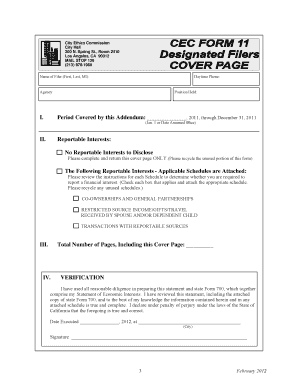

CEC Form 11

What is the CEC Form 11

The CEC Form 11 is a document used in the United States for specific regulatory or compliance purposes. It is essential for individuals or businesses to understand its function and implications. This form typically relates to the collection of information that may be required by various governmental agencies, ensuring compliance with state or federal regulations.

How to use the CEC Form 11

Using the CEC Form 11 involves several steps to ensure accurate completion and submission. First, gather all necessary information and documents that pertain to the specific requirements of the form. Carefully read the instructions provided with the form to understand what information is required. Complete the form accurately, ensuring that all sections are filled out correctly. Once completed, review the form for any errors before submission.

Steps to complete the CEC Form 11

Completing the CEC Form 11 requires a systematic approach:

- Collect necessary personal or business information.

- Review the instructions accompanying the form.

- Fill out the form, ensuring clarity and accuracy.

- Double-check all entries for correctness.

- Submit the form according to the specified submission methods.

Legal use of the CEC Form 11

The CEC Form 11 must be used in accordance with applicable laws and regulations. It is crucial to ensure that the information provided is truthful and complete, as inaccuracies can lead to legal penalties or compliance issues. Understanding the legal context of the form helps users navigate its requirements effectively.

Required Documents

When filling out the CEC Form 11, certain documents may be required to support the information provided. These documents can include identification, proof of residency, or other relevant records. It is important to verify the specific document requirements as they may vary based on the purpose of the form.

Form Submission Methods

The CEC Form 11 can typically be submitted through various methods, including online submission, mail, or in-person delivery. Each method has its own guidelines and timelines, so users should choose the method that best suits their needs while ensuring compliance with any deadlines.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the CEC Form 11 can result in significant penalties. These may include fines, legal action, or other consequences depending on the nature of the non-compliance. It is essential for users to understand these risks to ensure timely and accurate submission of the form.

Quick guide on how to complete cec form 11

Complete [SKS] seamlessly on any gadget

Digital document management has become increasingly prevalent among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any gadget with airSlate SignNow Android or iOS applications and simplify any document-centric task today.

The simplest method to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Modify and eSign [SKS] and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CEC Form 11

Create this form in 5 minutes!

How to create an eSignature for the cec form 11

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the filing of form 11?

Form 11 is due on 30th May of each year. All LLPs registered under Limited Liability Act, 2008 have to annually file two forms – Form 11 and Form 8. Annual Return: Form 11 is to be submitted within 60 days of closure of the financial year i.e 30th May of each year. (Financial year closes on 31st March.)

-

What is form 1120 PC used for?

Purpose of Form Use Form 1120-PC to report the income, gains, losses, deductions, and credits, and to figure the income tax liability of insurance companies, other than life insurance companies.

-

Is it mandatory to file form 11?

Form 11 is an Annual Return for LLP to be filed before May 30th every year and must be filed irrespective of whether the LLP has started its business or not. Learn more on Form 11, how its different between small LLPs and regular LLPs, fees, late fees, and certification requirement.

-

Who should file form 11?

A Form 11 (or an Income Tax return in Ireland) is a self-assessment tax return for self-employed individuals or individuals with additional income, such as rental or investment income. The form provides information on an individual's income, expenses, and tax credits.

-

What is IRS form 11 C?

Purpose of form. Form 11-C is used to register certain information with the IRS and to pay the occupational tax on wagering. You must pay the occupational tax if you accept taxable wagers for yourself or another person. There are two amounts of occupational tax ($50 or $500).

-

What is form 1120 used for and when must it be filed?

A corporation that is a component member of a controlled group must use Schedule O (Form 1120) to report the apportionment of taxable income, income tax, and certain tax benefits between all component members of the group.

-

What is form 11 C used for?

The IRS Form 11-C is used to register certain information with the Internal Revenue Service (IRS) and is used in order to pay the occupational tax on wagering.

-

What is a W 11 form?

Purpose of Form. Use Form W-11 to confirm that an employee is a qualified employee under the HIRE Act. You can use another similar statement if it contains the information above and the employee signs it under penalties of perjury.

Get more for CEC Form 11

- Online application process step by step bosch form

- A nigerian roman catholicsomething uwem akpan form

- Memphis i timespress form

- Motion to oppose proposed drastic reductions to nc soro nc soronc form

- Former account closure form advantiscu

- Motion to modify a court order 75 notice this form has butlercountyohio

- How to find out what postal code is associated with your credit form

- Microsoft word tc105 form

Find out other CEC Form 11

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple