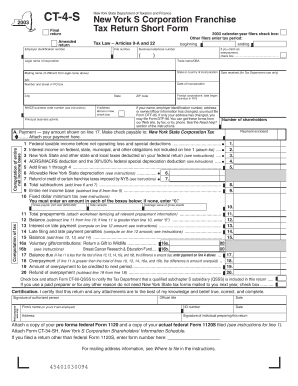

Tax Law Articles 9 a Tax Ny Form

Understanding Tax Law Articles 9 A Tax Ny

Tax Law Articles 9 A Tax Ny refers to specific provisions within New York State tax law that govern various tax obligations and compliance requirements for individuals and businesses. These articles provide detailed guidelines on how taxes are assessed, collected, and enforced within the state. They cover a range of topics, including income tax, sales tax, and property tax, ensuring that taxpayers understand their responsibilities and the legal framework surrounding taxation in New York.

How to Utilize Tax Law Articles 9 A Tax Ny

Utilizing Tax Law Articles 9 A Tax Ny involves understanding the specific tax obligations that apply to your situation. Taxpayers should review the articles relevant to their income type, business structure, or property ownership. Familiarizing oneself with these laws can help in accurate tax filing and compliance. Additionally, consulting with a tax professional may provide personalized guidance based on individual circumstances.

Steps to Complete Tax Law Articles 9 A Tax Ny

Completing the requirements under Tax Law Articles 9 A Tax Ny typically involves several steps:

- Identify the specific tax obligations applicable to your situation.

- Gather necessary documentation, such as income statements and receipts.

- Complete the relevant tax forms accurately, ensuring all information is correct.

- Submit the forms by the designated deadlines, either electronically or via mail.

- Retain copies of submitted forms and supporting documents for your records.

Key Elements of Tax Law Articles 9 A Tax Ny

Key elements of Tax Law Articles 9 A Tax Ny include definitions of taxable income, rates for various taxes, exemptions, and deductions available to taxpayers. It also outlines the procedures for tax assessments, appeals, and penalties for non-compliance. Understanding these elements is crucial for effective tax planning and ensuring compliance with state laws.

Filing Deadlines and Important Dates

Filing deadlines for Tax Law Articles 9 A Tax Ny vary depending on the type of tax being filed. Generally, individual income tax returns are due on April fifteenth, while corporate taxes may have different deadlines based on the fiscal year. It is essential to stay informed about these dates to avoid penalties and ensure timely compliance.

Required Documents for Tax Law Articles 9 A Tax Ny

To comply with Tax Law Articles 9 A Tax Ny, taxpayers must prepare various documents, including:

- W-2 forms for wage earners.

- 1099 forms for independent contractors.

- Receipts for deductible expenses.

- Records of any tax credits claimed.

- Previous tax returns for reference.

Penalties for Non-Compliance with Tax Law Articles 9 A Tax Ny

Non-compliance with Tax Law Articles 9 A Tax Ny can lead to significant penalties, including fines, interest on unpaid taxes, and potential legal action. The severity of penalties often depends on the nature of the non-compliance, whether it was intentional, and the amount of tax owed. Understanding these consequences is vital for maintaining compliance and avoiding financial repercussions.

Quick guide on how to complete tax law articles 9 a tax ny

Complete [SKS] effortlessly on any gadget

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Law Articles 9 A Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the tax law articles 9 a tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who is exempt from NY state income tax?

Exemption from New York State and New York City withholding You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and. You do not expect to have a New York income tax liability for this year.

-

Who is exempt from property taxes in NY?

The City of New York offers tax break down known as exemptions to seniors, veterans, clergy members, people with disabilities, and others. Please visit the Property Tax Benefits page for the most up-to-date information about property tax exemptions.

-

What is the NY estate tax law?

As of 2024, the New York State estate tax threshold is $6.94 million. This means estates valued below this threshold are not subject to estate tax. However, estates exceeding this threshold are taxed on a graduated scale, with rates ranging from 3.06% to 16% for the portion of the estate exceeding the threshold.

-

Do LLCs pay franchise tax in NY?

Tax responsibilities An LLC or LLP treated as a corporation for federal income tax purposes may be required to file a New York State corporation franchise tax return. An LLC or LLP may be required to pay a filing fee and/or estimated income tax on behalf of certain partners or members.

-

How do I avoid estate tax in NY?

A donor will need to survive for at least three years from the date of a gift to ensure that the value of a gift avoids New York estate tax upon their death. Note that there is a Federal gift tax on transfers during lifetime.

-

How much is $100,000 a year taxed in NY?

If you make $100,000 a year living in the region of New York, USA, you will be taxed $28,124. That means that your net pay will be $71,876 per year, or $5,990 per month. Your average tax rate is 28.1% and your marginal tax rate is 38.1%.

-

What is the Article 9a tax in NY?

Article 9-A—Franchise tax on general business corporations. Information on this page relates to a tax year that began on or after January 1, 2023, and before January 1, 2024. You must file and pay the franchise tax on general business corporations if: you are a domestic corporation (incorporated in New York State); or.

-

What is the 14 day rule in New York tax?

NY state has a threshold of 14days. An employer is required to withhold taxes on all NY state wages paid after the 14th day.

Get more for Tax Law Articles 9 A Tax Ny

- Undergraduate internship application ed sc form

- Market center website administration tool kw support form

- Division of consumer affairs state real estate appraiser board njconsumeraffairs form

- Court reporters board of california application for licensure for courtreportersboard ca form

- Application for police officer recruit philadelphia form

- Rnr prv band recruitment info sheet form

- Rnr az band recruitment info sheet form

- Web 2 0 for urban designers and planners dspace mit dspace mit form

Find out other Tax Law Articles 9 A Tax Ny

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed