Form C 8000, Single Business Tax Annual State of Michigan Michigan

What is the Form C 8000, Single Business Tax Annual State Of Michigan

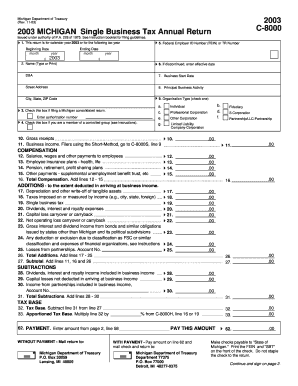

The Form C 8000 is a crucial document for businesses operating in Michigan, specifically designed for the Single Business Tax Annual. This form is utilized by various business entities, including corporations, partnerships, and limited liability companies, to report their business tax obligations to the state. The Single Business Tax is assessed based on a business's gross receipts, and filing this form ensures compliance with state tax regulations.

How to use the Form C 8000, Single Business Tax Annual State Of Michigan

Using the Form C 8000 involves accurately reporting your business's financial information for the tax year. Businesses must gather relevant financial data, including gross receipts, allowable deductions, and tax credits. Once the necessary information is compiled, the form can be filled out either digitally or on paper. After completing the form, it should be submitted to the Michigan Department of Treasury by the specified deadline to avoid penalties.

Steps to complete the Form C 8000, Single Business Tax Annual State Of Michigan

Completing the Form C 8000 requires several key steps:

- Gather financial records, including income statements and expense reports.

- Calculate total gross receipts for the tax year.

- Identify and document any deductions or tax credits applicable to your business.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for accuracy before submission.

- Submit the completed form to the Michigan Department of Treasury by the deadline.

Legal use of the Form C 8000, Single Business Tax Annual State Of Michigan

The legal use of the Form C 8000 is essential for maintaining compliance with Michigan tax laws. Filing this form is mandatory for businesses subject to the Single Business Tax, and failure to do so can result in penalties, interest, and potential legal action. It is important for businesses to understand their obligations under state law and ensure timely and accurate submissions to avoid complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form C 8000 are critical for businesses to adhere to in order to avoid penalties. Typically, the form must be filed by the last day of the fourth month following the close of the business's fiscal year. For businesses operating on a calendar year, this means the deadline is April 30. It is advisable to mark these dates on your calendar and prepare your documentation in advance to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The Form C 8000 can be submitted through various methods to accommodate different preferences. Businesses may choose to file online through the Michigan Department of Treasury's e-filing system, which offers a convenient and efficient way to submit forms. Alternatively, the form can be mailed to the appropriate address provided by the state or submitted in person at designated locations. Each method has its own advantages, and businesses should select the one that best suits their needs.

Quick guide on how to complete form c 8000 single business tax annual state of michigan michigan

Complete [SKS] effortlessly on any device

Web-based document management has become widely embraced by companies and individuals alike. It offers a superior eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form C 8000, Single Business Tax Annual State Of Michigan Michigan

Create this form in 5 minutes!

How to create an eSignature for the form c 8000 single business tax annual state of michigan michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Single Business Tax Act?

In 1975, the Michigan legislature approved Public Act 228, radically changing the state's business tax environment. Titled the Single Business Tax (SBT) Act, Public Act 228 replaced profit-based taxation with value-added taxation.

-

What businesses are tax exempt in Michigan?

Common Exemptions 501(c)(3) and 501(c)(4) Organizations. 501(c)(3) and 501(c)(4) organizations must provide proof that they are exempt under these codes by the Internal Revenue Service. ... Churches. Sales to organized churches or houses of religious worship are exempt from sales tax. ... Government. ... Hospitals. ... Schools.

-

How much can a small business make before paying taxes in Michigan?

Your business is required to pay CIT if you have more than $350,000 in gross receipts for the fiscal year and/or more than $100 in annual tax liability. Michigan requires CIT-qualifying businesses to file a quarterly return using Form 4913 or the MTO portal.

-

Who has to pay the Michigan business tax?

Michigan corporate income tax Michigan imposes a corporate income tax (CIT) on corporations and Limited Liability Companies (LLCs) that elect C corp status. Pass-through entities, including S corporations, partnerships, and sole proprietorships, don't have to pay the CIT.

-

What is the tax rate for C corporations in Michigan?

Michigan Corporate Income Tax (CIT) The CIT imposes a 6% corporate income tax on C corporations and taxpayers taxed as corporations federally.

-

Do I have to pay Michigan business tax?

As a business owner in Michigan, you may end up paying corporate income taxes, flow-through entity taxes, sales and use taxes, withholding taxes, or unemployment insurance taxes. The type of taxes you pay depends on your business entity and gross income.

-

What is the annual LLC tax in Michigan?

LLCs taxed as C-corp Additionally, LLCs filing as C-corps are more attractive to investors. In Michigan, filing as a C-corp will mean that your LLC must pay federal corporate income tax at 21% and state corporate income tax at 6%.

Get more for Form C 8000, Single Business Tax Annual State Of Michigan Michigan

- Residency form 12250239

- Required student immunization form

- Murray state university academic probation appeal form

- Marist college office of the registrar change or declaration of form

- Concordia university lesson plan long form stude

- How to pay human subjects participan ts using gift cards form

- Bcounselingb services informed consent form hilo hawaii

- Key receipt key return designee form department

Find out other Form C 8000, Single Business Tax Annual State Of Michigan Michigan

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement