Explanation of the Form 1042 S Uwservice Wisc

What is the Explanation Of The Form 1042 S Uwservice Wisc

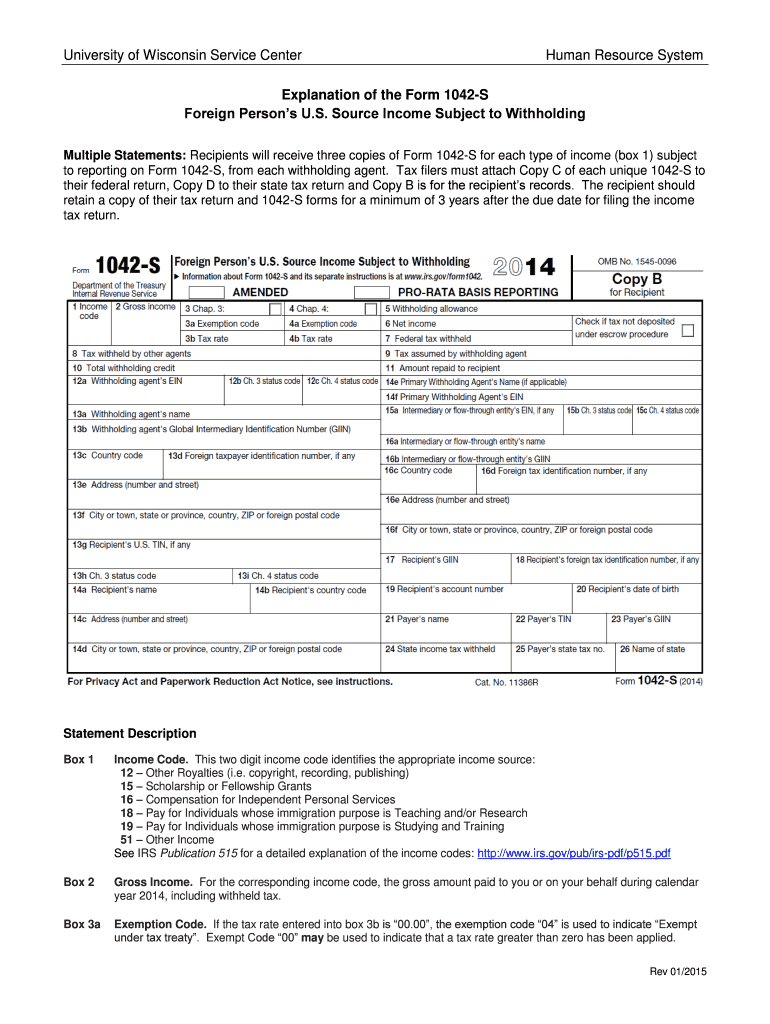

The Form 1042-S is a tax document used to report income paid to foreign persons, including non-resident aliens and foreign entities. It is essential for compliance with U.S. tax laws, particularly for payments subject to withholding tax. The "Uwservice Wisc" aspect refers to specific services provided by the University of Wisconsin, which may involve payments to foreign individuals or entities. Understanding this form is crucial for both payers and recipients to ensure proper tax reporting and withholding.

Steps to complete the Explanation Of The Form 1042 S Uwservice Wisc

Completing the Form 1042-S involves several key steps:

- Gather necessary information about the recipient, including their name, address, and taxpayer identification number.

- Determine the type of income being reported and the applicable withholding tax rate.

- Fill out the form accurately, ensuring all fields are completed, including income codes and amounts.

- Review the form for accuracy before submission to avoid penalties or compliance issues.

- Submit the form to the IRS and provide a copy to the recipient by the required deadlines.

Key elements of the Explanation Of The Form 1042 S Uwservice Wisc

Several key elements are critical when dealing with the Form 1042-S:

- Recipient Information: Accurate details about the foreign individual or entity receiving payment.

- Income Type: Specific codes that categorize the type of income being reported.

- Withholding Tax Rate: The percentage of tax withheld from the payment, which may vary based on tax treaties.

- Payment Amount: The total amount of income paid to the recipient during the tax year.

- Filing Requirements: Deadlines and procedures for submitting the form to the IRS and providing copies to recipients.

Legal use of the Explanation Of The Form 1042 S Uwservice Wisc

The legal use of the Form 1042-S is mandated by the Internal Revenue Service (IRS) for reporting payments made to foreign persons. This form ensures compliance with U.S. tax laws and helps prevent tax evasion. Payers are required to issue this form to report any income subject to withholding tax, which includes various types of payments, such as dividends, interest, and royalties. Failure to use the form correctly can result in penalties and legal repercussions.

Filing Deadlines / Important Dates

Timely filing of the Form 1042-S is crucial to avoid penalties. The following deadlines are important:

- Filing with IRS: The form must be filed by March 15 of the year following the payment.

- Recipient Copy: A copy of the Form 1042-S must be provided to the recipient by the same deadline, March 15.

Who Issues the Form

The Form 1042-S is typically issued by U.S. withholding agents, which can include businesses, universities, and other organizations that make payments to foreign persons. These entities are responsible for ensuring that the form is completed accurately and submitted to the IRS in compliance with federal tax regulations. Proper issuance helps maintain transparency and adherence to tax obligations.

Quick guide on how to complete explanation of the form 1042 s uwservice wisc

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the required form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight signNow sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information carefully and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether through email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS], ensuring exceptional communication at every step of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Explanation Of The Form 1042 S Uwservice Wisc

Create this form in 5 minutes!

How to create an eSignature for the explanation of the form 1042 s uwservice wisc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Explanation Of The Form 1042 S Uwservice Wisc?

The Explanation Of The Form 1042 S Uwservice Wisc provides detailed information about the withholding tax on income paid to foreign persons. This form is essential for compliance with U.S. tax regulations and helps ensure that the correct amount of tax is withheld. Understanding this form is crucial for businesses dealing with international clients.

-

How can airSlate SignNow assist with the Explanation Of The Form 1042 S Uwservice Wisc?

airSlate SignNow simplifies the process of managing the Explanation Of The Form 1042 S Uwservice Wisc by allowing users to easily send, sign, and store documents electronically. Our platform ensures that all necessary forms are completed accurately and securely, reducing the risk of errors. This streamlines compliance and enhances efficiency for businesses.

-

What are the pricing options for using airSlate SignNow for the Explanation Of The Form 1042 S Uwservice Wisc?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for small businesses and larger enterprises. Each plan provides access to features that facilitate the management of documents like the Explanation Of The Form 1042 S Uwservice Wisc. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Explanation Of The Form 1042 S Uwservice Wisc?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities, all of which are beneficial for handling the Explanation Of The Form 1042 S Uwservice Wisc. These tools help ensure that your documents are processed efficiently and in compliance with tax regulations. Additionally, you can track the status of your documents in real-time.

-

Are there any integrations available with airSlate SignNow for the Explanation Of The Form 1042 S Uwservice Wisc?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your ability to manage the Explanation Of The Form 1042 S Uwservice Wisc. These integrations allow for easy data transfer and document management across different systems, improving overall workflow efficiency. You can connect with popular tools like CRM systems and cloud storage services.

-

What benefits does airSlate SignNow provide for businesses dealing with the Explanation Of The Form 1042 S Uwservice Wisc?

Using airSlate SignNow for the Explanation Of The Form 1042 S Uwservice Wisc offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform helps businesses save time and resources by automating document processes. Additionally, the secure eSigning feature ensures that your documents are protected and compliant with legal standards.

-

How does airSlate SignNow ensure compliance when handling the Explanation Of The Form 1042 S Uwservice Wisc?

airSlate SignNow is designed with compliance in mind, particularly for documents like the Explanation Of The Form 1042 S Uwservice Wisc. Our platform adheres to industry standards and regulations, ensuring that all signed documents are legally binding. We also provide audit trails and secure storage to help businesses maintain compliance with tax laws.

Get more for Explanation Of The Form 1042 S Uwservice Wisc

- No interest loan osfa mass form

- Applying is easy form

- South texas community college form

- P f patricia anderson um personal world wide web server www personal umich form

- Dan join u s district court district of connecticut onevisionfcu form

- Dependent fee waiver transfer cal state l a form

- Member social security number exception request form

- Professional entertainer or athlete payment form university of fa ufl

Find out other Explanation Of The Form 1042 S Uwservice Wisc

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template