Vra Fha Form

Understanding the VRA FHA

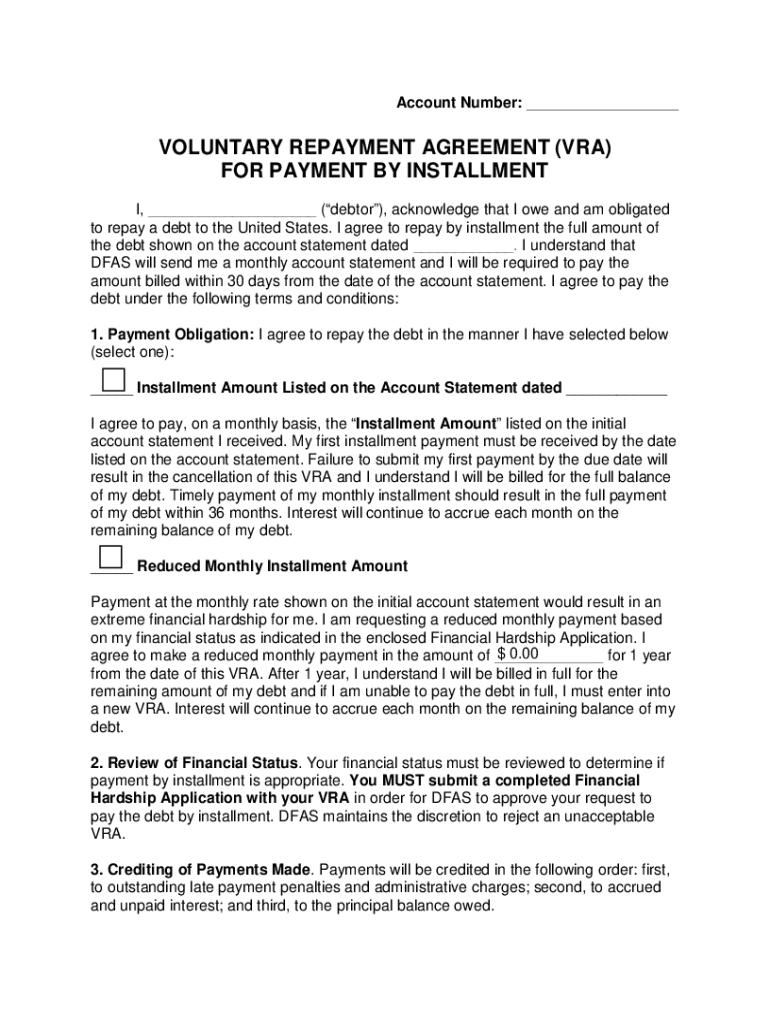

The Voluntary Repayment Agreement (VRA) under the Federal Housing Administration (FHA) is a crucial document for individuals facing financial hardship. It allows borrowers to manage their repayment obligations in a structured manner. This form is particularly beneficial for those who have fallen behind on payments and need a formalized plan to address their debts while maintaining compliance with FHA guidelines.

Steps to Complete the VRA FHA

Completing the VRA FHA involves several key steps to ensure accuracy and compliance. Start by gathering necessary financial documents, including income statements and any relevant correspondence regarding your debts. Next, fill out the VRA form with detailed information about your financial situation, including your income, expenses, and the amount owed. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form through the designated method, whether online, by mail, or in person, depending on the guidelines provided by the issuing authority.

Eligibility Criteria for the VRA FHA

To qualify for the VRA FHA, borrowers must meet specific eligibility criteria. Generally, this includes demonstrating a legitimate financial hardship, such as job loss, medical expenses, or other unforeseen circumstances that affect your ability to make regular payments. Additionally, borrowers must be current on their mortgage or have a plan in place to address any arrears. It is essential to provide accurate and complete information to facilitate the review process.

Required Documents for the VRA FHA

When applying for the VRA FHA, certain documents are required to support your application. These typically include:

- Proof of income, such as pay stubs or tax returns

- Documentation of any financial hardship, like medical bills or termination letters

- A completed VRA form with all relevant details

- Any correspondence from your lender regarding your account status

Having these documents ready will streamline the application process and enhance your chances of approval.

Legal Use of the VRA FHA

The VRA FHA is legally binding once it is signed by both parties involved. This means that the terms outlined in the agreement must be adhered to by the borrower and the lender. Compliance with the VRA is essential to avoid further penalties or legal actions. Understanding the legal implications of this agreement can help borrowers navigate their repayment options while ensuring they remain within the bounds of the law.

Form Submission Methods

Submitting the VRA FHA form can be done through various methods, depending on the guidelines set forth by the FHA or your lender. Common submission methods include:

- Online submission through the lender's portal

- Mailing the completed form to the designated address

- In-person submission at a local office

Choosing the appropriate submission method can impact the processing time and ensure that your application is received promptly.

Quick guide on how to complete vra fha application dfas home dfas

Complete Vra Fha effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documentation, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any setbacks. Handle Vra Fha on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Vra Fha with ease

- Obtain Vra Fha and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Decide how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Vra Fha and guarantee excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How many application forms does a person need to fill out in his/her lifetime?

As many as you want to !

-

How do I write qualification details in order to fill out the AIIMS application form if a student is appearing in 12th standard?

There must be provision in the form for those who are taking 12 th board exam this year , so go through the form properly before filling it .

Create this form in 5 minutes!

How to create an eSignature for the vra fha application dfas home dfas

How to create an electronic signature for the Vra Fha Application Dfas Home Dfas in the online mode

How to create an eSignature for the Vra Fha Application Dfas Home Dfas in Chrome

How to create an electronic signature for putting it on the Vra Fha Application Dfas Home Dfas in Gmail

How to create an eSignature for the Vra Fha Application Dfas Home Dfas right from your smartphone

How to create an eSignature for the Vra Fha Application Dfas Home Dfas on iOS devices

How to make an electronic signature for the Vra Fha Application Dfas Home Dfas on Android OS

People also ask

-

What is a VRA form and how can airSlate SignNow help with it?

A VRA form, or Volunteer Release Agreement, is a vital document for managing volunteer participation. airSlate SignNow enables you to quickly create, send, and eSign VRA forms, ensuring a smooth and efficient process for your organization.

-

How does airSlate SignNow handle the security of VRA forms?

AirSlate SignNow prioritizes the security of your VRA forms by employing advanced encryption methods and secure cloud storage. This ensures that all your sensitive information remains protected throughout the signing process.

-

Can I customize my VRA forms using airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your VRA forms with logos, colors, and specific fields tailored to your organization. This feature helps maintain brand consistency while meeting the unique needs of your volunteers.

-

What are the pricing options for using airSlate SignNow for VRA forms?

AirSlate SignNow offers flexible pricing plans to accommodate various business sizes and needs. You can choose from a range of options to ensure you have the right tools for managing VRA forms efficiently without breaking your budget.

-

Is it easy to integrate airSlate SignNow with other software for VRA forms?

Absolutely! AirSlate SignNow offers seamless integrations with popular software like Google Drive, Salesforce, and more. This makes it easy to manage your VRA forms alongside other vital business tools.

-

What are the benefits of using airSlate SignNow for VRA forms?

Using airSlate SignNow for VRA forms offers numerous benefits including fast turnaround times, legal compliance, and improved volunteer engagement. This streamlined approach enhances the overall experience for both your organization and its volunteers.

-

Can I track the status of my VRA forms in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your VRA forms. You can easily see who has signed and when, alongside reminders for anyone who has not completed their signature.

Get more for Vra Fha

- Landlord rent increase 497431669 form

- West virginia tenant form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase west virginia form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant west virginia form

- West virginia tenant 497431673 form

- West virginia notice 497431674 form

- Temporary lease agreement to prospective buyer of residence prior to closing west virginia form

- Wv eviction 497431676 form

Find out other Vra Fha

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP