Instructions for Current Owners Instructions for New Owners Nbc Nol Form

Understanding the Instructions for Current Owners and New Owners NBC NOL

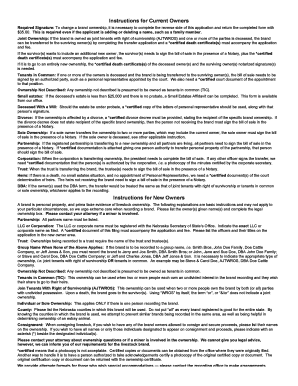

The Instructions for Current Owners and New Owners NBC NOL provide essential guidance for individuals managing or acquiring properties subject to specific regulations. This form is particularly relevant for property owners in the United States who need to understand their responsibilities and the necessary steps for compliance. It outlines the legal framework governing property ownership and includes information on how to navigate ownership transitions smoothly.

Steps to Complete the Instructions for Current Owners and New Owners NBC NOL

Completing the Instructions for Current Owners and New Owners NBC NOL involves several key steps:

- Review the form carefully to understand the requirements for both current and new owners.

- Gather all necessary documentation, including proof of ownership and any relevant legal agreements.

- Fill out the form accurately, ensuring all information is complete and up to date.

- Submit the completed form according to the specified submission methods, which may include online options or mailing instructions.

Legal Use of the Instructions for Current Owners and New Owners NBC NOL

The legal use of the Instructions for Current Owners and New Owners NBC NOL is crucial for ensuring compliance with property ownership laws. This form serves as an official record of ownership and outlines the rights and obligations of both current and new owners. Proper use of this form can help prevent legal disputes and ensure that all parties are aware of their responsibilities under the law.

Required Documents for the Instructions for Current Owners and New Owners NBC NOL

To successfully complete the Instructions for Current Owners and New Owners NBC NOL, several documents are typically required:

- Proof of identity for both current and new owners, such as a driver's license or passport.

- Documentation proving ownership, like a deed or title.

- Any previous agreements or contracts related to the property.

- Additional forms that may be specified in the instructions.

Form Submission Methods for the Instructions for Current Owners and New Owners NBC NOL

Submitting the Instructions for Current Owners and New Owners NBC NOL can be done through various methods, depending on the guidelines provided:

- Online submission through designated government portals, if available.

- Mailing the completed form to the appropriate office as indicated in the instructions.

- In-person submission at local offices, where applicable.

Eligibility Criteria for the Instructions for Current Owners and New Owners NBC NOL

Eligibility to use the Instructions for Current Owners and New Owners NBC NOL typically includes:

- Current property owners seeking to transfer ownership.

- New owners who have acquired property and need to formalize their ownership.

- Individuals who meet any specific state or local requirements outlined in the instructions.

Quick guide on how to complete instructions for current owners instructions for new owners nbc nol

Effortlessly Set Up [SKS] on Any Device

Digital document management has gained increased popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

How to Alter and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a classic ink signature.

- Review all the information and click on the Done button to save your edits.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Alter and electronically sign [SKS] to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Current Owners Instructions For New Owners Nbc Nol

Create this form in 5 minutes!

How to create an eSignature for the instructions for current owners instructions for new owners nbc nol

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Is there an 80% limitation on Nols?

How It Works. The rules state that the amount of the NOL is limited to 80% of the excess of taxable income without respect to any § 199A (QBI), § 250 (GILTI), or the NOL. For example: In this example, tax is paid on $20,000 of income even though there was an NOL carryover more than the current year's income.

-

What are the NOL rules for 2024?

For pass-through businesses, TCJA prohibits NOLs above $305,000 for individuals and $610,000 for joint filers in 2024, with those thresholds adjusted for inflation annually. The passive business loss limitation from before TCJA still applies. TCJA made the limits on C corporations permanent.

-

Are NOLs transferrable?

However, NOLs are not freely transferable. The Code places limits on the extent to which a Loss Corporation may utilize an NOL following a change in ownership. While these limitations can be signNow, importantly, there are exceptions for restructuring transactions completed through a bankruptcy proceeding.

-

What are the NOL limitations for 2024?

Among the provisions of the trailer legislation are a suspension of the net operating loss (“NOL”) deduction for tax years 2024–2026 for individual and corporate taxpayers with net business income or modified adjusted gross income of $1 million or more, and a limit of $5 million of business credits on the aggregate use ...

-

What happens to NOLs in an acquisition?

Treatment of NOLs in M&A Transactions Any remaining NOLs of the target do not survive the transaction and are lost. Therefore, when the target has substantial NOLs, the deal is often structured to achieve a step-up in the acquired net assets.

-

Is the California NOL suspended in 2024?

As part of its overall enactment of the state budget, California enacted the revenue trailer bill for the 2024-25 budget, S.B. 167, on June 27, 2024. This legislation suspends the use of net operating losses (NOLs) and limits the use of business credits to $5 million for the 2024-2026 tax years.

-

What are the new rules for NOL?

Two companion tax bills that recently passed in California suspend the ability of most taxpayers to claim a net operating loss (NOL) deduction in 2024 through 2026 and place a $5 million limitation on the aggregate amount of most income tax credits that can be claimed in 2024 through 2026.

-

How to carryforward a net operating loss?

Net Operating Loss (NOL) Carryforward Example The full loss from the first year can be carried forward on the balance sheet to the second year as a deferred tax asset. The loss, limited to 80% of income in the second year, can then be used in the second year as an expense on the income statement.

Get more for Instructions For Current Owners Instructions For New Owners Nbc Nol

- Delaware non resident individual income tax return form

- 712 ms ms8453 taxpayer last name spouse last name mailing address number ampamp dor ms form

- For faster submission and processing form

- Schoolofteachereducationamp concernampformamp unco

- Request for reimbursement request for reimbursement form

- Employment application form 688265199

- Medical information and liability release form thi

- Attn account services dept form

Find out other Instructions For Current Owners Instructions For New Owners Nbc Nol

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF