504NR Please Print Using Blue or Black Ink Only FORM MARYLAND FIDUCIARY NONRESIDENT INCOME TAX CALCULATION or FISCAL YEAR BEGINN

Understanding the 504NR Form

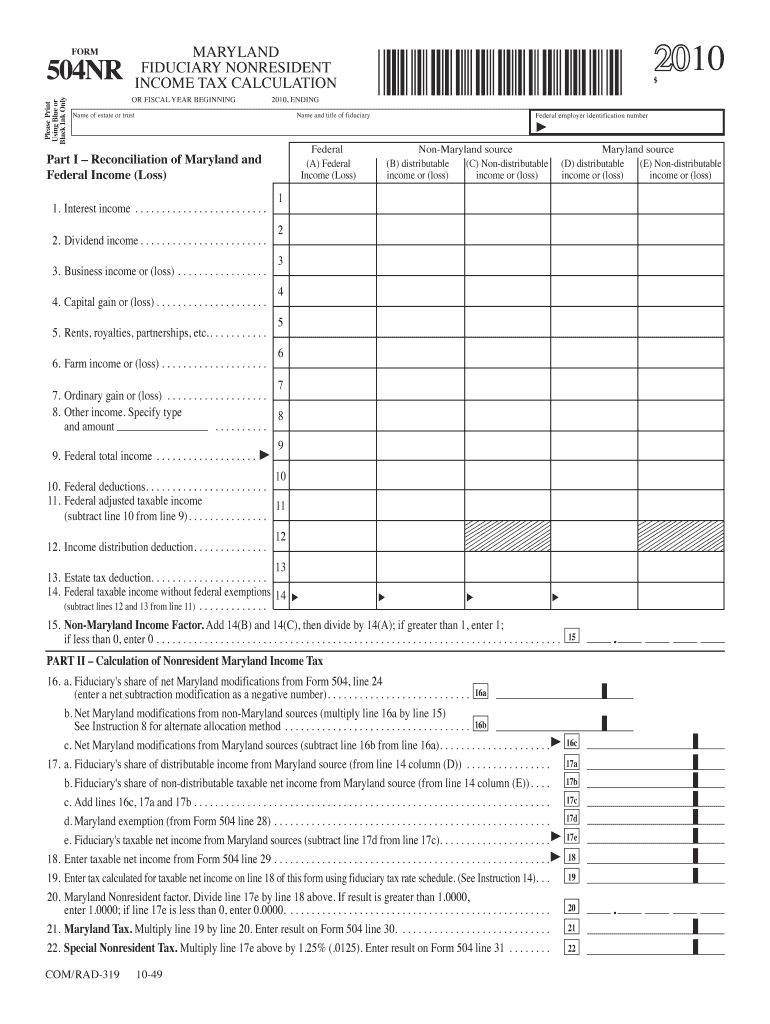

The 504NR form, officially known as the Maryland Fiduciary Nonresident Income Tax Calculation, is essential for estates or trusts that are nonresidents of Maryland. This form is specifically designed to calculate the Maryland income tax owed by these entities. It requires careful completion to ensure compliance with state tax laws. The form must be filled out using blue or black ink only, as specified in the instructions, to maintain clarity and legibility. Understanding the purpose of this form is crucial for fiduciaries managing estates or trusts that generate income in Maryland.

Steps to Complete the 504NR Form

Completing the 504NR form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the estate or trust's income. Next, fill in the name of the estate or trust at the top of the form. Follow the instructions to report income, deductions, and credits accurately. Each section of the form corresponds to specific types of income and deductions applicable to nonresidents. After completing the form, review it for any errors before submission. This careful approach helps avoid delays or penalties from the state.

Obtaining the 504NR Form

The 504NR form can be obtained through the Maryland Comptroller's website or directly from local tax offices. It is important to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations. Additionally, many tax preparation software programs may include this form, allowing for easier digital completion. If you prefer a physical copy, visiting a local tax office can provide you with the necessary paperwork.

Legal Use of the 504NR Form

The 504NR form serves a legal purpose in the context of Maryland tax law. It is required for nonresident estates or trusts that earn income from Maryland sources. Filing this form is a legal obligation, and failure to do so can lead to penalties or interest on unpaid taxes. Understanding the legal implications of the form ensures that fiduciaries fulfill their responsibilities while managing the estate or trust's tax obligations.

Key Elements of the 504NR Form

Several key elements are crucial when filling out the 504NR form. These include the identification of the estate or trust, the reporting of income from Maryland sources, and the calculation of any applicable deductions. Additionally, the form requires the fiduciary's signature, affirming the accuracy of the information provided. Each section must be completed with attention to detail to ensure compliance and avoid potential issues with the Maryland tax authorities.

Filing Deadlines for the 504NR Form

Timely submission of the 504NR form is critical to avoid penalties. The filing deadline typically aligns with the federal tax deadline, which is usually April fifteenth for most taxpayers. However, if the estate or trust operates on a fiscal year basis, the deadline may differ. It is essential to be aware of these dates and plan accordingly to ensure that the form is filed on time, thereby avoiding any unnecessary penalties or interest charges.

Quick guide on how to complete 504nr please print using blue or black ink only form maryland fiduciary nonresident income tax calculation or fiscal year

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, edit, and eSign your paperwork swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Edit and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your updates.

- Choose how to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or errors that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any preferred device. Edit and eSign [SKS] to ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 504NR Please Print Using Blue Or Black Ink Only FORM MARYLAND FIDUCIARY NONRESIDENT INCOME TAX CALCULATION OR FISCAL YEAR BEGINN

Create this form in 5 minutes!

How to create an eSignature for the 504nr please print using blue or black ink only form maryland fiduciary nonresident income tax calculation or fiscal year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Do I need to file a Maryland nonresident tax return?

Form 505 and You will need to file a nonresident income tax return to Maryland, using Form 505NR if you have income derived from: tangible property, real or personal, permanently located in Maryland; a business, trade, profession or occupation carried on in Maryland; or, gambling winnings derived from Maryland sources.

-

What is the form for non resident income tax in Maryland?

If you are a nonresident, file Form 505 and Form 505NR. If you are a nonresident and need to amend your return, file Form 505X. If you are a nonresident employed in Maryland but living in a jurisdiction that levies a local income or earnings tax on Maryland residents, file Form 515.

-

What does fiduciary income tax return mean?

Fiduciary income tax is a tax imposed on the income earned by certain types of legal entities, such as trusts and estates, while they hold and manage assets on behalf of beneficiaries.

-

Who must file a 1041 tax return?

Decedent's Estate The fiduciary (or one of the joint fiduciaries) must file Form 1041 for a domestic estate that has: 1. Gross income for the tax year of $600 or more; 2. A beneficiary who is a nonresident alien; or 3.

-

Who must file a California fiduciary income tax return?

The fiduciary (or one of the fiduciaries) must file Form 541 for a trust if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $100. An alternative minimum tax liability.

-

What is Maryland Form 504?

The MD 504 tax form is used by residents of Maryland who want to claim a tax credit for taxes paid to another state. Therefore, individuals who have paid taxes to another state and want to claim a credit on their Maryland tax return are required to file MD 504.

-

What is a fiduciary income tax return?

Fiduciary income tax is a tax imposed on the income earned by certain types of legal entities, such as trusts and estates, while they hold and manage assets on behalf of beneficiaries.

-

What is a fiduciary income tax return it 205?

If you are the fiduciary of a New York State resident estate or trust, you must file Form IT-205 if the estate or trust: is required to file a federal income tax return for the tax year; had any New York taxable income for the tax year; or. is subject to a separate tax on lump-sum distributions.

Get more for 504NR Please Print Using Blue Or Black Ink Only FORM MARYLAND FIDUCIARY NONRESIDENT INCOME TAX CALCULATION OR FISCAL YEAR BEGINN

- Valerie myers colleges arent all about academics erie pa form

- Non directory form

- Current students winona state university form

- I wish to declare a form

- Classactivity form

- Special events food service application form

- Student life travel liability waiverstudent life travel liability waiver form

- Lutgert college of business application for 5 year msaampampt form

Find out other 504NR Please Print Using Blue Or Black Ink Only FORM MARYLAND FIDUCIARY NONRESIDENT INCOME TAX CALCULATION OR FISCAL YEAR BEGINN

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy