We, the Underwriters, Will Pay the Sum Assured Mentioned in the Certificate to the Person or Persons to Form

Understanding the We, The Underwriters, Will Pay The Sum Assured Mentioned In The Certificate To The Person Or Persons To

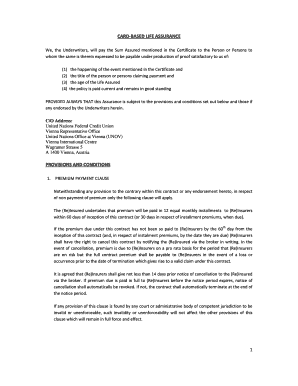

This form serves as a formal declaration from the underwriters, outlining their commitment to pay a specified sum assured to designated individuals. It is commonly used in insurance policies and financial agreements to ensure that beneficiaries receive the agreed-upon amount in the event of a claim. This document provides clarity on who is entitled to the funds and under what circumstances the payment will be made.

Steps to Complete the We, The Underwriters, Will Pay The Sum Assured Mentioned In The Certificate To The Person Or Persons To

Completing this form involves several key steps:

- Identify the correct certificate that outlines the sum assured and the beneficiaries.

- Fill in the necessary details, including the names of the person or persons entitled to receive the payment.

- Ensure that all information is accurate and matches the details provided in the insurance policy or agreement.

- Review the completed form for any errors or omissions before submission.

Legal Use of the We, The Underwriters, Will Pay The Sum Assured Mentioned In The Certificate To The Person Or Persons To

This form has legal significance as it establishes the contractual obligation of the underwriters to pay the specified sum. It is essential for beneficiaries to understand their rights under this agreement. The form must comply with applicable state laws and regulations to ensure its enforceability. Proper execution of this form can prevent disputes regarding payment and clarify the responsibilities of all parties involved.

Key Elements of the We, The Underwriters, Will Pay The Sum Assured Mentioned In The Certificate To The Person Or Persons To

Several key elements are crucial for this form:

- The name of the underwriters, which identifies the entity responsible for the payment.

- The specific sum assured, which indicates the amount to be paid upon a valid claim.

- The names and details of the beneficiaries, ensuring that the correct individuals receive the funds.

- The conditions under which the payment will be made, providing clarity on any requirements or limitations.

How to Obtain the We, The Underwriters, Will Pay The Sum Assured Mentioned In The Certificate To The Person Or Persons To

This form can typically be obtained through the issuing insurance company or financial institution. It may be included as part of the policy documentation or available upon request. It is advisable to contact customer service or your insurance agent to ensure you have the correct and most up-to-date version of the form.

Examples of Using the We, The Underwriters, Will Pay The Sum Assured Mentioned In The Certificate To The Person Or Persons To

Common scenarios for using this form include:

- Life insurance policies where the sum assured is paid to beneficiaries upon the policyholder's death.

- Accidental death and dismemberment insurance, which pays a specified amount in case of severe injuries or death.

- Health insurance claims where a lump sum is paid for critical illnesses as outlined in the policy.

Quick guide on how to complete we the underwriters will pay the sum assured mentioned in the certificate to the person or persons to

Finish [SKS] effortlessly on any gadget

Online document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to amend and eSign [SKS] with ease

- Find [SKS] and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to We, The Underwriters, Will Pay The Sum Assured Mentioned In The Certificate To The Person Or Persons To

Create this form in 5 minutes!

How to create an eSignature for the we the underwriters will pay the sum assured mentioned in the certificate to the person or persons to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the two ways life insurance is paid out to beneficiaries?

Depending on the insurer, a life insurance payout can typically be distributed in three ways: in the form of a lump sum, via a life insurance annuity, or through a retained asset account.

-

How long does it take for life insurance to pay a beneficiary?

How long does it take for beneficiaries to receive life insurance money? Life insurers typically take 14 to 60 days to pay out the death benefit after the beneficiary files the claim. This is because they must verify the policy terms and policyholder's death certificate and confirm who the beneficiaries are.

-

How is life insurance paid out to beneficiaries?

Depending on the insurer, a life insurance payout can typically be distributed in three ways: in the form of a lump sum, via a life insurance annuity, or through a retained asset account. Check with the insurer to see which life insurance payout options they offer.

-

What is the average life insurance payout after death?

The average life insurance payout in the U.S. is about $168,000, ing to Aflac. However, the payout of your life insurance policy will depend on the face amount (death benefit) you choose and any money accelerated, borrowed against or withdrawn from the policy prior to the payout.

-

Where is additional insured on an insurance certificate?

With an attached endorsement, a certificate of insurance lists additional insured entities in the Certificate Holder section of the document. Checking this section will quickly tell you who is covered by the policy if you see a check next to ADDL INSR on the document.

-

Does life insurance send you a check?

At this point, your work is most likely done. You'll simply wait until the insurance company sends you the payout via check or direct deposit. That can take anywhere from a few days to several weeks. The insurer or your financial professional can give you an idea of when to expect the life insurance pay out.

-

What is the meaning of paid up sum assured?

Description: Paid-up policy falls into the category of traditional insurance plans. The sum assured is limited to the paid-up value. It is calculated as the ratio of number of premiums paid to the total number of premiums that were supposed to be paid ing to the policy multiplied by the sum assured at maturity.

-

What does sum assured mean in insurance?

What is the meaning of sum assured? A sum assured is a fixed amount that is paid to the nominee of the plan in the unfortunate event of the policyholder's demise. The insurance company pays this money as per the sum chosen by you at the time of purchasing the policy.

Get more for We, The Underwriters, Will Pay The Sum Assured Mentioned In The Certificate To The Person Or Persons To

- Satisfactory academic progress appeals application for form

- Student grievance form

- Sexual misconduct complaint form

- Application for admission nutrition ampampamp dietetic technician form

- 2019 2020 dependent verification worksheet dv1 form

- Resistant profile form submitter client information sample

- 2016 2017 standard verification worksheet delta college delta form

- Uil waiver form

Find out other We, The Underwriters, Will Pay The Sum Assured Mentioned In The Certificate To The Person Or Persons To

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later