Underpayment of Estimated Maryland Income Tax by Individuals Form

What is the Underpayment Of Estimated Maryland Income Tax By Individuals

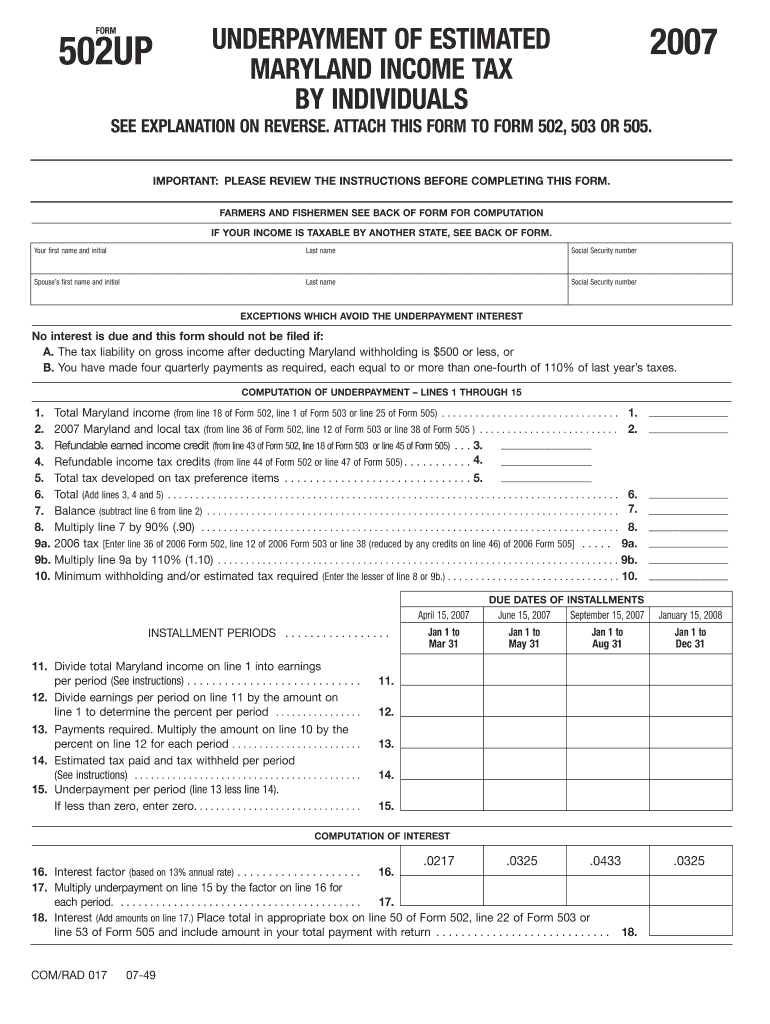

The Underpayment of Estimated Maryland Income Tax by Individuals refers to a situation where taxpayers do not pay enough tax throughout the year, resulting in a tax liability that exceeds a certain threshold. Maryland residents are required to make estimated tax payments if they expect to owe more than a specific amount when filing their annual tax return. This form helps individuals calculate the amount of underpayment and determine any penalties that may apply.

Steps to complete the Underpayment Of Estimated Maryland Income Tax By Individuals

Completing the Underpayment of Estimated Maryland Income Tax form involves several steps:

- Gather your income information, including wages, self-employment income, and any other earnings.

- Calculate your expected tax liability for the year based on your income and applicable deductions.

- Determine if your estimated payments meet Maryland’s requirements, which generally state that you must pay at least 90% of your current year’s tax or 100% of your previous year’s tax.

- Fill out the form accurately, ensuring all calculations are correct.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Underpayment Of Estimated Maryland Income Tax By Individuals

This form is legally required for individuals who do not meet their tax obligations through withholding or other means. It serves as a means for the state to assess any penalties for underpayment. Proper completion and submission of this form ensure compliance with Maryland tax laws, helping taxpayers avoid additional fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Underpayment of Estimated Maryland Income Tax typically align with the state’s tax calendar. Generally, estimated payments are due on the 15th of April, June, September, and January of the following year. It is crucial to adhere to these deadlines to avoid penalties for late payment.

Penalties for Non-Compliance

Failure to comply with the estimated tax payment requirements can result in significant penalties. Maryland imposes interest on underpayments, which accumulates until the tax is paid in full. Additionally, there may be a penalty assessed for failing to file the form on time, which can increase the overall tax liability.

Examples of using the Underpayment Of Estimated Maryland Income Tax By Individuals

Examples of scenarios where individuals might need to use this form include:

- A self-employed individual who expects to owe taxes at the end of the year due to fluctuating income.

- A retiree receiving pension income that is not subject to withholding.

- An employee with multiple jobs or additional income sources that do not have adequate tax withholding.

Who Issues the Form

The Underpayment of Estimated Maryland Income Tax form is issued by the Maryland State Comptroller's Office. This office is responsible for tax administration and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the Comptroller's website or through authorized tax preparation services.

Quick guide on how to complete underpayment of estimated maryland income tax by individuals

Complete [SKS] seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly and without hold-ups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign [SKS] effortlessly

- Locate [SKS] and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Underpayment Of Estimated Maryland Income Tax By Individuals

Create this form in 5 minutes!

How to create an eSignature for the underpayment of estimated maryland income tax by individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 2210 underpayment of estimated tax by individuals?

Purpose of Form Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish and include the penalty on your return.

-

Does Maryland require estimated tax payments?

Maryland follows the IRS standards for estimated payments. If you will owe $500 or more in tax for the current year, you are required to make 90% of the tax due, over quarterly payments.

-

How do I know if I need to pay estimated taxes?

Answer: Generally, you must make estimated tax payments for the current tax year if both of the following apply: You expect to owe at least $1,000 in tax for the current tax year after subtracting your withholding and refundable credits.

-

What is the Maryland underpayment penalty?

Penalty charges for late payments can be up to 25 percent of the amount of tax you owe. If you do not settle your account promptly after you receive an assessment notice, legal action will begin which may include filing a property lien or attaching your bank accounts and salary.

-

Can you get in trouble for not paying estimated taxes?

If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax.

-

Do I have to pay Maryland estimated taxes?

Estimated Payments If your employer does withhold Maryland taxes from your pay, you may still be required to make quarterly estimated income tax payments if you develop a tax liability that exceeds the amount withheld by your employer by more than $500.

-

What is underpayment of estimated tax by individuals?

The Underpayment of Estimated Tax by Individuals Penalty applies to individuals, estates and trust that don't pay enough estimated tax on their income or you pay it late. There are two ways to pay tax: Withholding from your pay, your pension or certain government payments, such as Social Security.

-

Can I choose not to pay estimated taxes?

If you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings. To do this, file a new Form W-4 with your employer. There is a special line on Form W-4 for you to enter the additional amount you want your employer to withhold.

Get more for Underpayment Of Estimated Maryland Income Tax By Individuals

- Fiddler on the roof jr script pdf form

- The merancas education assistance loangrant program atlantatech form

- Concordia university wisconsin special education form

- Letter of recommendation fordham university bnet fordham form

- Progress report form allan hancock college hancockcollege

- Lsu appeal form

- Student accessibility resource center sarc emotional support animal esa request form

- Get graduate chapter reactivation form alpha kappa

Find out other Underpayment Of Estimated Maryland Income Tax By Individuals

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT