New York State Department of Taxation and Finance Nonresident or Part Year Resident Spouse S Certi Form

What is the New York State Department Of Taxation And Finance Nonresident Or Part Year Resident Spouse S Certi

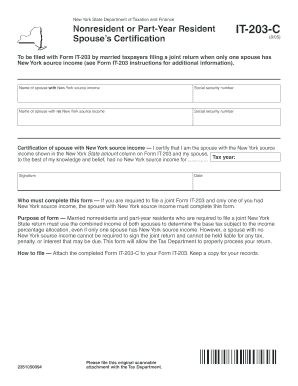

The New York State Department Of Taxation And Finance Nonresident Or Part Year Resident Spouse S Certi is a tax form used by nonresident or part-year resident spouses to claim certain tax benefits. This form is essential for individuals who are not full-time residents of New York but have a spouse who is. It allows for the appropriate allocation of income and tax credits, ensuring compliance with state tax regulations.

How to use the New York State Department Of Taxation And Finance Nonresident Or Part Year Resident Spouse S Certi

To use the New York State Department Of Taxation And Finance Nonresident Or Part Year Resident Spouse S Certi, individuals must first determine their residency status. Once confirmed, they should complete the form accurately, providing necessary information about both spouses' income and residency periods. This form is typically submitted alongside the New York State tax return to ensure proper processing of tax obligations.

Steps to complete the New York State Department Of Taxation And Finance Nonresident Or Part Year Resident Spouse S Certi

Completing the New York State Department Of Taxation And Finance Nonresident Or Part Year Resident Spouse S Certi involves several steps:

- Gather necessary documents, including income statements for both spouses.

- Determine the residency status for both individuals.

- Fill out the form with accurate income details and residency periods.

- Review the completed form for accuracy.

- Submit the form along with the state tax return by the designated deadline.

Key elements of the New York State Department Of Taxation And Finance Nonresident Or Part Year Resident Spouse S Certi

Key elements of this form include sections for reporting income earned by both spouses, the residency period for each spouse, and any applicable tax credits. It is crucial to provide accurate information to avoid delays in processing and potential penalties. The form also includes instructions for calculating the tax owed based on the combined income of both spouses.

Eligibility Criteria

Eligibility for using the New York State Department Of Taxation And Finance Nonresident Or Part Year Resident Spouse S Certi includes being a nonresident or part-year resident of New York while having a spouse who is a resident. Additionally, both spouses must have income that is subject to New York State tax laws. It is important to review specific criteria to ensure compliance before filing.

Form Submission Methods

The New York State Department Of Taxation And Finance Nonresident Or Part Year Resident Spouse S Certi can be submitted through various methods. Taxpayers can file online through the state’s tax portal, mail the completed form along with their tax return, or deliver it in person at designated tax offices. Each method has specific guidelines and deadlines that should be followed to ensure timely processing.

Quick guide on how to complete new york state department of taxation and finance nonresident or part year resident spouse s certi

Effortlessly prepare [SKS] on any device

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] across any platform with airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The simplest way to modify and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to New York State Department Of Taxation And Finance Nonresident Or Part Year Resident Spouse S Certi

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation and finance nonresident or part year resident spouse s certi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 11 month rule for NYS residency?

Generally, you maintain a permanent place of abode for substantially all of the tax year if you maintain it for more than eleven months during the year.

-

What is the difference between a nonresident and a part-year resident in New York State?

A Nonresident of New York is an individual that was not domiciled nor maintained a permanent place of abode in New York during the tax year. A Part-Year Resident is an individual that meets the definition of resident or nonresident for only part of the year.

-

What is the tax form for part-year resident in New York City?

Used by nonresident and part-year resident (Form IT-203) filers who need to report other New York State or New York City taxes, and tax credits other than those reported directly on Form IT-203. Attached to Form IT-203. The instructions for this form are found in Form IT-203-I.

-

What is New York Source income Part-Year resident?

If you are a part-year resident, your New York source income is the sum of: all income reported on your federal return for your New York State resident period; plus. your New York source income for your nonresident period.

-

Who must file a NY nonresident return?

ing to Form IT-203-I, you must file a New York part-year or nonresident return if: You have any income from a New York source and your New York AGI exceeds your New York State standard deduction.

-

What is the 11 month rule for NYS residency?

Generally, you maintain a permanent place of abode for substantially all of the tax year if you maintain it for more than eleven months during the year.

-

What is the NY state tax form for non-residents?

Form IT-203, Nonresident and Part-Year Resident Income Tax Return. Your browser will need to support JavaScript to use this site completely. Site functionality and usability will be disrupted. Additionally, videos, data, site search and notifications will be disabled or function poorly.

-

How do I know if I am resident or nonresident?

If you are not a U.S. citizen, you are considered a nonresident of the United States for U.S. tax purposes unless you meet one of two tests. You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year (January 1 – December 31).

Get more for New York State Department Of Taxation And Finance Nonresident Or Part Year Resident Spouse S Certi

- Changes in pharmacy law california state board of pharmacy form

- Assessement form for mental retardation

- Iowa pharmacist licensure by form

- Pharmacist intern registration application iowa board of form

- Tattoo establishment application form iowa department of public idph state ia

- Arizona state board of pharmacy protects the health form

- Alabama birth certificate application pdf form

- How do i file a medical malpractice claimalllaw form

Find out other New York State Department Of Taxation And Finance Nonresident Or Part Year Resident Spouse S Certi

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter