Signature of Paid Preparer Revenue Delaware Form

What is the Signature of Paid Preparer Revenue Delaware

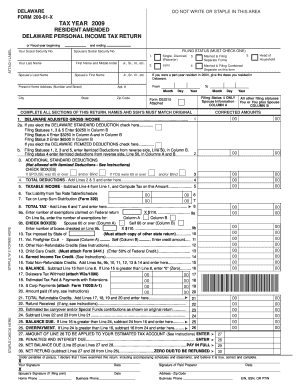

The Signature of Paid Preparer Revenue Delaware is a crucial component of tax filing in the state. This signature indicates that a paid preparer has completed the tax return on behalf of a taxpayer. It serves as a formal acknowledgment that the preparer has reviewed the information provided and affirms its accuracy to the best of their knowledge. This signature is necessary for various tax forms, ensuring compliance with state regulations and facilitating the processing of returns by the Delaware Division of Revenue.

Steps to Complete the Signature of Paid Preparer Revenue Delaware

Completing the Signature of Paid Preparer Revenue Delaware involves several key steps. First, the paid preparer must gather all necessary information from the taxpayer, including income details, deductions, and credits. After preparing the tax return, the preparer should review the document for accuracy. Once confirmed, the preparer must sign the form in the designated area, including their name, signature, date, and preparer identification number. It is essential to ensure that all information is correct to avoid potential penalties or delays in processing.

Legal Use of the Signature of Paid Preparer Revenue Delaware

The legal use of the Signature of Paid Preparer Revenue Delaware is governed by state tax laws. This signature not only legitimizes the tax return but also holds the preparer accountable for the accuracy of the information submitted. In cases of discrepancies or audits, the signature may serve as evidence that the preparer has verified the data. Therefore, it is imperative for preparers to maintain ethical standards and ensure compliance with all relevant tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Signature of Paid Preparer Revenue Delaware align with the overall tax filing schedule set by the state. Typically, individual tax returns are due by April fifteenth, while extensions may be requested. It is important for preparers to be aware of these dates to ensure timely submission. Missing the deadline can result in penalties for both the taxpayer and the preparer, emphasizing the need for careful planning and adherence to the schedule.

Required Documents

To complete the Signature of Paid Preparer Revenue Delaware, several documents are typically required. These may include the taxpayer's previous year tax return, W-2 forms from employers, 1099 forms for additional income, and any relevant documentation for deductions or credits. Having these documents on hand ensures that the preparer can accurately fill out the tax return and provide the necessary information for their signature.

Examples of Using the Signature of Paid Preparer Revenue Delaware

Examples of using the Signature of Paid Preparer Revenue Delaware include various tax scenarios. For instance, a self-employed individual may engage a paid preparer to file their tax return, requiring the preparer's signature to validate the submission. Similarly, businesses filing corporate tax returns will also need the signature of their paid preparer. These examples illustrate the importance of the signature in ensuring compliance and accuracy across different tax situations.

Quick guide on how to complete signature of paid preparer revenue delaware

Prepare [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to initiate the process.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your adjustments.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and electronically sign [SKS] while ensuring exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Signature Of Paid Preparer Revenue Delaware

Create this form in 5 minutes!

How to create an eSignature for the signature of paid preparer revenue delaware

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a paid preparer signature?

It is the Department of Revenue's policy to accept a paid preparer's signature on a return as authorization to discuss certain matters relating to that return, such as assessment and adjustment notices, information contained or missing on the return, and information about a refund or payment.

-

Can you deduct gambling losses in Delaware?

You can write off gambling losses as a miscellaneous itemized deduction. While miscellaneous deductions subject to the 2% of adjusted gross income floor are not allowed for 2018 through 2025 under the TCJA, the deduction for gambling losses isn't subject to that floor. So gambling losses are still deductible.

-

Can you write off money lost gambling?

If you itemize your deductions, you can deduct your gambling losses (up to your gambling income amount). For example, if you report $5,000 in gambling income on your W-2G, you can deduct up to $5,000 of your gambling losses.

-

What is the 179 deduction in Delaware?

179 expensing, combined with bonus and regular depreciation, cannot exceed $18,000. For SUVs between 6,000 and 14,000 pounds, expensing is limited to $25,000 — but this is a moot point through 2022 because 100% bonus depreciation generally can be taken for such vehicles.

-

What income is not taxed in Delaware?

Social Security and Railroad benefits ARE NOT taxable in Delaware and SHOULD NOT be included in your Delaware taxable income.

-

How are lottery winnings taxed in Delaware?

For any prize of more than $5,000, the Lottery withholds 24% of your winnings for Federal tax. All winning Delaware Lottery tickets are subject to Delaware Income Tax. However, if you are not a Delaware resident, your state may tax your winnings.

-

How does Delaware make money without sales tax?

Unlike most other states in the United States, Delaware does not have a statewide sales tax. This tax structure has made Delaware a popular shopping destination because consumers may purchase most goods and services tax-free. Delaware relies on other revenue streams, such as corporation taxes and fees.

-

Do I have to file a Delaware income tax return?

You must file a tax return if you have any gross income from sources in Delaware during the tax year. If your spouse files a married filing separate return and you had no Delaware source income, you do NOT need to file a Delaware return.

Get more for Signature Of Paid Preparer Revenue Delaware

- Cava membership form vocationscava org

- Sponsor form sussex lions club sussexlions

- Click here for a printable order form if rockbridge historical society rockhist

- Western illinois economic development authority application wieda wieda form

- Disposition of tenants39 personal property form

- 3509 motion to vacate order form

- Watervliet housing authority 24oo 2nd avenue watervliethousing form

- 3 request to vacate form claremont graduate university cgu

Find out other Signature Of Paid Preparer Revenue Delaware

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document