740 NP R *0900020007* 42A740 NP R Department of Revenue Last Name Your First Name and Middle Initial Mailing Address Number and Form

Understanding the 740 NP R Form

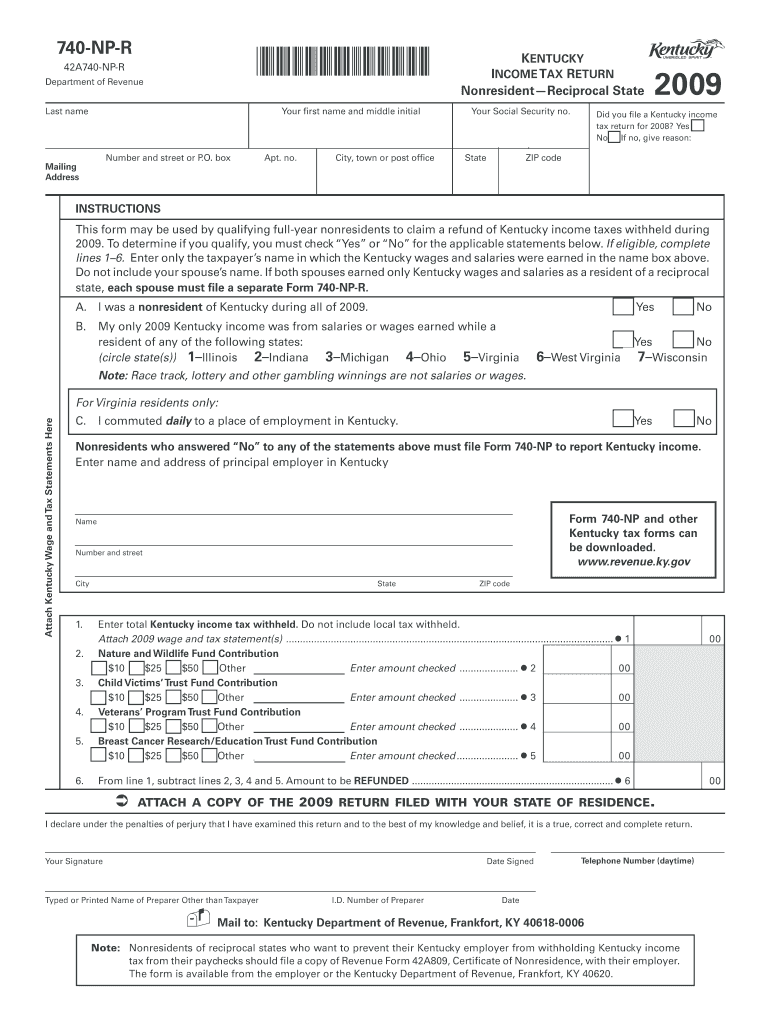

The 740 NP R form, officially known as the Kentucky Individual Income Tax Return Non-Resident, is used by individuals who earn income in Kentucky but do not reside there. This form is essential for reporting income earned within the state and ensuring compliance with Kentucky tax regulations. It requires specific personal information, including your last name, first name, middle initial, and mailing address, which can be a street address or a P.O. Box. Understanding the purpose and requirements of this form is crucial for non-residents to accurately report their income and avoid penalties.

Steps to Complete the 740 NP R Form

Completing the 740 NP R form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2s and other income statements related to your earnings in Kentucky. Next, fill in your personal information accurately, including your last name, first name, middle initial, and mailing address. Then, report your total income earned in Kentucky and calculate any deductions or credits applicable to your situation. Finally, review the form for any errors before submitting it to the Kentucky Department of Revenue.

Legal Use of the 740 NP R Form

The 740 NP R form is legally required for non-residents who earn income in Kentucky. Failing to file this form can result in penalties, including fines and interest on unpaid taxes. It is important to understand the legal obligations associated with this form to ensure compliance with state tax laws. Non-residents should be aware of their rights and responsibilities when it comes to filing and paying taxes in Kentucky, as this can affect their financial standing and legal status.

Required Documents for the 740 NP R Form

When preparing to complete the 740 NP R form, certain documents are necessary to provide accurate information. These typically include:

- W-2 forms from employers reporting income earned in Kentucky

- 1099 forms for any additional income sources

- Documentation of any deductions or credits you intend to claim

- Identification information such as Social Security number

Having these documents ready will streamline the process of completing the form and ensure that all income is reported correctly.

Filing Deadlines for the 740 NP R Form

Filing deadlines for the 740 NP R form are crucial to avoid late fees and penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year for which you are filing. If April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes in deadlines or regulations that may affect your filing.

Form Submission Methods for the 740 NP R

The 740 NP R form can be submitted through various methods, ensuring flexibility for taxpayers. You can file the form online through the Kentucky Department of Revenue's e-filing system, which is often the fastest option. Alternatively, you may choose to mail a paper copy of the form to the appropriate address provided by the Department of Revenue. In-person submissions may also be possible at designated tax offices, although this option may vary by location.

Quick guide on how to complete 740 np r 0900020007 42a740 np r department of revenue last name your first name and middle initial mailing address number and

Complete [SKS] effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, enabling you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without hindrances. Handle [SKS] on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select how you would like to distribute your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 740 NP R *0900020007* 42A740 NP R Department Of Revenue Last Name Your First Name And Middle Initial Mailing Address Number And

Create this form in 5 minutes!

How to create an eSignature for the 740 np r 0900020007 42a740 np r department of revenue last name your first name and middle initial mailing address number and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the R value in Kentucky?

Unless the attic ceiling (underside of the roof) and walls are insulated, where supply ducts run through attic space, Kentucky's energy code requires that they be insulated to a minimum of R-8. All other ducts outside the building thermal envelope shall be insulated to a minimum of R-6.

-

What is a 740 NP-R for Kentucky?

Taxpayers who qualify for this exemption and have no other Kentucky taxable income should file Form 740-NP-R, Kentucky Income Tax Return, Nonresident–Reciprocal State, to obtain a refund.

-

Do I have to file a Kentucky nonresident tax return?

Individual Income Tax is due on all income earned by Kentucky residents and all income earned by nonresidents from Kentucky sources. Kentucky's individual income tax law is based on the Internal Revenue Code in effect as of December 31, 2022.

-

Where do I mail my Kentucky tax return?

If you live in Kentucky... and you are filing a Form...and you are not enclosing a payment, then use this address...and you are enclosing a payment, then use this address... 4868 Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0045 Internal Revenue Service P.O. Box 931300 Louisville, KY 40293-13005 more rows • Aug 19, 2024

-

Where do I find my Form 740 in Kentucky?

The instructions for Form 740-ES include a worksheet for calculating the amount of estimated tax due and for making installment payments. These forms may be obtained from the Kentucky Department of Revenue, P. O. Box 518, Frankfort, KY 40602-0518, or any Kentucky Taxpayer Service Center, or by calling (502) 564- 3658.

-

What is my Kentucky withholding account number?

You can find your Withholding Tax ID on notices received from the Kentucky Department of Revenue. If you cannot locate this document or account number, please call the Kentucky Department of Revenue at (502)-564-7287 to request it.

-

Why would I get a letter from Kentucky Department of Revenue?

You may receive telephone calls about the debt/return you owe. In addition to the Notice of Tax Due sent, the department will send several letters to you about the debt/return owed.

-

What is the pension exclusion for 2024 in Kentucky?

Bill Summary. Amend KRS 141.019, relating to the individual income tax, to increase the retirement distribution exclusion from $31,110 to $41,110 for taxable years beginning on or after January 1, 2024.

Get more for 740 NP R *0900020007* 42A740 NP R Department Of Revenue Last Name Your First Name And Middle Initial Mailing Address Number And

Find out other 740 NP R *0900020007* 42A740 NP R Department Of Revenue Last Name Your First Name And Middle Initial Mailing Address Number And

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship