UK Outlook Selector Deposit Growth Plan 3 Pensions RBS Form

What is the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS

The UK Outlook Selector Deposit Growth Plan 3 Pensions RBS is a financial product designed to help individuals save for retirement while potentially benefiting from market growth. This plan combines elements of deposit accounts with investment features, allowing participants to benefit from interest accumulation along with the possibility of capital growth based on market performance. It is specifically tailored for pension savings, providing a structured approach to retirement planning.

How to use the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS

To use the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS, individuals typically need to follow a few key steps. First, they should review their retirement goals and assess how this plan aligns with their financial objectives. Next, they can open an account through RBS, providing necessary personal information and documentation. Once the account is established, contributions can be made regularly, and participants can monitor their investment performance through RBS's online platform or customer service.

Key elements of the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS

Several key elements define the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS. These include:

- Interest Rates: The plan offers competitive interest rates, which can enhance the growth of savings.

- Investment Options: Participants may have the option to invest in various market-linked assets, providing the potential for higher returns.

- Tax Benefits: Contributions to the plan may be eligible for tax relief, depending on individual circumstances.

- Withdrawal Flexibility: The plan may offer options for accessing funds under specific conditions, such as retirement or financial hardship.

Eligibility Criteria

Eligibility for the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS generally requires individuals to meet certain criteria. Typically, applicants must be of legal age, usually eighteen years or older. They may also need to be residents of the UK or have a specific connection to the UK financial system. Additionally, individuals should assess their financial situation to ensure that this plan aligns with their retirement planning needs.

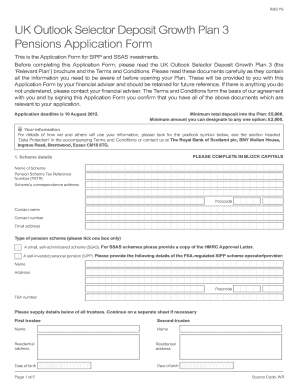

Application Process & Approval Time

The application process for the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS involves several steps. First, individuals need to gather the required documentation, such as identification and proof of residence. Next, they can complete the application form, which is available through RBS. After submission, the approval time may vary, but applicants can generally expect a response within a few business days. Once approved, they can begin contributing to their plan and benefit from its features.

Form Submission Methods (Online / Mail / In-Person)

Individuals can submit their applications for the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS through various methods. The most convenient option is online submission, where applicants can fill out the form on the RBS website. Alternatively, individuals may choose to print the form and send it via mail to the designated RBS address. For those who prefer face-to-face interaction, applications can also be submitted in person at an RBS branch, where staff can provide assistance throughout the process.

Quick guide on how to complete uk outlook selector deposit growth plan 3 pensions rbs

Effortlessly prepare [SKS] on any device

Managing documents online has become popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it on the internet. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your paperwork quickly and efficiently. Handle [SKS] on any platform with the airSlate SignNow apps for Android or iOS, and streamline your document-related tasks today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to UK Outlook Selector Deposit Growth Plan 3 Pensions RBS

Create this form in 5 minutes!

How to create an eSignature for the uk outlook selector deposit growth plan 3 pensions rbs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS?

The UK Outlook Selector Deposit Growth Plan 3 Pensions RBS is a financial product designed to help individuals grow their pension savings over time. It combines investment strategies with a focus on capital preservation, making it suitable for those looking to secure their retirement funds.

-

What are the key features of the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS?

Key features of the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS include flexible investment options, competitive interest rates, and the ability to adjust contributions as needed. Additionally, it offers a structured approach to managing pension growth while minimizing risks.

-

How does the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS benefit me?

The UK Outlook Selector Deposit Growth Plan 3 Pensions RBS provides several benefits, including potential for higher returns on your pension savings and a safety net for your investments. This plan is tailored to help you achieve your retirement goals with peace of mind.

-

What is the pricing structure for the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS?

The pricing structure for the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS typically includes management fees and potential performance fees based on the growth of your investments. It's important to review the specific terms and conditions to understand all associated costs.

-

Can I integrate the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS with other financial products?

Yes, the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS can often be integrated with other financial products, such as ISAs or other pension plans. This flexibility allows you to create a comprehensive financial strategy tailored to your needs.

-

What are the withdrawal options for the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS?

Withdrawal options for the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS typically include partial withdrawals or full encashment upon signNowing retirement age. It's advisable to consult with a financial advisor to understand the implications of withdrawals on your overall pension strategy.

-

Is the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS suitable for all investors?

While the UK Outlook Selector Deposit Growth Plan 3 Pensions RBS is designed for a wide range of investors, it may be particularly beneficial for those seeking a balanced approach to pension growth. It's essential to assess your individual financial situation and risk tolerance before investing.

Get more for UK Outlook Selector Deposit Growth Plan 3 Pensions RBS

- A calculus of number based on spatial forms

- Schedule h homestead credit form pdf fillable form schedule h revenue wi

- C 8043 michigan sbt statutory exemption schedule c 8043 michigan sbt statutory exemption schedule form

- Check box if a pro forma federal return is attached

- Bankruptcy forms cabrillo commons paul e manasian 130855

- Bankruptcy forms keuka capital inc charles d tolbert esq 4549044

- Alfred wegener institute for polar and marine research awi bcws elcamino form

- Re importer security filing request isf 10 2 form

Find out other UK Outlook Selector Deposit Growth Plan 3 Pensions RBS

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template