of Taxation.

-

What is a git rep?

The GIT/REP form is a Gross Income Tax form that is required to be recorded with a deed when selling/transferring real property in New Jersey.

-

What is the personal exemption in New Jersey?

Each taxpayer shall be allowed a personal exemption of $1,000.00 which may be taken as a deduction from his New Jersey gross income. (b) Additional exemptions.

-

What is NJ seller's residency certification exemption?

Seller's Residency Certification/Exemption Instructions Individuals, estates, trusts, or any other entity selling or transferring property in New Jersey must complete this form if they are not subject to the Gross Income Tax estimated payment requirements under N.J.S.A.

Get more for Seller's Residency CertificationlExemption Instructions

- Indian head massage consultation form 324271079

- Application form for registration of orchid hybrid royal horticultural

- Prior authorization chart dental insuranceprior authorization chart dental insuranceprior authorization and pre claim review form

- C o b c a r e s maxine mcclean scholarship awards programme application form

- The peace corps welcomes you to tanzania peace corps welcome book for volunteers going to tanzania peace corps peacecorps form

- Illness accident expatinsurance form

- Ielts test report authorization form british council

- Alexa nr 10 de modifier si insecure an alexei nr form

Find out other Seller's Residency CertificationlExemption Instructions

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast