Form 3582 EFile

What is the Form 3582 EFile

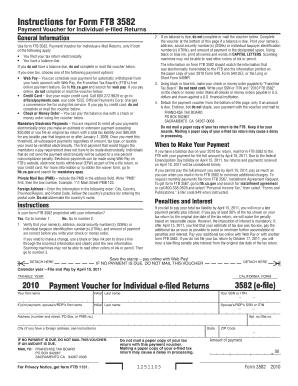

The Form 3582 EFile is a specific tax form used in the United States for electronic filing with the Internal Revenue Service (IRS). This form is primarily utilized by taxpayers to report certain financial information, ensuring compliance with federal tax regulations. The electronic filing option facilitates a streamlined submission process, reducing the need for paper forms and promoting efficiency in tax reporting.

How to use the Form 3582 EFile

Using the Form 3582 EFile involves several straightforward steps. First, taxpayers must gather all necessary financial information relevant to the form. This includes income details, deductions, and any applicable credits. Next, users can access the form through authorized e-filing software or platforms that support IRS submissions. After entering the required data, the form must be reviewed for accuracy before submission. Once confirmed, the form can be electronically filed with the IRS, providing immediate confirmation of receipt.

Steps to complete the Form 3582 EFile

Completing the Form 3582 EFile requires careful attention to detail. Follow these steps:

- Gather all necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Access the Form 3582 EFile through a compatible e-filing software.

- Input your personal information, including name, address, and Social Security number.

- Enter your income details and any deductions or credits you wish to claim.

- Review the form for any errors or omissions.

- Submit the form electronically to the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3582 EFile are crucial for compliance. Typically, individual tax returns must be filed by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file the form. It is essential to stay informed about these dates to avoid penalties.

Required Documents

To successfully complete the Form 3582 EFile, several documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical bills or charitable contributions.

- Any relevant tax credit documentation.

Having these documents organized and ready will facilitate a smoother filing process.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 3582 EFile. Taxpayers must adhere to these guidelines to ensure compliance and avoid potential issues. Key points include ensuring that all information is accurate, using the correct version of the form, and submitting it through authorized e-filing channels. Familiarizing oneself with these guidelines can help mitigate errors and streamline the filing process.

Quick guide on how to complete form 3582 efile

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among organizations and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents quickly without delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS apps and streamline any document-centric process today.

How to Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 3582 EFile

Create this form in 5 minutes!

How to create an eSignature for the form 3582 efile

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3582 EFile?

Form 3582 EFile is a digital form used for electronic filing of specific documents. It streamlines the submission process, making it easier for businesses to manage their paperwork efficiently. With airSlate SignNow, you can complete and eSign Form 3582 EFile quickly and securely.

-

How does airSlate SignNow facilitate Form 3582 EFile?

airSlate SignNow provides a user-friendly platform that allows you to fill out and eSign Form 3582 EFile seamlessly. The solution is designed to enhance productivity by reducing the time spent on document management. You can access your forms anytime, anywhere, ensuring flexibility and convenience.

-

What are the pricing options for using airSlate SignNow for Form 3582 EFile?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of various businesses. You can choose from monthly or annual subscriptions, which provide access to all features necessary for managing Form 3582 EFile. Additionally, a free trial is available to help you evaluate the service before committing.

-

What features does airSlate SignNow offer for Form 3582 EFile?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage for Form 3582 EFile. These tools enhance collaboration and ensure that your documents are always accessible and up-to-date. The platform also supports multiple file formats for added convenience.

-

Can I integrate airSlate SignNow with other applications for Form 3582 EFile?

Yes, airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow for Form 3582 EFile. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to enhance your document management process. This integration capability helps you maintain a cohesive workflow across platforms.

-

What are the benefits of using airSlate SignNow for Form 3582 EFile?

Using airSlate SignNow for Form 3582 EFile provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are signed and filed electronically, minimizing the risk of errors. Additionally, it helps you save time and resources, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for handling Form 3582 EFile?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Form 3582 EFile is handled with the utmost care. The platform employs advanced encryption and authentication measures to protect your sensitive information. You can trust that your documents are safe and secure throughout the eSigning process.

Get more for Form 3582 EFile

- Income eligibility form ief boulder day nursery

- Lorton byways magazine stories lorton valley star newspaper form

- Florida college application medical form a floridacollege

- Chicago chapter of the conference of minority transportation officials form

- Exhibitor prospectus and partnership opportunities form

- Ccp brochure 10 06 08 caldera capital partners form

- Closure report form

- Informs nrc2126 wpf

Find out other Form 3582 EFile

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter